Whales with a lot of money to spend have taken a noticeably bearish stance on Williams Companies.

Looking at options history for Williams Companies WMB we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 20% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $202,100 and 7, calls, for a total amount of $286,938.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $65.0 for Williams Companies over the recent three months.

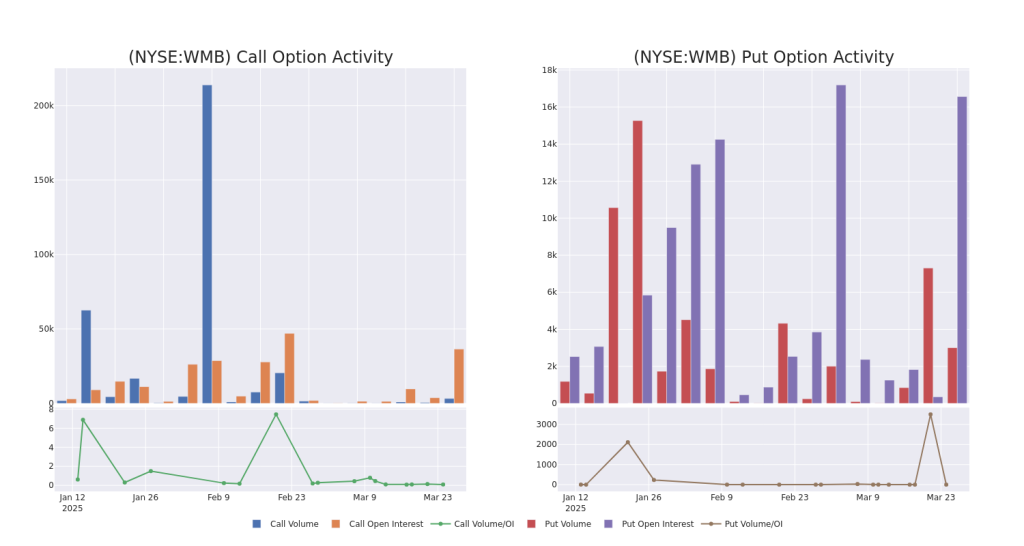

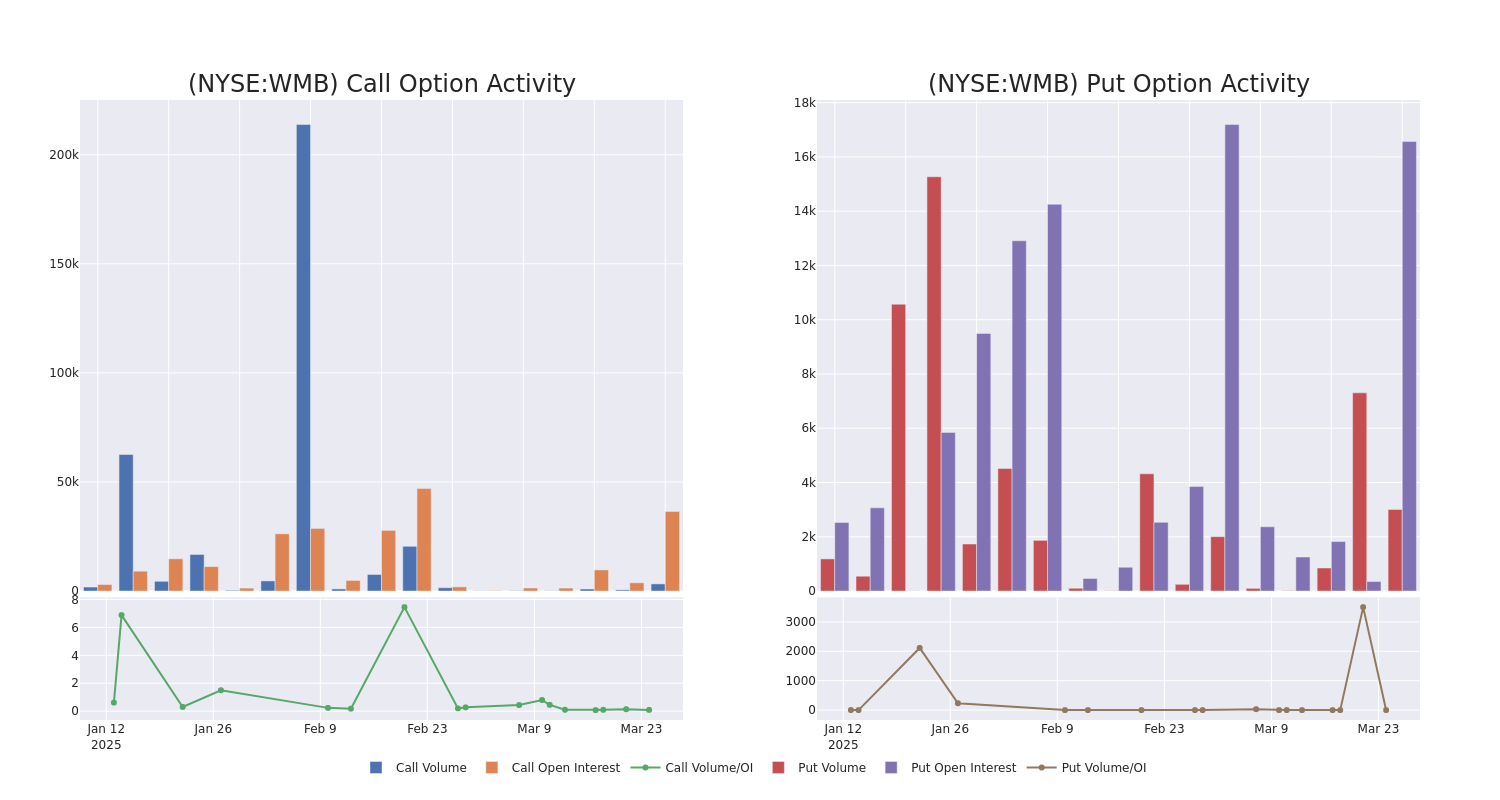

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Williams Companies options trades today is 7570.86 with a total volume of 6,281.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Williams Companies’s big money trades within a strike price range of $50.0 to $65.0 over the last 30 days.

Williams Companies Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WMB | PUT | TRADE | BEARISH | 09/19/25 | $1.3 | $0.7 | $1.2 | $50.00 | $101.5K | 1.3K | 846 |

| WMB | CALL | SWEEP | BEARISH | 04/17/25 | $2.15 | $2.05 | $2.05 | $60.00 | $69.2K | 16.5K | 416 |

| WMB | CALL | SWEEP | BEARISH | 04/17/25 | $2.4 | $2.3 | $2.3 | $60.00 | $63.4K | 16.5K | 739 |

| WMB | PUT | SWEEP | BEARISH | 01/16/26 | $5.1 | $5.0 | $5.1 | $60.00 | $60.1K | 1.2K | 127 |

| WMB | CALL | TRADE | BULLISH | 05/16/25 | $3.4 | $3.3 | $3.4 | $60.00 | $52.0K | 14.6K | 268 |

About Williams Companies

Williams Companies is a midstream energy company that owns and operates the large Transco and Northwest pipeline systems and associated natural gas gathering, processing, and storage assets. In August 2018, the firm acquired the remaining 26% ownership of its limited partner, Williams Partners.

Following our analysis of the options activities associated with Williams Companies, we pivot to a closer look at the company’s own performance.

Current Position of Williams Companies

- With a trading volume of 3,584,194, the price of WMB is up by 2.63%, reaching $61.17.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 42 days from now.

What Analysts Are Saying About Williams Companies

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $59.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Williams Companies with a target price of $65.

* Consistent in their evaluation, an analyst from CIBC keeps a Neutral rating on Williams Companies with a target price of $57.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Williams Companies with a target price of $58.

* Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Perform rating on Williams Companies with a target price of $53.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Williams Companies, which currently sits at a price target of $63.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Williams Companies, Benzinga Pro gives you real-time options trades alerts.

Momentum93.35

Growth29.86

Quality68.85

Value24.45

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.