Investors with significant funds have taken a bearish position in Teradyne TER, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in TER usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 17 options transactions for Teradyne. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 5% being bullish and 52% bearish. Of all the options we discovered, 16 are puts, valued at $795,688, and there was a single call, worth $26,200.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $130.0 for Teradyne during the past quarter.

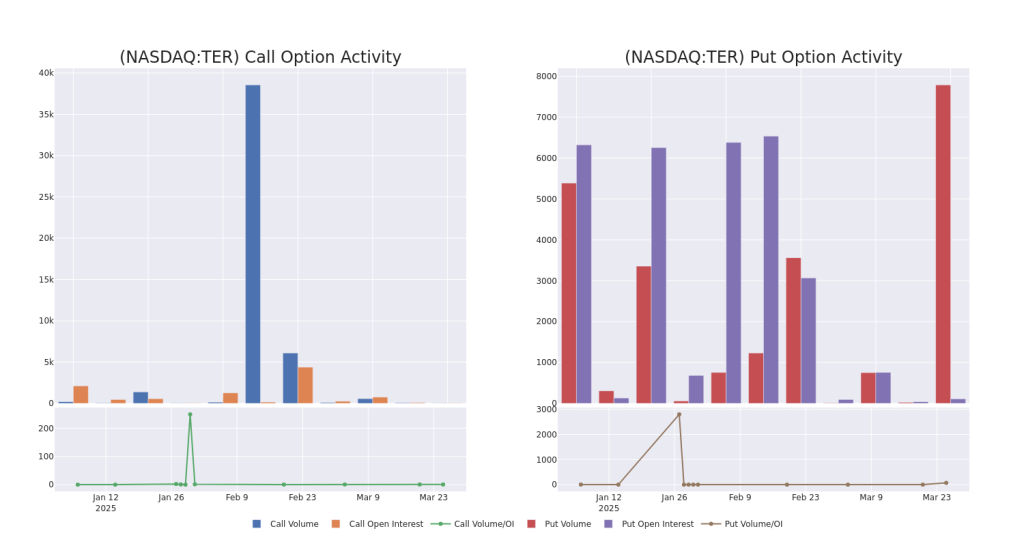

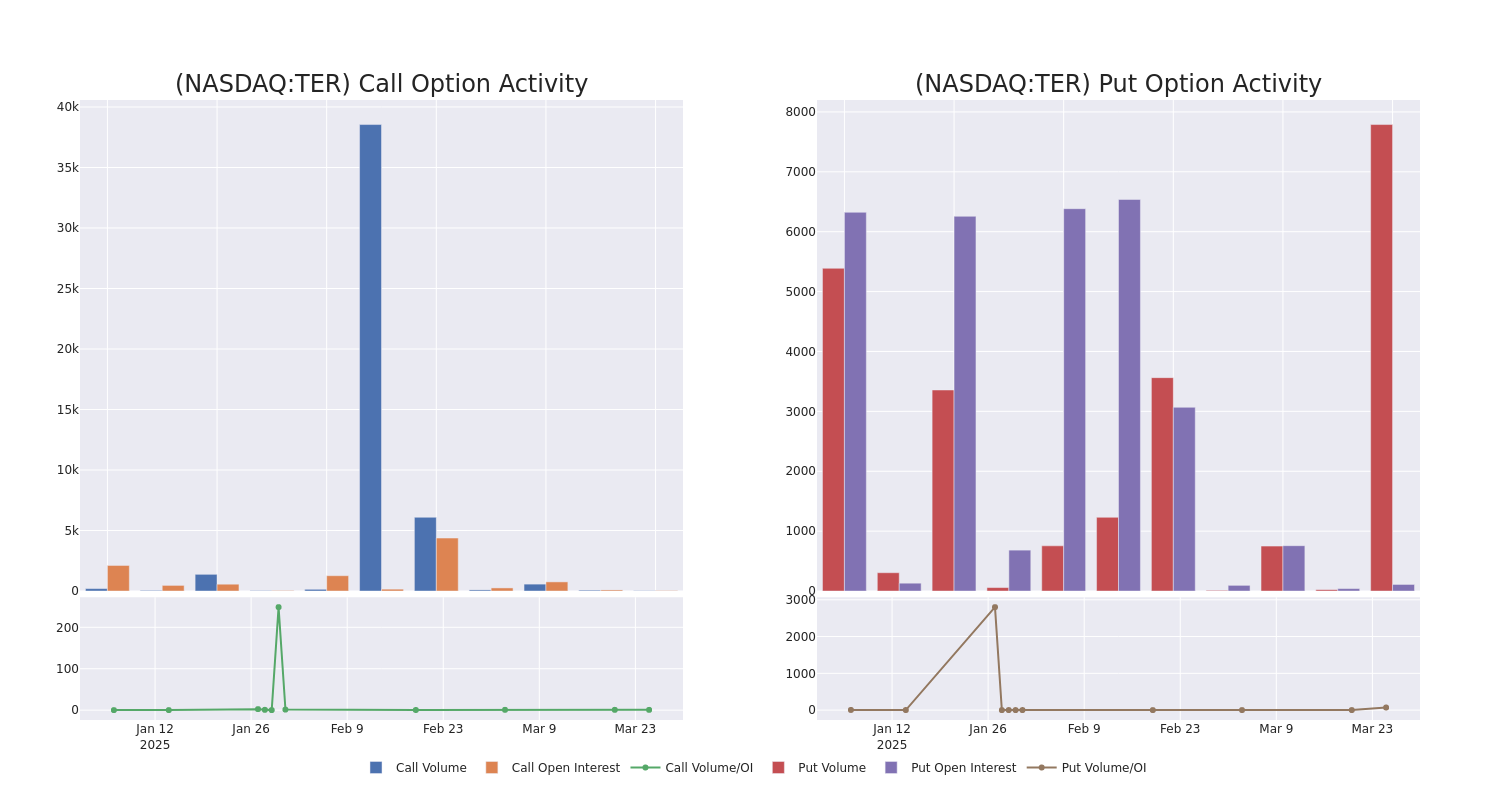

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Teradyne’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Teradyne’s substantial trades, within a strike price spectrum from $100.0 to $130.0 over the preceding 30 days.

Teradyne 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TER | PUT | SWEEP | BEARISH | 01/16/26 | $17.9 | $17.8 | $17.78 | $100.00 | $90.7K | 110 | 294 |

| TER | PUT | SWEEP | BEARISH | 01/16/26 | $18.6 | $17.8 | $17.85 | $100.00 | $75.0K | 110 | 576 |

| TER | PUT | SWEEP | NEUTRAL | 01/16/26 | $17.8 | $17.7 | $17.75 | $100.00 | $72.8K | 110 | 61 |

| TER | PUT | SWEEP | BEARISH | 01/16/26 | $17.8 | $17.7 | $17.78 | $100.00 | $67.5K | 110 | 166 |

| TER | PUT | SWEEP | BEARISH | 01/16/26 | $17.8 | $17.7 | $17.78 | $100.00 | $64.0K | 110 | 781 |

About Teradyne

Teradyne provides testing equipment, including automated test equipment for semiconductors, system testing for hard disk drives, circuit boards, and electronics systems and wireless testing for devices. The firm entered the industrial automation market in 2015, into which it sells collaborative and autonomous robots for factory applications. Teradyne serves numerous end markets and geographies directly and indirectly with its products, but its most significant exposure is to semiconductor testing. Teradyne serves vertically integrated, fabless, and foundry chipmakers with its equipment.

Having examined the options trading patterns of Teradyne, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Teradyne Standing Right Now?

- With a trading volume of 530,072, the price of TER is down by -1.21%, reaching $89.9.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 29 days from now.

Professional Analyst Ratings for Teradyne

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $128.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Teradyne with a target price of $155.

* Maintaining their stance, an analyst from Stifel continues to hold a Hold rating for Teradyne, targeting a price of $110.

* An analyst from UBS has decided to maintain their Buy rating on Teradyne, which currently sits at a price target of $130.

* An analyst from Baird has decided to maintain their Outperform rating on Teradyne, which currently sits at a price target of $110.

* An analyst from Vertical Research downgraded its action to Buy with a price target of $135.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Teradyne with Benzinga Pro for real-time alerts.

Momentum18.14

Growth40.10

Quality75.97

Value51.58

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.