(Bloomberg) — The UK’s richest are set to unleash their savings to splash on luxury goods, cars or tech, a report showed, in signs that lower interest rates are boosting demand.

Most Read from Bloomberg

Households with incomes of £50,000 ($65,000) and above are planning to increase their spending on big ticket items at the highest rate since the run-up to the festive shopping season in November, according to a Gfk survey conducted between Feb. 28 and March 13. Its gauge of major purchases intentions among the top earners reached 4 — up 3 points on the month and a dramatic improvement from the -22 recorded in the same period last year.

“Higher-income people are starting to feel the impact of the drop in interest rates on their savings,” said Neil Bellamy, consumer insights director at NIQ GfK. “Higher spenders are feeling generally more positive about spending than they were a year ago.”

The findings could represent an early sign of a brightening mood among consumers. UK households have been pocketing their recent real wage gains as a hedge against uncertainty at home and abroad, much to the detriment of the Labour government’s plans to revive growth. Such savings become less lucrative as interest rates fall.

A resilient labor market is also helping the consumer recovery. Wages are still growing faster than inflation, as Prime Minister Keir Starmer has frequently emphasized in recent weeks, and predicted job losses after Labour’s increase in payroll taxes have so far failed to materialize.

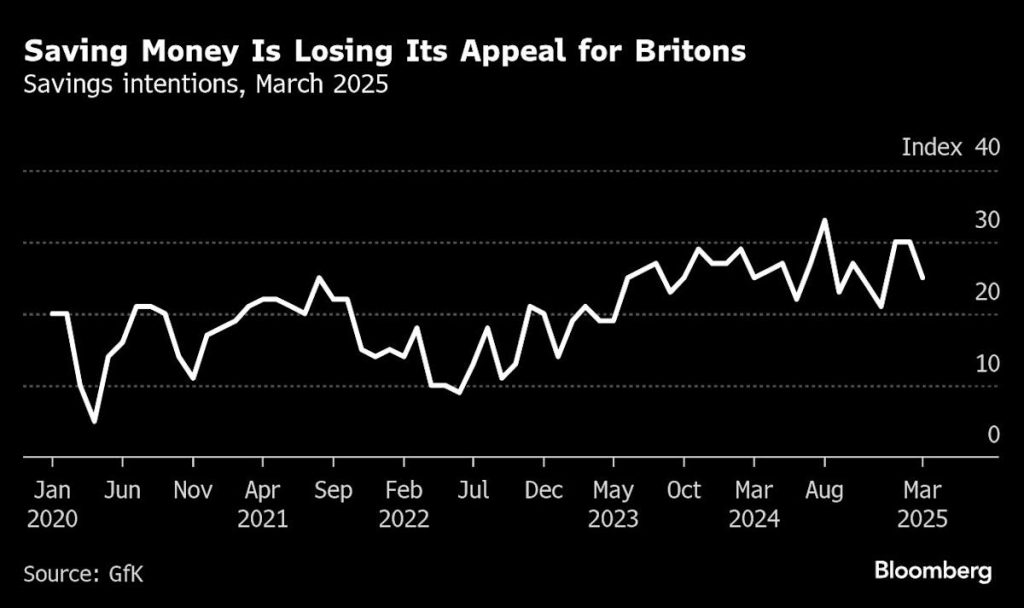

While most households are planning to save less, not everyone is using that cash for cars or furniture. GfK’s major purchases index across the income spectrum remained flat, even as as its indicator of overall savings intentions fell in March by the most since September.

One explanation could be rising bills, which are felt more acutely by people in lower-income groups. Britons are facing a £600 cost increase coming in April when water bills, energy costs and other regulated services go up in price. The poorest households are also bracing for public services belt-tightening, including a £5 billion cut to welfare benefits, in Chancellor of the Exchequer Rachel Reeves’ spring fiscal statement next week.

GfK’s overall confidence gauge improved one point to -19, but remained below levels recorded before the Labour government started its warnings about tax rises in the October budget.