Deep-pocketed investors have adopted a bearish approach towards Cadence Design Systems CDNS, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CDNS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Cadence Design Systems. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $230,015, and 2 are calls, amounting to $62,271.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $220.0 to $320.0 for Cadence Design Systems during the past quarter.

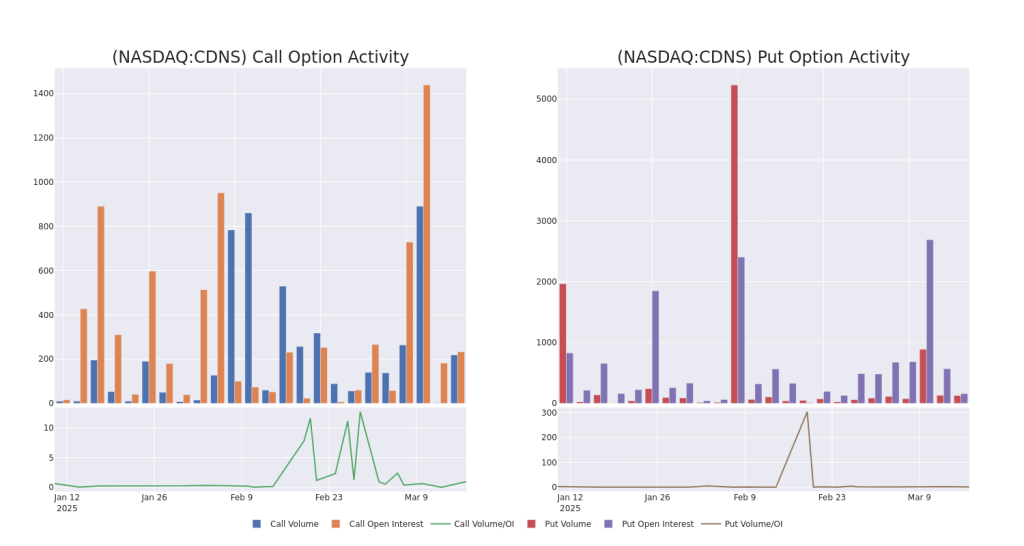

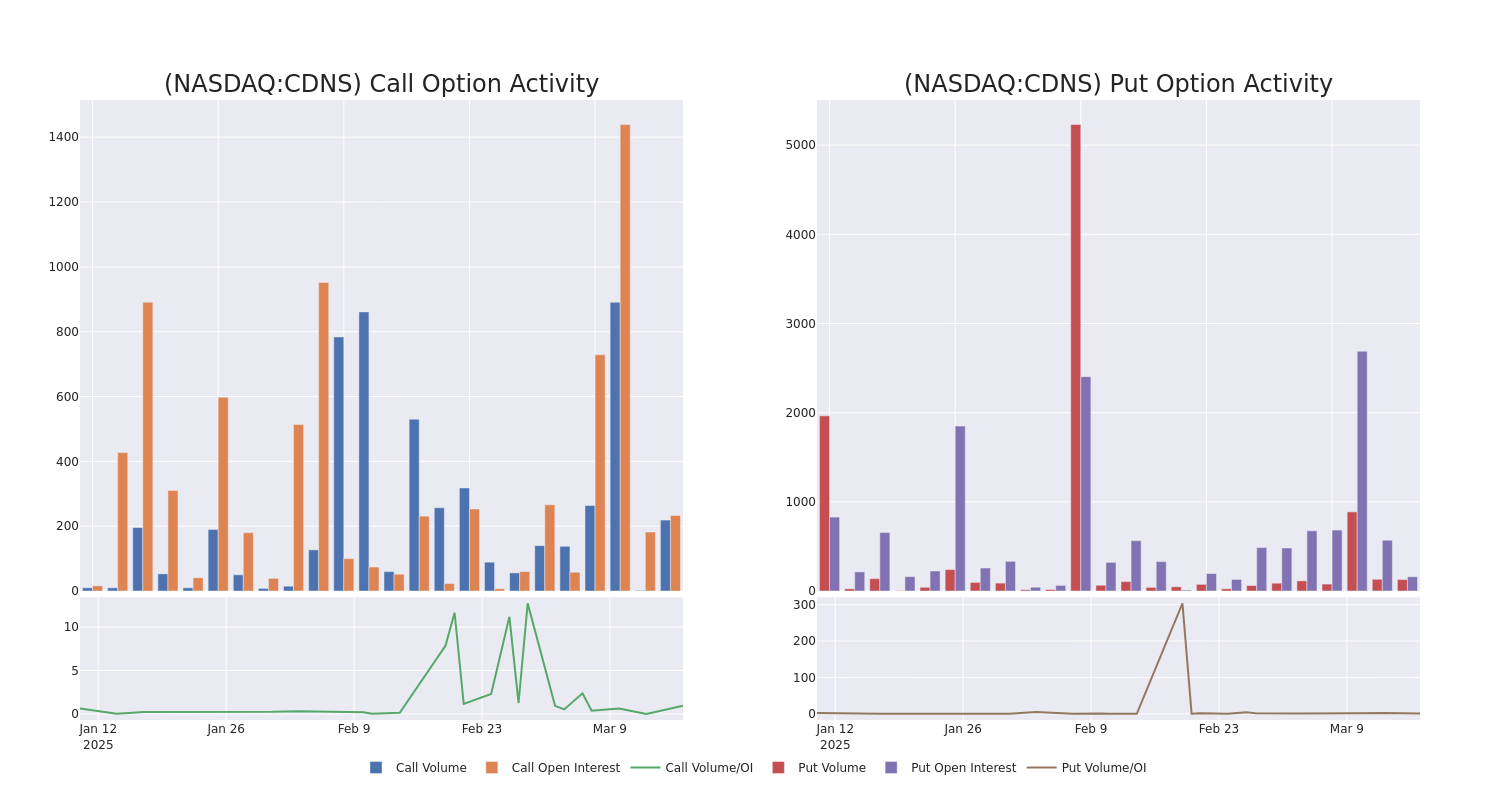

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Cadence Design Systems stands at 72.0, with a total volume reaching 250.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cadence Design Systems, situated within the strike price corridor from $220.0 to $320.0, throughout the last 30 days.

Cadence Design Systems Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CDNS | PUT | SWEEP | BEARISH | 08/15/25 | $7.3 | $7.0 | $7.3 | $220.00 | $47.4K | 91 | 66 |

| CDNS | PUT | TRADE | BULLISH | 09/19/25 | $18.1 | $17.5 | $17.6 | $250.00 | $45.7K | 127 | 54 |

| CDNS | PUT | TRADE | BULLISH | 09/19/25 | $17.8 | $17.3 | $17.4 | $250.00 | $45.2K | 127 | 28 |

| CDNS | CALL | TRADE | NEUTRAL | 04/17/25 | $5.0 | $4.6 | $4.8 | $275.00 | $36.0K | 82 | 79 |

| CDNS | PUT | TRADE | BULLISH | 04/17/25 | $37.6 | $35.0 | $35.46 | $300.00 | $35.4K | 0 | 10 |

About Cadence Design Systems

Cadence Design Systems is a provider of electronic design automation software, intellectual property, and system design and analysis products. EDA software automates and aids in the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. Cadence offers a portfolio of design IP, as well as system design and analysis products, which enables system-level analysis and verification solutions.

In light of the recent options history for Cadence Design Systems, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Cadence Design Systems

- With a volume of 1,767,275, the price of CDNS is down -1.58% at $254.42.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 31 days.

Professional Analyst Ratings for Cadence Design Systems

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $267.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Oppenheimer continues to hold a Underperform rating for Cadence Design Systems, targeting a price of $200.

* An analyst from Baird has decided to maintain their Outperform rating on Cadence Design Systems, which currently sits at a price target of $335.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cadence Design Systems options trades with real-time alerts from Benzinga Pro.

Momentum30.25

Growth74.59

Quality72.17

Value7.38

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.