Micron Technology Inc MU reported better-than-expected second-quarter financial results Thursday.

Micron reported second-quarter revenue of $8.05 billion, beating the consensus estimate of $7.89 billion. Total revenue was up from $5.82 billion on a year-over-year basis. The company reported second-quarter adjusted earnings of $1.56 per share, beating analyst estimates of $1.42 per share, according to Benzinga Pro.

“Micron delivered fiscal Q2 EPS above guidance and data center revenue tripled from a year ago,” said Sanjay Mehrotra, president and CEO of Micron.

Micron expects third-quarter revenue of $8.8 billion, plus or minus $200 million, versus estimates of $8.49 billion. The company anticipates third-quarter adjusted earnings of $1.57 per share, plus or minus 10 cents per share, versus estimates of $1.47 per share.

Micron shares fell 8% to trade at $94.77 on Friday.

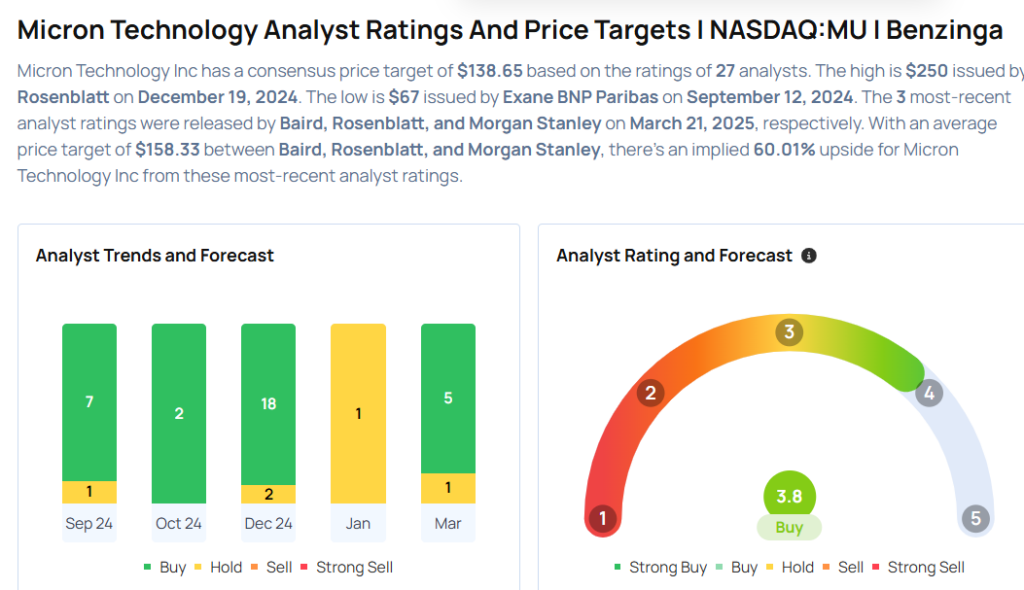

These analysts made changes to their price targets on Micron following earnings announcement.

- Morgan Stanley analyst Joseph Moore maintained Micron with an Equal-Weight rating and raised the price target from $91 to $112.

- Rosenblatt analyst Kevin Cassidy maintained the stock with a Buy and lowered the price target from $250 to $200.

- Baird analyst Tristan Gerra maintained Micron with an Outperform rating and raised the price target from $130 to $163.

Considering buying MU stock? Here’s what analysts think:

Read This Next:

Momentum77.85

Growth66.56

Quality74.83

Value58.60

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.