On Thursday, Jabil Inc. JBL reported second-quarter adjusted earnings per share of $1.94, beating the analyst consensus estimate of $1.83. Quarterly sales of $6.73 billion outpaced the analyst consensus estimate of $6.408 billion.

Regulated Industries revenue increased by 8% year over year, Intelligent Infrastructure revenue grew by 18% year over year, and Connected Living & Digital Commerce revenue decreased by 13% year over year.

The company exited the quarter with cash and equivalents worth $1.592 billion, with an adjusted free cash flow of $261 million.

Also Read: AI-Powered Grid? Itron And NVIDIA Join Forces To Transform Utilities With Smarter, Faster Solutions

Jabil’s core EBITDA as of quarter end was pegged at $488 million, lower than $505 million a year ago.

“In Q2, we exceeded our expectations due to continued strength in our capital equipment, cloud and data center infrastructure, and digital commerce end-markets,” said CEO Mike Dastoor.

According to Benzinga Pro, JBL stock has gained over 15% in the past year. Investors can gain exposure to the stock via Collaborative Investment Series Trust Mohr Company Nav ETFCNAV.

Outlook: For the third quarter, the company projects net revenues of $6.7 billion to $7.3 billion (consensus: $6.74 billion). Adjusted EPS is expected to be $2.08 to $2.48 (consensus: $2.22).

For FY25, Jabil raised its guidance. The company expects revenues to be $27.9 billion (consensus $27.316 billion), up from the prior view of $27.3 billion. Adjusted EPS is projected to be $8.95 (consensus: $8.74), up from the prior view of $8.75.

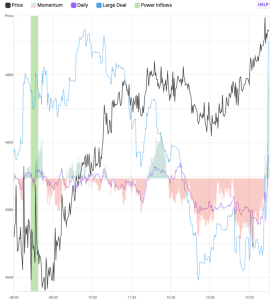

Price Action: JBL shares are trading higher by 5.5% to $147.19 at last check on Thursday.

Read Next:

Momentum83.36

Growth19.52

Quality82.94

Value41.25

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.