(Bloomberg) — This year’s unexpected demand for European stocks is helping to drive the region’s largest wave of block sales this century, with bankers anticipating more deals ahead.

Most Read from Bloomberg

From Pfizer Inc. finalizing its Haleon Plc exit to governments disposing of their crisis-era stakes in banks, investors have sold nearly $26 billion worth of European stocks through big-ticket trades in 2025, according to data compiled by Bloomberg.

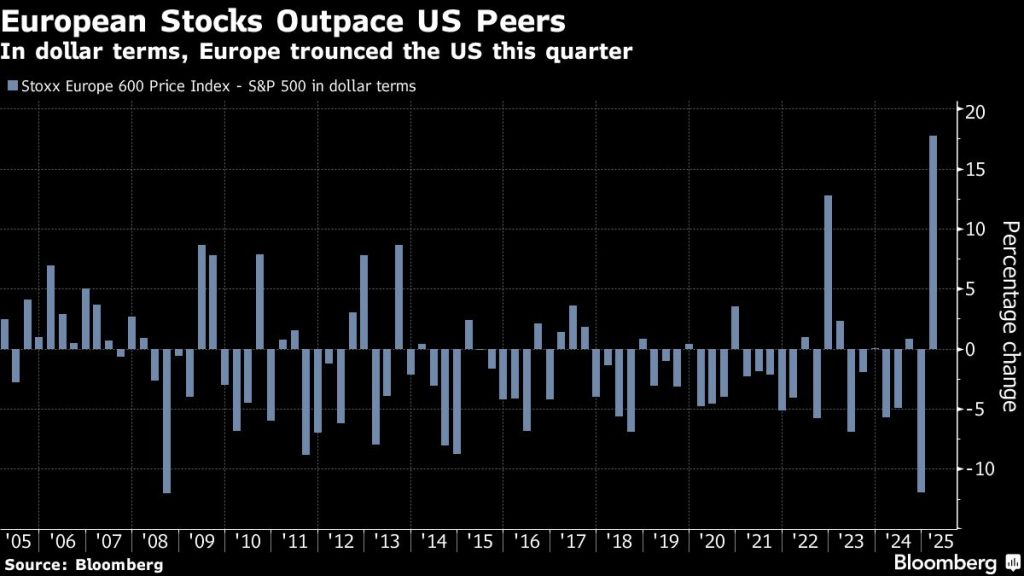

Weighed down by weak economic growth prospects and looming fears of US tariffs, most strategists entered 2025 expecting European stocks to once again play second fiddle to their US peers. As it turned out, Europe’s benchmark is having its best start since 2019, sparking a flurry of accelerated bookbuild (ABB) offerings — quick sales of large blocks — as bulls take charge of the market.

“This has helped underpin the robust ABB volumes we’ve seen,” said Saadi Soudavar, head of equity capital markets in Europe, the Middle East and Africa at Deutsche Bank AG. “We do anticipate a fair amount of secondary activity still to come.”

The blitz builds on selldown volumes that were already strong in 2024, gaining fresh momentum as investors rotated into European stocks. Appetite for US equities — lifted at first by Donald Trump’s election victory — has cooled amid growing concerns over trade policies and a weakening economic outlook.

The opportunity has prompted shareholders in European companies to monetize often long-held positions, with Italy’s Agnelli clan and Switzerland’s Sandoz family selling a combined $6 billion of shares in Ferrari NV and Novartis AG respectively in February.

Private equity has also taken advantage of the conducive market to exit positions. A group of shareholders led by EQT AB sold a stake of about 1.34 billion Swiss francs ($1.5 billion) in Galderma Group AG earlier this month, even though some market turbulence prompted the backers to offer the shares at a wider discount.

In a more creative deal, Wendel agreed to sell a stake in Bureau Veritas through a three-year process.

“Long-term holders appear to be making the most of a Lazarus moment after a decade of dreadful European market returns,” said Mark Taylor, director of sales trading at Panmure Liberum.