Investors with a lot of money to spend have taken a bearish stance on Devon Energy DVN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DVN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for Devon Energy.

This isn’t normal.

The overall sentiment of these big-money traders is split between 12% bullish and 75%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $64,540, and 6 are calls, for a total amount of $209,690.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $27.5 to $37.5 for Devon Energy over the last 3 months.

Analyzing Volume & Open Interest

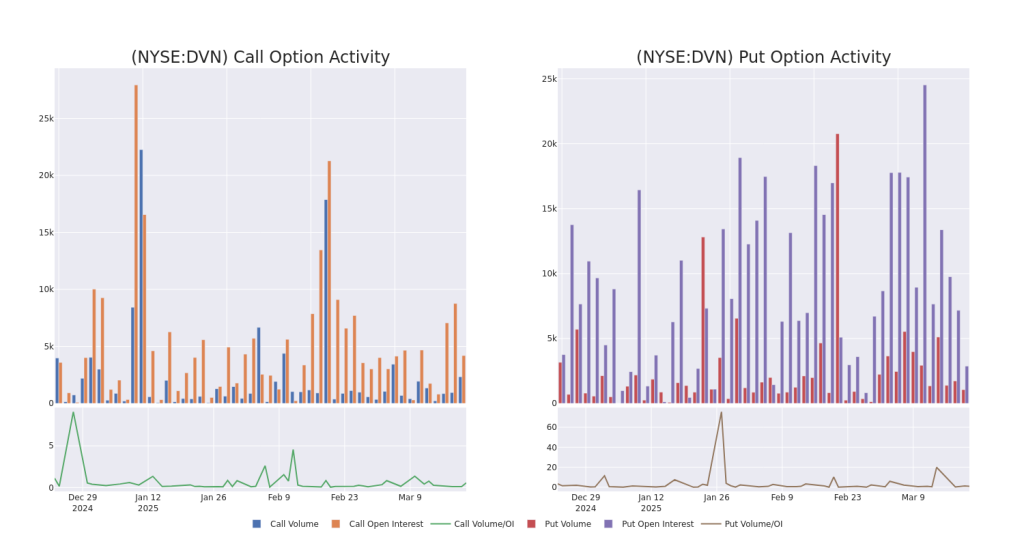

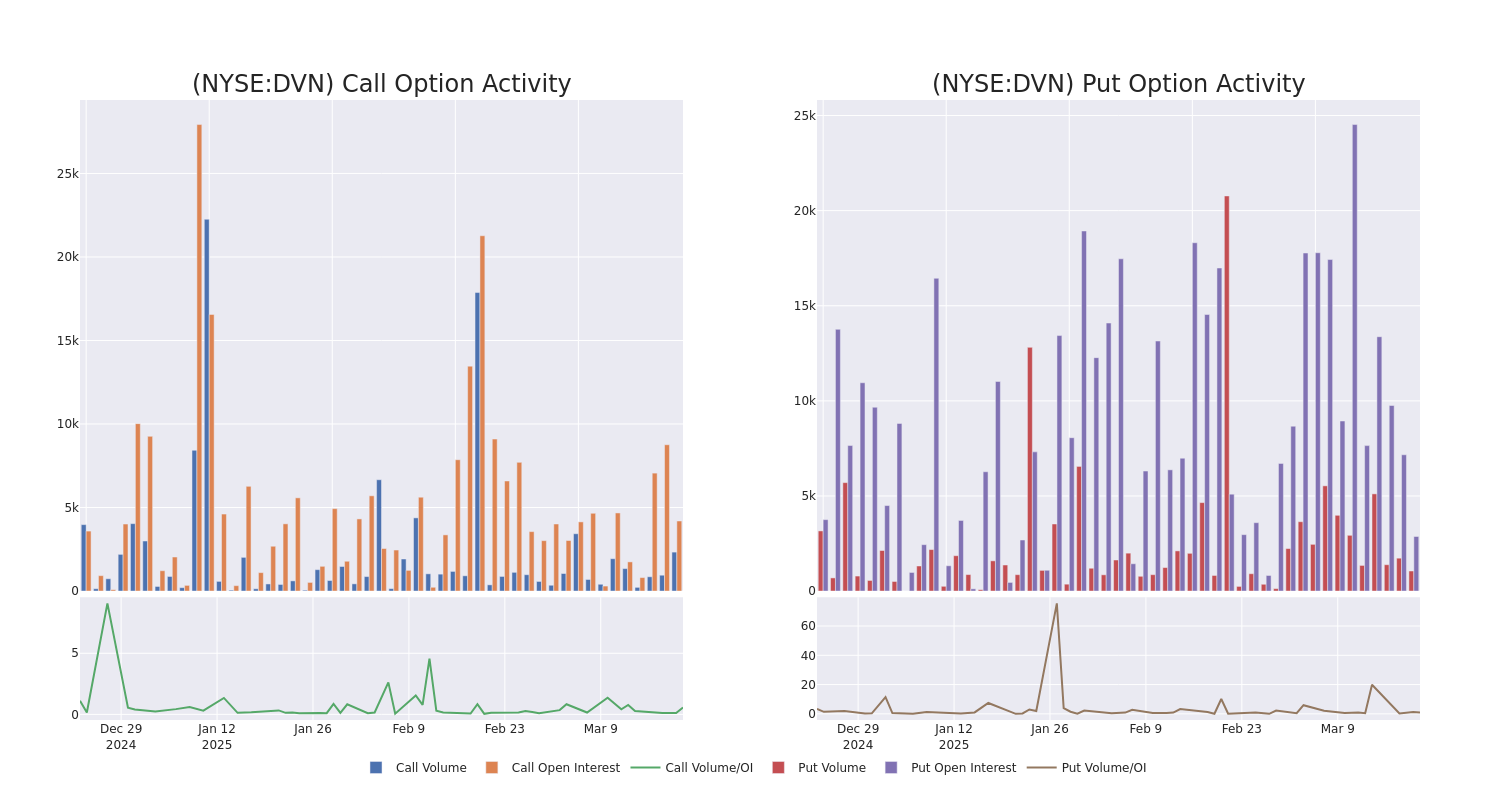

In today’s trading context, the average open interest for options of Devon Energy stands at 1177.0, with a total volume reaching 3,301.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Devon Energy, situated within the strike price corridor from $27.5 to $37.5, throughout the last 30 days.

Devon Energy Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | CALL | TRADE | BEARISH | 05/16/25 | $1.61 | $1.59 | $1.59 | $37.50 | $55.8K | 3.6K | 1.0K |

| DVN | CALL | SWEEP | NEUTRAL | 03/21/25 | $8.6 | $8.5 | $8.55 | $27.50 | $42.7K | 55 | 50 |

| DVN | PUT | TRADE | BULLISH | 10/17/25 | $4.4 | $4.3 | $4.3 | $37.50 | $36.1K | 151 | 84 |

| DVN | CALL | TRADE | BEARISH | 05/16/25 | $1.6 | $1.59 | $1.59 | $37.50 | $29.0K | 3.6K | 663 |

| DVN | CALL | TRADE | BEARISH | 10/17/25 | $3.5 | $3.45 | $3.45 | $37.50 | $28.9K | 236 | 84 |

About Devon Energy

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2024, Devon reported net proved reserves of 2.2 billion barrels of oil equivalent. Net production averaged roughly 848,000 barrels of oil equivalent per day in 2024 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

In light of the recent options history for Devon Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Devon Energy

- Currently trading with a volume of 3,873,829, the DVN’s price is up by 0.04%, now at $36.15.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 40 days.

Professional Analyst Ratings for Devon Energy

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $48.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Devon Energy, targeting a price of $44.

* An analyst from Barclays has decided to maintain their Equal-Weight rating on Devon Energy, which currently sits at a price target of $44.

* Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Devon Energy with a target price of $46.

* An analyst from Piper Sandler has decided to maintain their Overweight rating on Devon Energy, which currently sits at a price target of $55.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Devon Energy with a target price of $52.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Devon Energy options trades with real-time alerts from Benzinga Pro.

Momentum23.11

Growth64.25

Quality–

Value85.88

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.