(Bloomberg) — Business activity in the euro area reached its highest level in seven months as manufacturers recovered more than expected ahead of a massive increase in German spending.

Most Read from Bloomberg

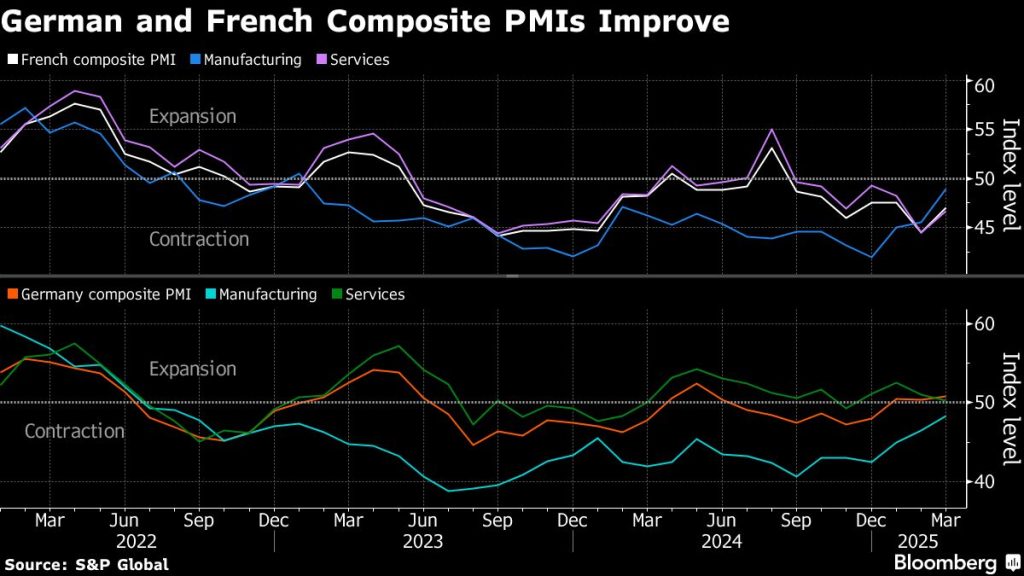

The Composite Purchasing Managers’ Index by S&P Global rose slightly to 50.4, further above the 50 threshold separating expansion from contraction. Analysts had predicted a slightly higher reading of 50.7.

The uptick was largely down to Germany, where a package of infrastructure and defense outlays worth hundreds of billions of euros is set to haul Europe’s largest economy out of five years of stagnation.

But there was also an improvement in France, which while maintaining a sub-50 reading outpaced analyst expectations as factories also regained some ground.

“Given the will of Europe, to invest heavily in defense and infrastructure – in Germany a corresponding historical fiscal package has been approved only last week – hope for a more sustained recovery seems well founded,” Cyrus de la Rubia, an economist at Hamburg Commercial Bank, said Monday in a statement.

The region’s sluggish economy is primed for a boost not just from Germany’s fiscal largess but also a general rearmament drive across the continent in response to waning military support from the US. Factories, which have long been a weak spot – particularly in Germany – are set to be the biggest beneficiaries, even if the improvement takes several months to be felt.

While manufacturers surprised analysts on the upside, the services sector – while still growing – fell short of estimates.

The European Central Bank has also lifted the mood by lowering interest rates for the sixth time since June at this month’s meeting. But the upcoming surge in government spending complicates its task as that will almost certainly prove inflationary.

“We are living at a time of extreme uncertainty,” Irish central bank Governor Gabriel Makhlouf said in Dublin. Officials “need to be pretty prudent, pretty cautious about changes to our monetary-policy stance when we’re not yet at target and when quite exceptional events are happening around the world, which could have a direct effect on inflation.”

Consumer-price growth currently appears to be heading back to 2%, with the latest headline number from the 20-nation currency bloc coming in at 2.3%.