Deep-pocketed investors have adopted a bullish approach towards Groupon GRPN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GRPN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Groupon. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 44% bearish. Among these notable options, 3 are puts, totaling $122,764, and 6 are calls, amounting to $502,075.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $9.0 to $20.0 for Groupon over the recent three months.

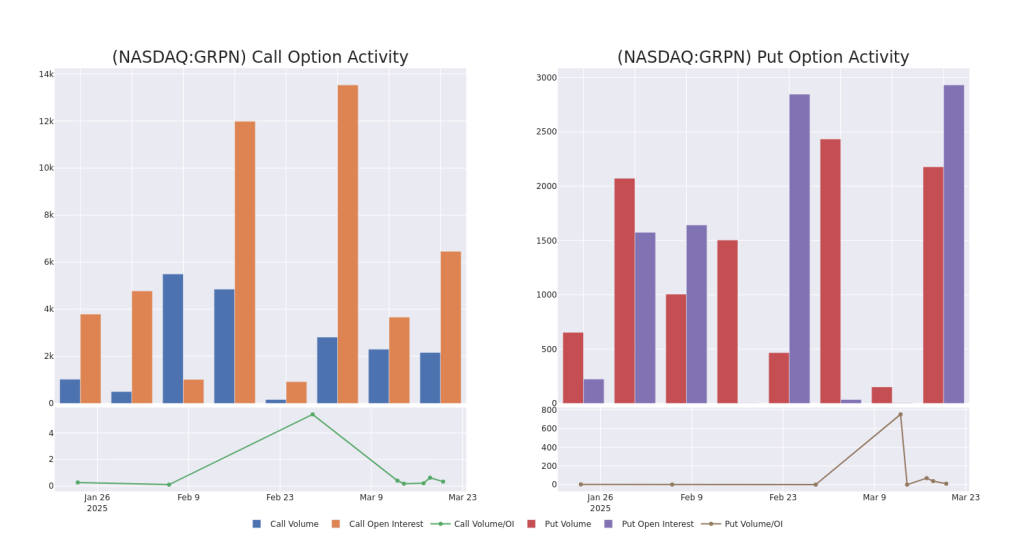

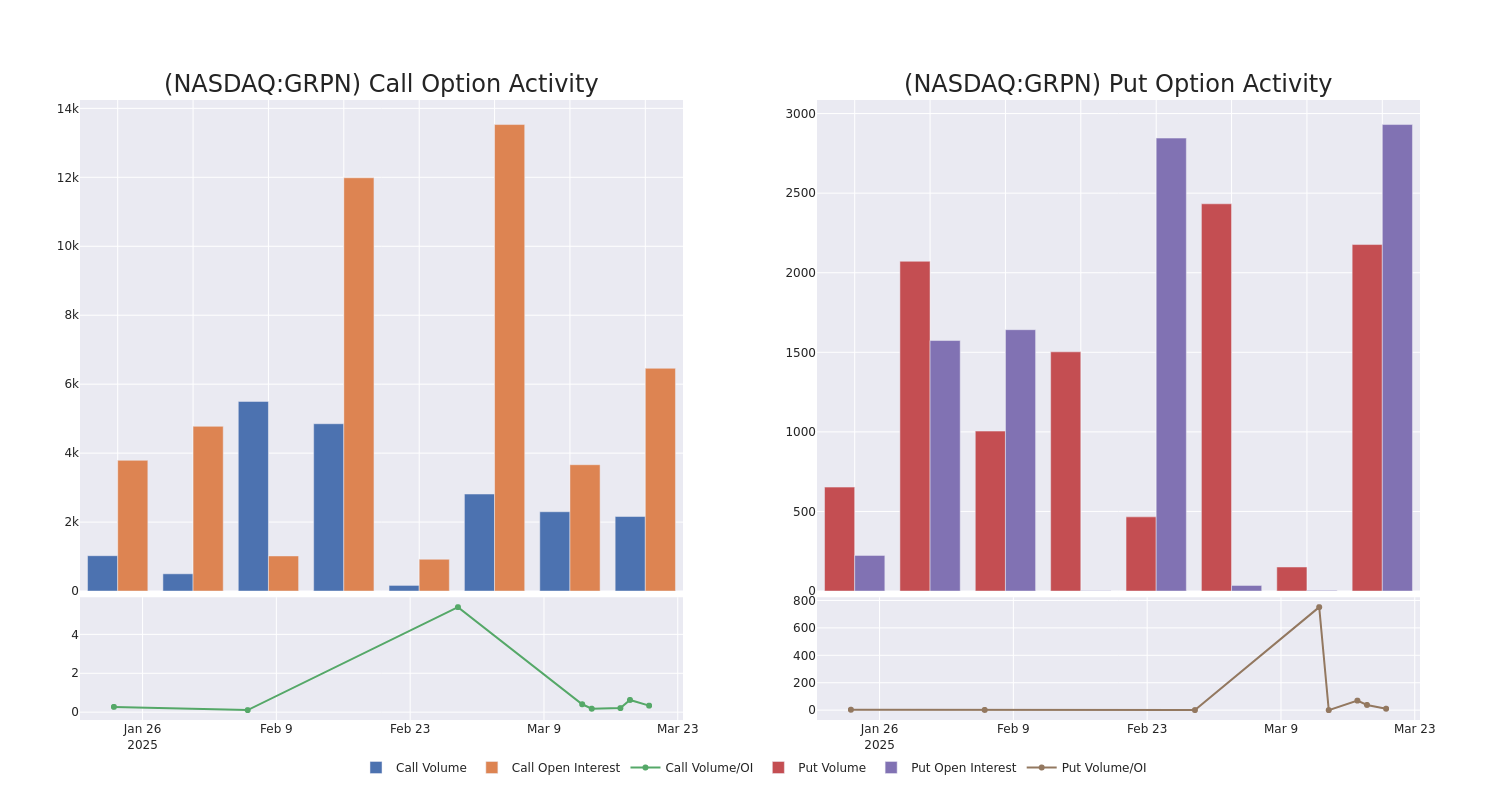

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Groupon options trades today is 1341.71 with a total volume of 4,338.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Groupon’s big money trades within a strike price range of $9.0 to $20.0 over the last 30 days.

Groupon Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GRPN | CALL | TRADE | BULLISH | 05/16/25 | $3.0 | $2.85 | $2.95 | $15.00 | $147.5K | 5.8K | 611 |

| GRPN | CALL | SWEEP | BULLISH | 01/15/27 | $5.3 | $4.9 | $5.2 | $20.00 | $129.4K | 385 | 0 |

| GRPN | CALL | TRADE | BULLISH | 07/18/25 | $1.55 | $1.45 | $1.53 | $20.00 | $76.5K | 196 | 500 |

| GRPN | CALL | TRADE | BULLISH | 07/18/25 | $1.55 | $1.45 | $1.52 | $20.00 | $76.0K | 196 | 1.0K |

| GRPN | PUT | SWEEP | BEARISH | 03/28/25 | $0.6 | $0.5 | $0.6 | $16.00 | $60.0K | 173 | 1.0K |

About Groupon

Groupon Inc acts as the middleman between consumers and merchants, offering products and services at discounts via its online store. It offers consumers daily deals from local merchants. The company’s operations are organized into two segments: North America and International. The company generates the majority of its revenue from North America. The company generates revenue from transactions during which the company generates commissions by selling goods or services on behalf of third-party merchants. Revenue also includes commissions the company earn when customers make purchases with retailers using digital coupons accessed through its digital properties.

After a thorough review of the options trading surrounding Groupon, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Groupon

- Currently trading with a volume of 1,145,969, the GRPN’s price is down by -2.2%, now at $16.42.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

What Analysts Are Saying About Groupon

In the last month, 2 experts released ratings on this stock with an average target price of $14.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Ascendiant Capital keeps a Buy rating on Groupon with a target price of $19.

* An analyst from Goldman Sachs has decided to maintain their Sell rating on Groupon, which currently sits at a price target of $9.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Groupon with Benzinga Pro for real-time alerts.

Momentum88.89

Growth10.61

Quality–

Value28.91

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.