Investors with a lot of money to spend have taken a bearish stance on Viking Therapeutics VKTX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with VKTX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for Viking Therapeutics.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 62%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $342,498, and 2 are calls, for a total amount of $63,900.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $70.0 for Viking Therapeutics over the recent three months.

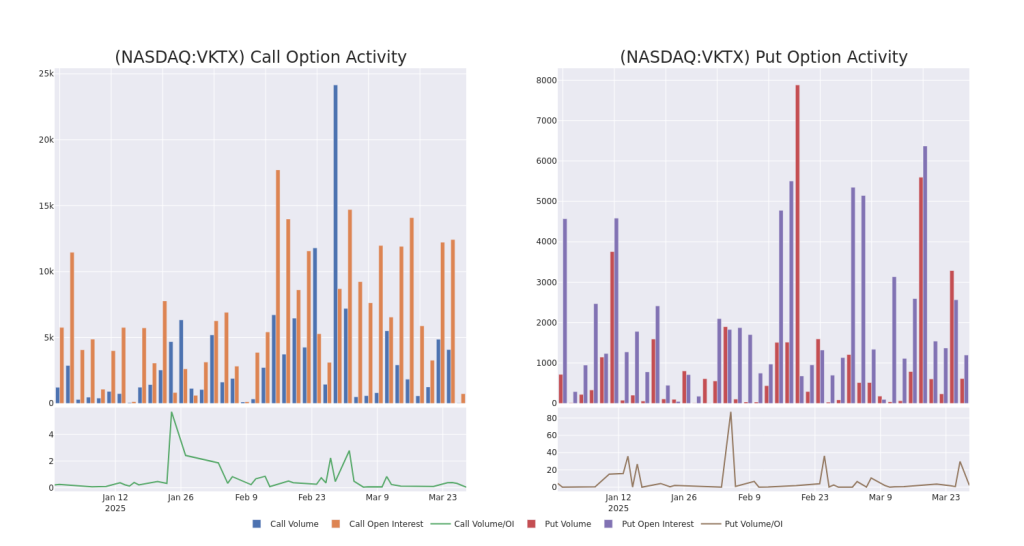

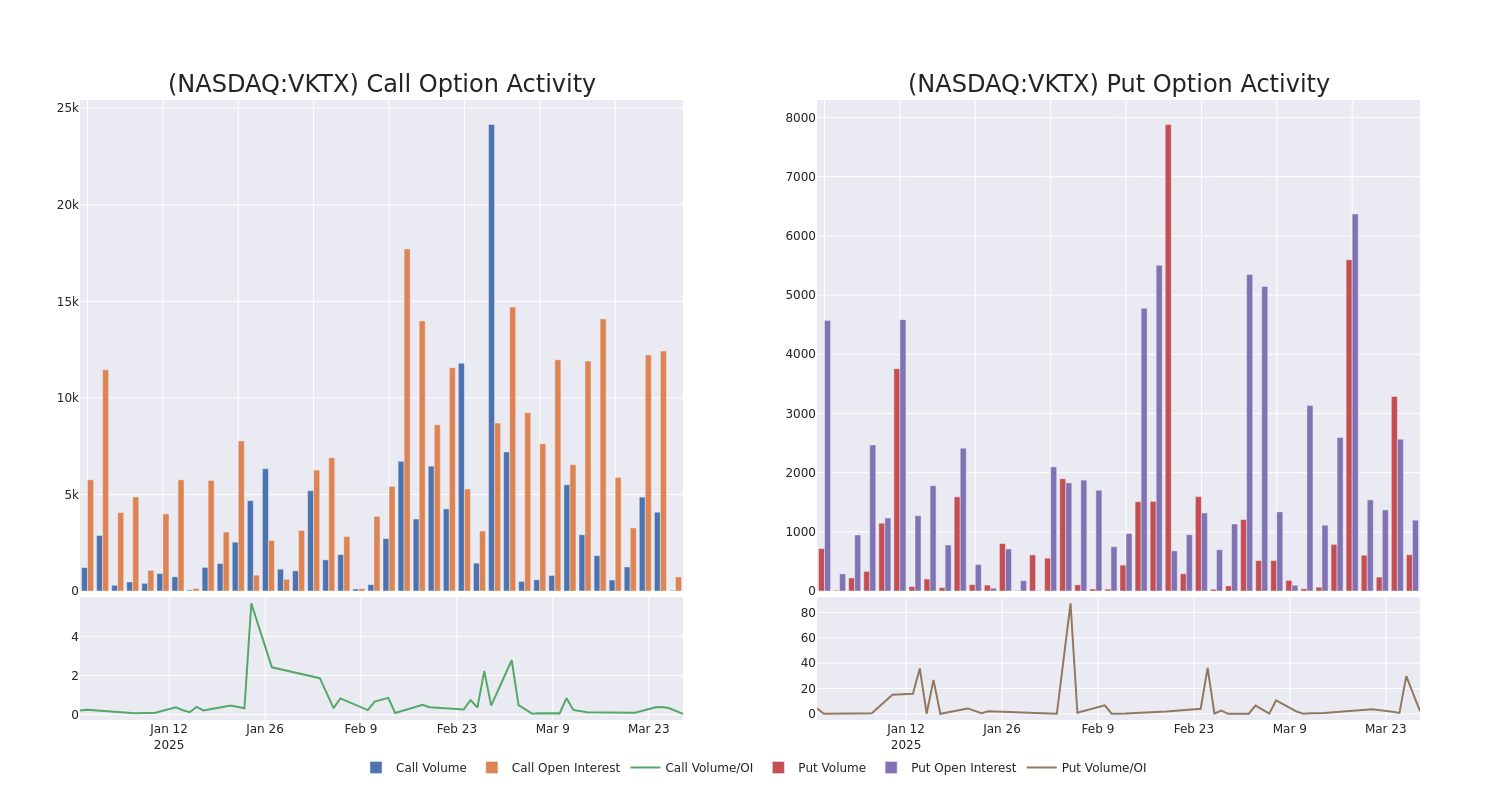

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Viking Therapeutics’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Viking Therapeutics’s substantial trades, within a strike price spectrum from $20.0 to $70.0 over the preceding 30 days.

Viking Therapeutics 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | PUT | SWEEP | BULLISH | 05/16/25 | $8.2 | $8.1 | $8.1 | $32.50 | $102.0K | 495 | 213 |

| VKTX | PUT | SWEEP | BULLISH | 05/16/25 | $8.2 | $8.1 | $8.1 | $32.50 | $69.6K | 495 | 87 |

| VKTX | PUT | TRADE | BEARISH | 01/15/27 | $20.65 | $20.45 | $20.65 | $40.00 | $61.9K | 49 | 30 |

| VKTX | PUT | SWEEP | BULLISH | 05/16/25 | $8.2 | $8.1 | $8.1 | $32.50 | $39.6K | 495 | 262 |

| VKTX | PUT | TRADE | BEARISH | 05/16/25 | $44.0 | $42.9 | $44.0 | $70.00 | $39.6K | 30 | 9 |

About Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company’s clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

In light of the recent options history for Viking Therapeutics, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Viking Therapeutics

- With a trading volume of 1,390,322, the price of VKTX is down by -2.51%, reaching $25.48.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 26 days from now.

Expert Opinions on Viking Therapeutics

In the last month, 2 experts released ratings on this stock with an average target price of $102.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $102.

* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $102.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Viking Therapeutics, Benzinga Pro gives you real-time options trades alerts.

Momentum4.89

Growth–

Quality–

Value–

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.