A stark warning from Moody’s is turning up the heat again in Washington, as elevated U.S. deficits, mounting interest payments and renewed Republican tax cut plans threaten to crack the last pillar holding America’s triple-A credit rating.

As reported by Reuters on Tuesday, Moody’s Investors Service indicates U.S. fiscal strength is headed for a “multi-year decline,” a deterioration that began before the rating agency downgraded the country’s credit outlook in November 2023.

Moody’s, the only major ratings firm still maintaining a top rating for U.S. sovereign debt, said the current trajectory of ballooning deficits and rising interest costs risks undermining America’s financial credibility on the global stage.

Debt Ratios Soaring, Interest Costs Surging

According to Moody’s, the U.S. debt-to-gross domestic product ratio will climb from nearly 100% in 2025 to around 130% by 2035.

More alarming is the rise in interest payments, which are projected to absorb 30% of government revenue by 2035 — more than triple the 9% seen in 2021.

“Even in a very positive and low probability economic and financial scenario, debt affordability remains materially weaker than for other Aaa-rated and highly rated sovereigns,” Moody’s said.

The report also emphasized the unique role of the U.S. dollar and Treasury market in preserving the top rating, but noted these strengths are no longer enough to offset worsening fiscal dynamics.

“We see diminished prospects that these strengths will continue to offset widening fiscal deficits and declining debt affordability,” the agency said.

While some cost-cutting initiatives have emerged, such as the Department of Government Efficiency led by Elon Musk, Moody’s considers these efforts marginal.

The agency said truly meaningful fiscal repair would require large-scale cuts, particularly in mandatory spending — a politically toxic arena requiring bipartisan consensus.

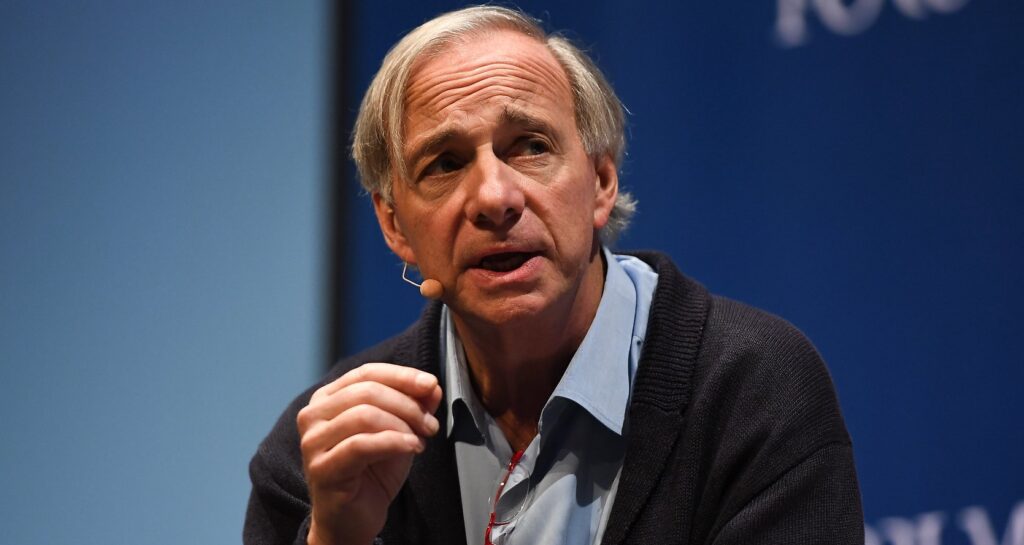

Dalio Urges Austerity Before It’s Too Late

Bridgewater Associates founder and billionaire investor Ray Dalio appeared before House Republicans on Tuesday, urging them to cap budget deficits to 3% of the GDP before interest payments squeeze out critical spending.

As reported in this Bloomberg story, Dalio said the U.S. may be approaching a fiscal tipping point.

“We are at a precarious time in what I call the Big Cycle, where there is a confluence of major forces playing out in a way that is similar to many times in history,” he said.

The backdrop to these warnings is a renewed push by Republican lawmakers to make President Donald Trump‘s 2017 tax cuts permanent and to roll out an additional $4.5 trillion in tax reductions.

Yet, the proposed House plan only includes $2 trillion in offsetting spending cuts over the next decade — a shortfall that would swell the deficit by roughly $3 trillion.

The U.S. fiscal deficit was 6.6% of GDP last year, according to the Congressional Budget Office.

Read Now:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.