(Bloomberg) — While investors are eyeing warily Donald Trump’s tariff “Liberation Day” on April 2, options markets show it’s far from the only event on the calendar.

Most Read from Bloomberg

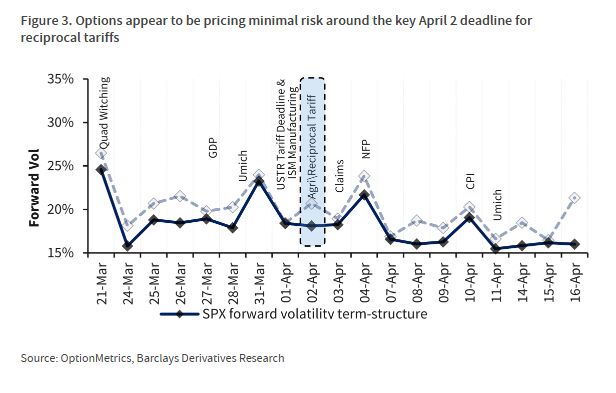

Implied volatility for S&P 500 Index options is elevated for a couple of particular days in the next two weeks, signaling greater demand for protection against big market swings then. That kink in the volatility curve is bigger for March 31 — just after the Core PCE Price Index, the Federal Reserve’s favored inflation measure, is released — and for April 4, when monthly US unemployment data come out.

This underscores that investors are paying at least as much attention to economic data that may signal how the labor market and prices are responding to the effects of Trump’s deep cuts across government payrolls and bellicose trade policies as they are to his pronouncements themselves. With recent on- and off-again tariff statements whipsawing markets, it seems more and more that traders are waiting to see what’s real.

“Through the lens of SPX options, markets appear to be downplaying the impact on US equities of the US’s implementation of agricultural and reciprocal tariffs,” said Anshul Gupta and Stefano Pascale, equity-derivatives strategists at Barclays Bank Plc.

While there are signs that retail investors have reduced their participation, Barclays’s Equity Euphoria Indicator suggests they could further disengage from the stock market, Gupta and Pascale said.

One feature of the 10% decline in the S&P 500 was that while it was swift, there was a relative calm in the market. The Cboe Volatility Index hasn’t been as reactive as in previous selloffs in early August and December. And the VVIX, which measures expected swings in the VIX, sank last week to the lowest since early December, signaling tepid demand for hedges against wider market upsets.

The lack of volatility spikes is partly due to the fact that some investors have been lightening their positions and rotating into other parts of the world, lessening the need to buy insurance against the risk of further declines.

Max Grinacoff, head of US equity-derivatives research at UBS Securities, said he expects the VIX to remain in its current range in the short term. Investors who are long US equities are not “flooding into puts, as they did on August 5th,” he said.