(Bloomberg) — Amundi SA is positioning itself for a realignment in investor flows triggered by a growing divide in how asset managers on either side of the Atlantic handle stewardship and climate policies.

Most Read from Bloomberg

There are already signs that a number of asset owners across Europe are currently conducting reviews of their US mandates, said Jean-Jacques Barbéris, head of institutional and corporate division and ESG at Amundi. Europe’s largest asset manager, which won business from State Street earlier this year, expects the broader reassessment underway to play out over several months, he said.

“We do see some indications that some investors are reviewing what they do with some American asset managers because of responsible investment alignment,” Barbéris told Bloomberg.

Money management is becoming the latest stage on which transatlantic tensions are now playing out. So far this year, State Street has lost mandates in the UK and Scandinavia amid concerns it no longer does enough to address climate change. BlackRock Inc. faces similar challenges, with PME in the Netherlands saying it’s in the process of reviewing a €5 billion ($5.4 billion) mandate over climate concerns.

Barbéris said the People’s Pension, a UK pensions manager that reassigned £28 billion ($36.3 billion) worth of mandates to Amundi and Invesco Ltd. earlier this year, first approached the Paris-based firm about a year ago, shortly after State Street said it was pulling out of Climate Action 100+.

State Street is just one of a number of major US asset managers to have exited CA100+, which is the world’s largest investor coalition dedicated to addressing global warming. Others that have walked away include BlackRock, Pacific Investment Management Co., as well as the asset management arms of Goldman Sachs Group Inc. and JPMorgan Chase & Co.

For much of the US investment industry, continued membership has become untenable as firms adapt to a political reality in which net zero targets have been called “a sinister goal” by US Secretary of Energy Chris Wright. Firms that don’t conform face bans in Republican-led states, as well as lawsuits.

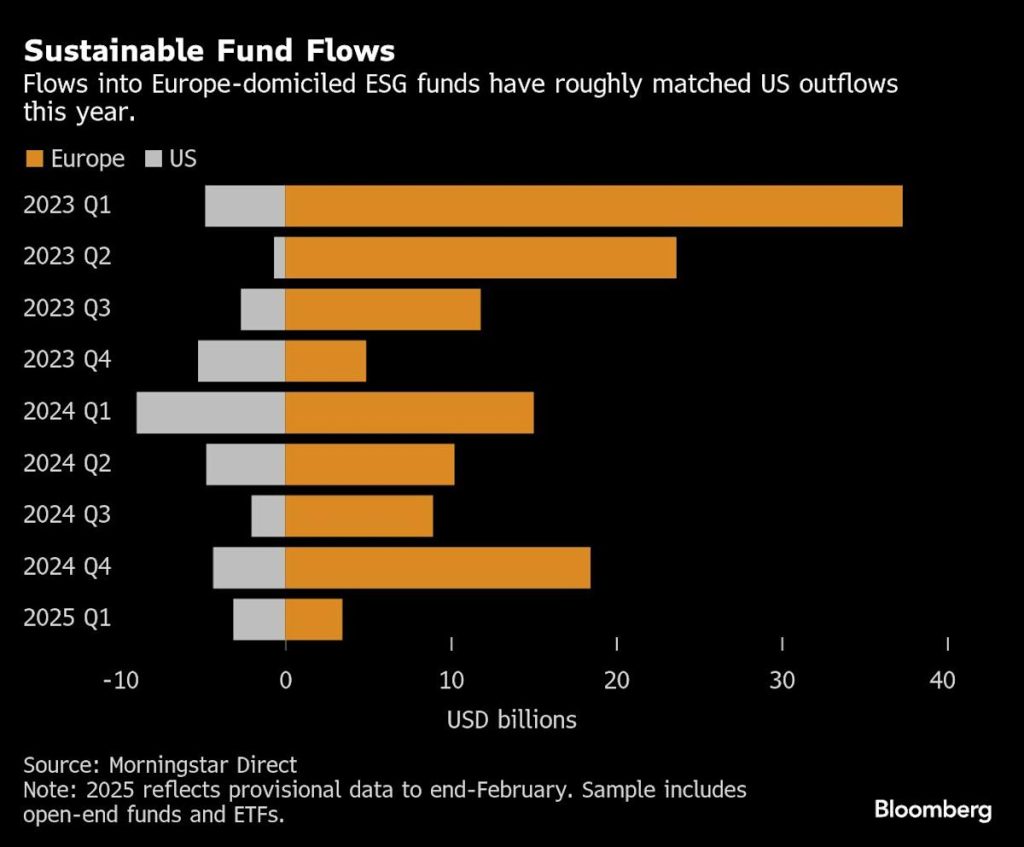

But as US asset managers adapt to politics at home by scaling back their climate commitments, investors in Europe are taking note. According to data provided by Morningstar Direct, funds domiciled in Europe and identified as pursuing environmental, social and governance goals attracted an estimated $3.5 billion of inflows in the first two months of the year. In the US, meanwhile, such funds suffered about $3.1 billion of client outflows in the same period.