Elon Musk on Wednesday said that Tesla Inc. TSLA will face a significant impact due to President Donald Trump‘s 25% tariffs on foreign-made automobiles.

Musk highlighted on X that while Tesla manufactures all its U.S.-sold vehicles domestically, it still imports parts from other countries, particularly from China.

What Happened: Following the tariff announcement, Tesla’s shares plummeted nearly 6% on Wednesday. The tariffs are expected to further complicate Tesla’s efforts to refresh its aging electric vehicle lineup, advance autonomous driving technology, and develop robotaxis.

Musk, in his post on X, said that the cost impact of the tariffs on Tesla is “not trivial.”

Additionally, Tesla is dealing with a consumer boycott in both Europe and the U.S. due to Musk’s alleged connections to the far-right and his involvement with the Trump administration.

Recent data revealed a significant drop in Tesla’s European sales, which fell over 40% for the second consecutive month in February, amid increasing competition and declining demand.

Why It Matters: The introduction of a 25% tariff on auto imports by President Trump is intended to bolster domestic production, potentially generating $100 billion annually.

However, this move has sparked criticism from international partners like Canada and the EU, who have opposed the tariffs.

Economists and market analysts have expressed concerns about the potential economic repercussions of these tariffs. The increased costs could lead to higher car prices and potentially impact interest rates.

This could further strain automakers like Tesla, which rely on global supply chains for essential components.

Amidst these developments, President Trump’s approval rating has reached a new low since his re-election, reflecting public dissatisfaction with his economic policies.

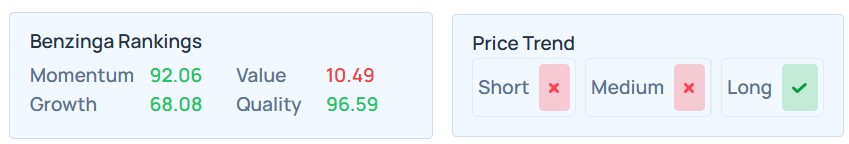

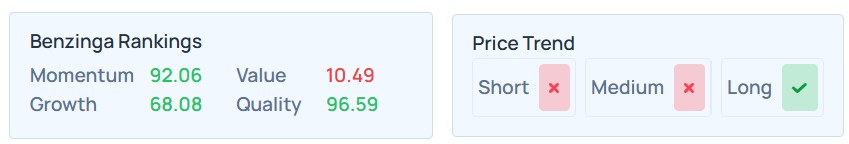

Tesla holds a momentum rating of 92.06% and a growth rating of 68.08%, according to Benzinga’s Proprietary Edge Rankings. The Benzinga Growth metric evaluates a stock’s historical earnings and revenue expansion across multiple timeframes, prioritizing both long-term trends and recent performance. For an in-depth report on more stocks and insights into growth opportunities, sign up for Benzinga Edge.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Momentum92.06

Growth68.08

Quality96.59

Value10.49

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.