Financial giants have made a conspicuous bullish move on GE Vernova. Our analysis of options history for GE Vernova GEV revealed 20 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $457,844, and 13 were calls, valued at $997,248.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $250.0 and $470.0 for GE Vernova, spanning the last three months.

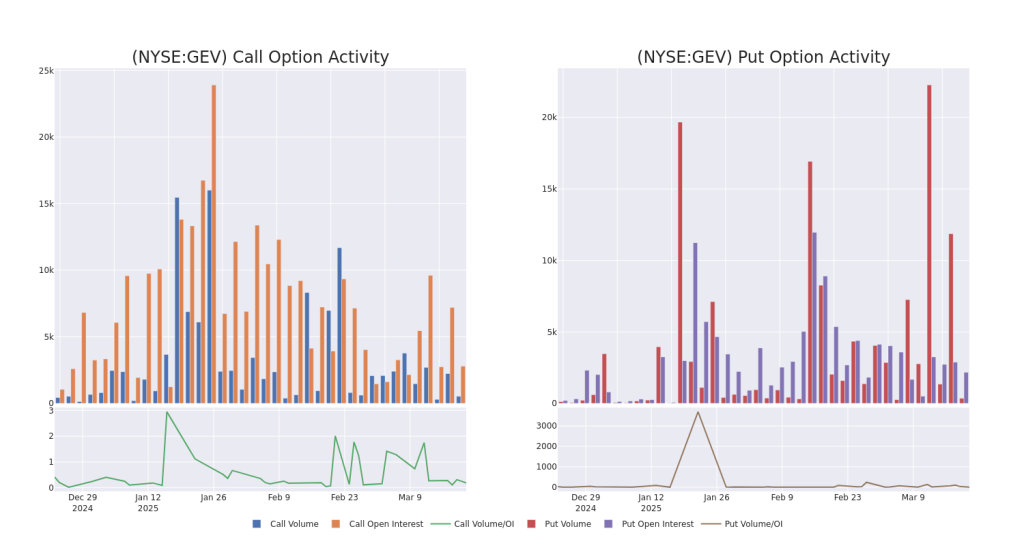

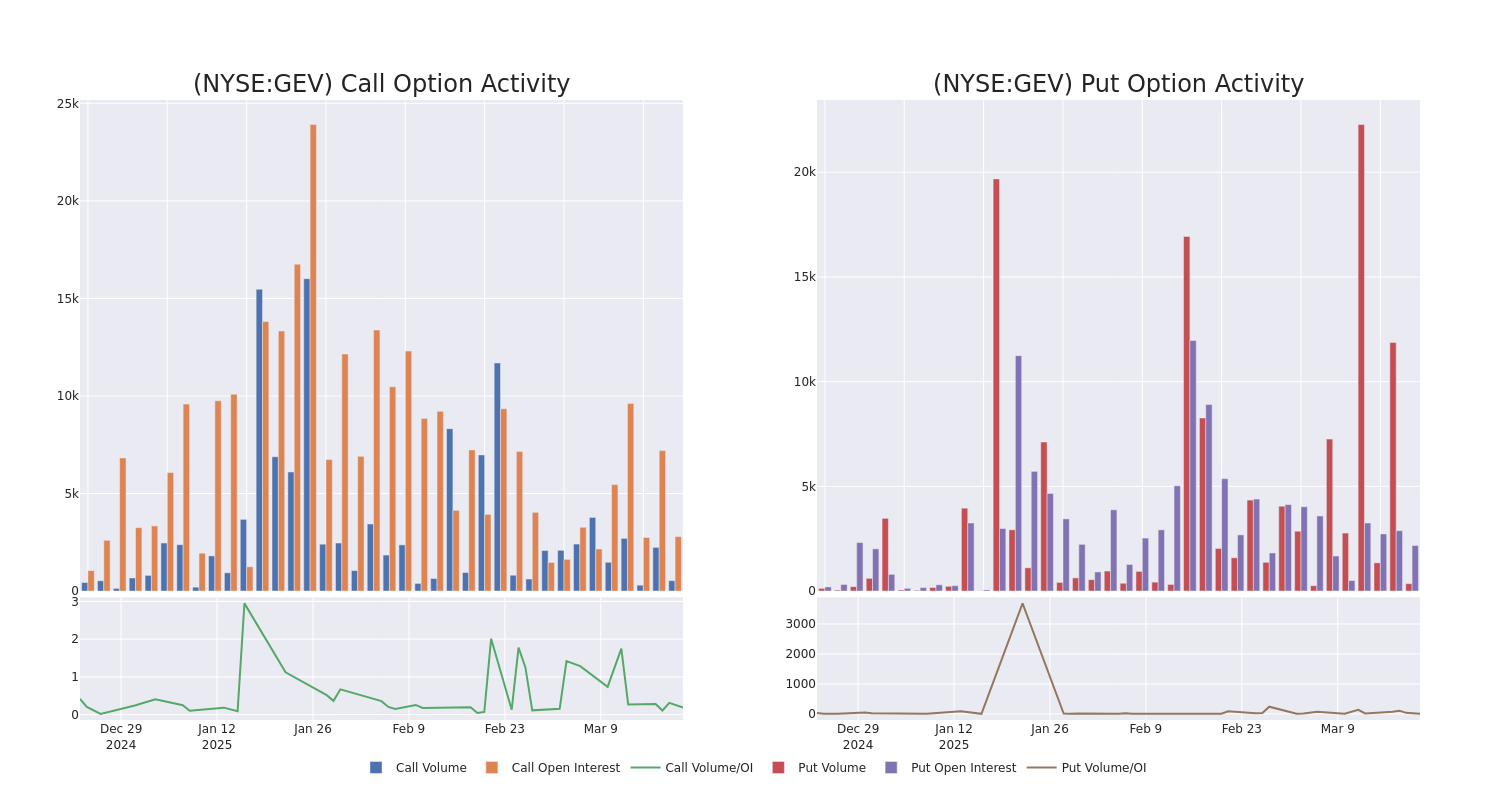

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of GE Vernova stands at 277.12, with a total volume reaching 885.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in GE Vernova, situated within the strike price corridor from $250.0 to $470.0, throughout the last 30 days.

GE Vernova Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GEV | CALL | SWEEP | BEARISH | 01/16/26 | $29.3 | $27.8 | $27.8 | $450.00 | $275.2K | 255 | 1 |

| GEV | PUT | TRADE | BULLISH | 07/18/25 | $48.8 | $48.0 | $48.0 | $350.00 | $139.2K | 52 | 29 |

| GEV | CALL | TRADE | BEARISH | 01/15/27 | $138.9 | $135.5 | $135.5 | $250.00 | $121.9K | 91 | 9 |

| GEV | CALL | SWEEP | BEARISH | 06/20/25 | $26.0 | $24.7 | $24.7 | $360.00 | $108.6K | 133 | 44 |

| GEV | CALL | SWEEP | BULLISH | 10/17/25 | $16.4 | $16.3 | $16.3 | $470.00 | $105.8K | 1 | 65 |

About GE Vernova

GE Vernova is a global leader in the electric power industry, with products and services that generate, transfer, convert, and store electricity. The company has three business segments: power, wind, and electrification. Power includes gas, nuclear, hydroelectric, and steam technologies, providing dispatchable power. The wind segment includes wind generation technologies, inclusive of onshore and offshore wind turbines and blades. Electrification includes grid solutions, power conversion, electrification software, and solar and storage solutions technologies required for the transmission, distribution, conversion, and storage of electricity from the point of generation to point of consumption.

After a thorough review of the options trading surrounding GE Vernova, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

GE Vernova’s Current Market Status

- Currently trading with a volume of 1,435,271, the GEV’s price is down by -1.52%, now at $331.71.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 33 days.

What The Experts Say On GE Vernova

4 market experts have recently issued ratings for this stock, with a consensus target price of $418.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from BMO Capital persists with their Outperform rating on GE Vernova, maintaining a target price of $420.

* In a positive move, an analyst from Guggenheim has upgraded their rating to Buy and adjusted the price target to $380.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on GE Vernova with a target price of $427.

* An analyst from RBC Capital persists with their Outperform rating on GE Vernova, maintaining a target price of $445.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GE Vernova with Benzinga Pro for real-time alerts.

Momentum–

Growth34.81

Quality–

Value9.28

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.