Tesla Inc. TSLA has seen its market share in Europe shrink, despite a surge in demand for electric vehicles (EVs). The company’s sales have dipped for two consecutive months.

What Happened: Data from the European Automobile Manufacturers Association (ACEA) indicates that Tesla’s sales in Europe have plummeted by 42.6% this year. Tesla’s market share stood at 1.8% of the overall market and 10.3% of the BEV market, marking a notable decline from the previous year’s 2.8% and 21.6%, respectively, reported Reuters.

In February, Tesla sold fewer than 17,000 cars across the European Union, Britain, and European Free Trade Association countries, a sharp drop from over 28,000 in the same month of 2024. The company is grappling with challenges such as an aging lineup and stiff competition from traditional automakers and new Chinese entrants launching often cheaper electric models.

Interestingly, despite Tesla’s struggles, overall BEV sales in these markets rose by 26.1% compared to February 2024, even as total car sales fell by 3.1%, according to ACEA. A recent EU filing disclosed that Tesla had established a pool to sell carbon credits to over half a dozen automakers, assisting them in complying with European CO2 emission targets that took effect in January.

Why It Matters: This decline in Tesla’s market share comes on the heels of a forecast by JPMorgan analysts predicting a sharp decline in Tesla’s share price. The report, published by Forbes, noted that Tesla’s stock lost $127 billion in value in just one day of trading in early March.

The analysis also downgraded its expectations for Tesla’s delivery vehicles this quarter from 445,000 to 335,000. If these predictions hold true, Tesla’s delivery total would be its lowest since Q3 2022. Also, Deepwater Asset’s Managing Partner, Gene Munster predicted on Monday that Tesla’s delivery numbers would be weaker than anticipated in March.

However, Felipe Munoz, Global Analyst at JATO Dynamics, stated that Tesla is undergoing significant changes, including CEO Elon Musk‘s growing political involvement, rising competition in the EV market, and the phase-out of the current Model Y to make way for a refreshed version, as reported by Autocar Professional.

“During this process, brands often experience a drop in sales before they return to normal levels, once the updated model becomes widely available. Brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover,” explained Munoz.

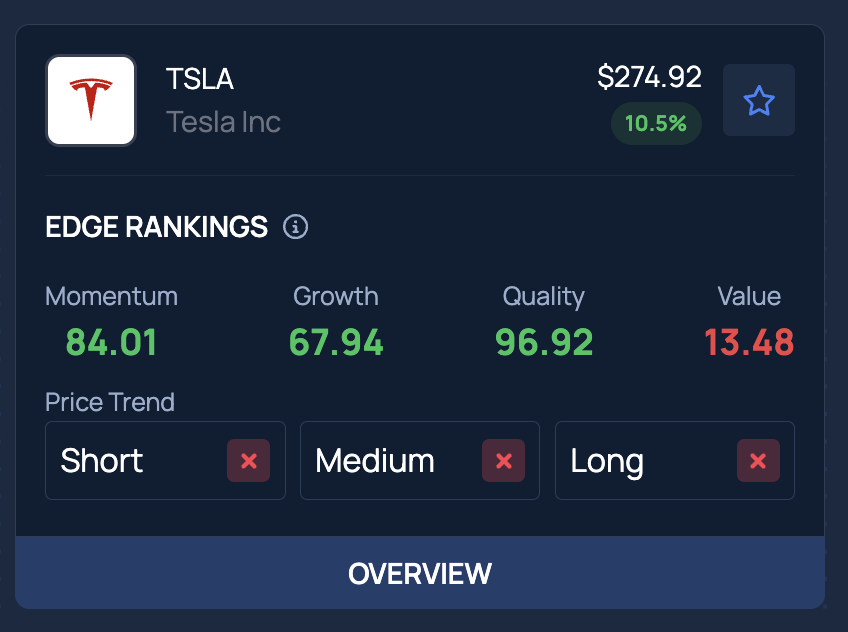

Tesla holds a momentum rating of 84.01% and a growth rating of 67.94%, according to Benzinga’s Proprietary Edge Rankings. The Benzinga Growth metric evaluates a stock’s historical earnings and revenue expansion across multiple timeframes, prioritizing both long-term trends and recent performance. For an in-depth report on more stocks and insights into growth opportunities, sign up for Benzinga Edge.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Momentum84.01

Growth67.94

Quality96.92

Value13.48

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.