Sportradar Group AG SRAD on Wednesday announced a deal to acquire IMG ARENA from Endeavor Group Holdings EDR, expanding its global sports betting rights and strengthening its presence in top sports like tennis, soccer, and basketball.

The transaction is expected to immediately enhance Sportradar’s adjusted EBITDA margins and accelerate revenue and cash flow growth. Notably, the deal requires no upfront payment from Sportradar. Instead, it includes $125 million paid to the company and up to $100 million in cash prepayments from Endeavor to certain sports rightsholders—totaling $225 million in financial consideration.

Adding IMG ARENA’s rights enhances Sportradar’s coverage across 14 global sports, including marquee events like Wimbledon, the U.S. Open, and Roland-Garros. The deal expands reach to over 70 rightsholders and nearly 70,000 live data and streaming events annually. Sportradar’s scalable technology platform and broad client network will help quickly integrate and monetize these assets.

The transaction further strengthens the company’s balance sheet and liquidity position, supporting future investments and potentially accelerating its share buyback program. As of Dec. 31, Sportradar reported €348 million ($382.8 million) in cash and cash equivalents, with total liquidity rising to €568 million, and maintained a debt-free balance sheet.

Earnings Recap:

- Full-Year 2024: Revenue rose 26% to €1.1 billion, adjusted EBITDA grew 33% to €222 million, and free cash flow surged 133%. Net cash from operations increased 36% to €353 million.

- Strategic Moves: The company achieved a 127% customer net retention rate, launched a $200 million share repurchase program (buying back $20.3 million), and acquired affiliate marketing assets from XLMedia PLC.

- Q4 2024: Revenue increased 22% to €307 million; adjusted EBITDA jumped 53% to €61 million. A €1 million quarterly loss was attributed to foreign currency fluctuations, with a temporary dip in free cash flow due to the timing of sports rights payments.

2025 Outlook: Sportradar expects at least €1.27 billion in revenue and €281 million in adjusted EBITDA, with margin expansion and improved free cash flow conversion above the 2024 level of 53%.

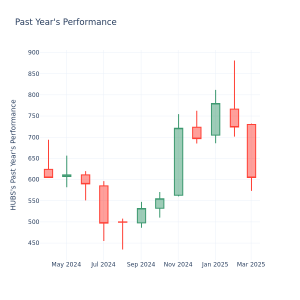

Price Action: SRAD shares are trading lower by 0.64% at $19.95 in early Wednesday trading at the last check.

Image via Shutterstock

Momentum78.10

Growth13.74

Quality–

Value26.81

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.