(Bloomberg) — Days before the fateful White House encounter between Donald Trump and Volodymyr Zelenskiy, Ukraine took a symbolic step on the path to regaining its financial footing when officials received a delegation of foreign investors in Kyiv.

Most Read from Bloomberg

Representatives from the country’s creditors, including TCW Funds and Lazard Asset Management LLC, as well as multinational firms like Siemens AG were among the 16 executives who took part in the meetings, the first of their kind since Russia’s invasion in 2022.

Those two groups — capable of both carrying out large-scale construction projects and providing the financing to pay for it — are key to Ukraine’s plans to rebuild its ravaged economy once a deal is finally struck to end the fighting.

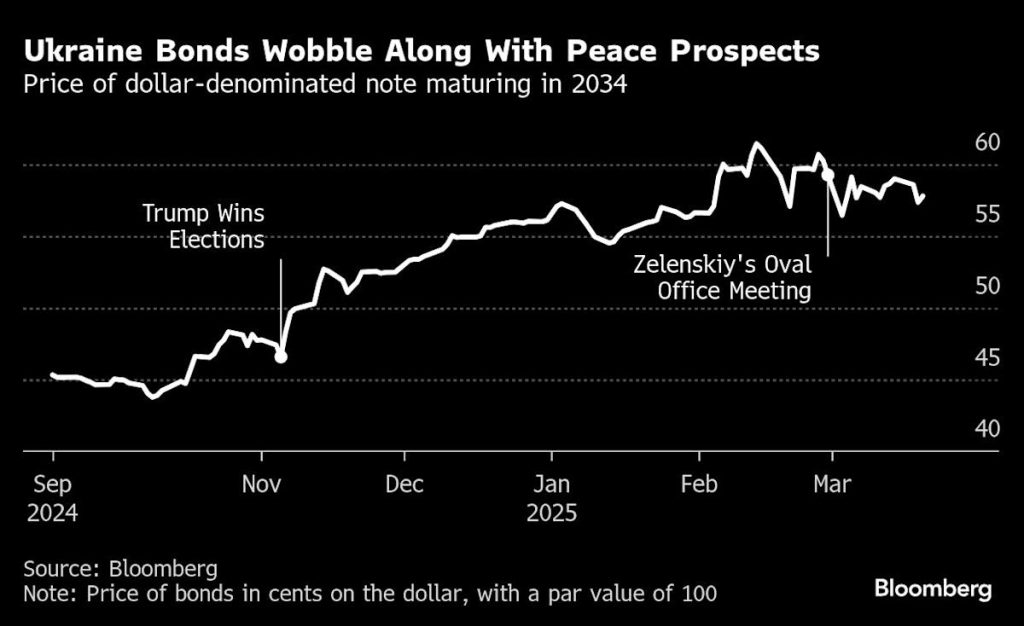

Investors had piled into Ukraine’s existing overseas bonds late last year, bidding up their prices from deeply distressed levels on optimism Trump would quickly forge a peace deal.

The late-February clash in the Oval Office damped that enthusiasm but prices are still up markedly from last year in a sign that, with more progress on peace talks, Ukraine may eventually be able to tap investors for fresh financing.

“We are still constructive on Ukrainian assets,” Arif Joshi, the co-head of emerging-market debt at Lazard and one of the investors from the Kyiv trip, told Bloomberg News. “There are many different vectors for a positive outcome in Ukraine.”

Ukraine’s push to reconnect with investors is taking place at a time of rising interest in global reconstruction plays from Venezuela to Lebanon. Efforts to resolve to the conflict have also rekindled interest in assets affected by international sanctions on Russia.

Ukraine’s First Deputy Economy Minister Oleksiy Sobolev, who met the investors in Kyiv, said talks had focused on prospects for increased FDI, reconstruction, the fight against corruption and progress in reforming legislation on the path toward closer links with the European Union.

“We also discussed key sectors for attracting private capital, interest in privatization, access to financing and how to decrease risks for investors,” he said.

Ukraine’s recovery and reconstruction needs have increased to $524 billion over the next decade, nearly three times the size of the country’s economy, the World Bank said last month. The sovereign restructured a $20 billion chunk of its foreign-currency bonds last August, giving the authorities more time to redeem the debt.

Lazard’s Joshi said that policymakers in Kyiv had spoken of a window to get a peace deal staying open potentially until Easter. The latest attempt, Tuesday’s phone call between Trump and Russian leader Vladimir Putin, didn’t impress investors and the price of Ukraine’s dollar notes due in 2034 fell to a two-week low.

The rally in Ukraine’s foreign-currency debt became crowded as more and more investors piled in on the back of Trump’s assurances over a rapid peace deal, stretching valuations. Strategists at Citigroup Inc and Morgan Stanley said the gains appear overdone unless Ukraine is able to get security guarantees as part of a peace settlement.

The price of Ukraine’s GDP warrants, a fixed-income instrument whose interest payments increase if the country’s economy grows quickly, has dropped more than that of its regular debt in past weeks. This suggests diminishing expectations over the availability of postwar funding.

Polina Kurdyavko, head of emerging markets and senior portfolio manager at RBC BlueBay in London who was not part of the investor trip, said she’s long been “constructive” on Ukraine but has grown concerned due to risks that a peace offering negotiated by Trump and Putin won’t be accepted by Zelenskiy.

“There is a risk that this deal will not materialize at all, and ultimately we could see the fighting continuing, and there is equally a risk that if it materializes, it might not be as good of a deal for Ukraine as we would like to see,” she said. “We are taking a more cautious approach.”

While in Kyiv, the investors got regular reminders of just how elusive a peace accord remains. Every night, they said, air raid sirens started to blare around midnight, followed by bursts of gunfire and flashes of tracers aimed at incoming drones and projectiles. A central bank meeting room the group visited had its windows boarded up after a nearby explosion blew them out.

With airspace over Ukraine shut, the organizers — US-based consultants Signum Global Advisors LLC — chartered a train-car for the roughly 800 kilometer (500 mile) voyage from the Polish border to Kyiv. On the way back, the group hired vans to take them all the way to Warsaw.

Signum Chairman Charles Myers expects Ukraine’s reconstruction to become a top global investment theme and is preparing another trip.

“We will be back,” he told Bloomberg News in Kyiv.

–With assistance from Vinícius Andrade, Volodymyr Verbianyi, Maciej Martewicz and Todd Gillespie.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.