Financial giants have made a conspicuous bearish move on Apple. Our analysis of options history for Apple AAPL revealed 55 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 52% showed bearish tendencies. Out of all the trades we spotted, 23 were puts, with a value of $13,323,035, and 32 were calls, valued at $1,808,142.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $165.0 to $250.0 for Apple over the last 3 months.

Analyzing Volume & Open Interest

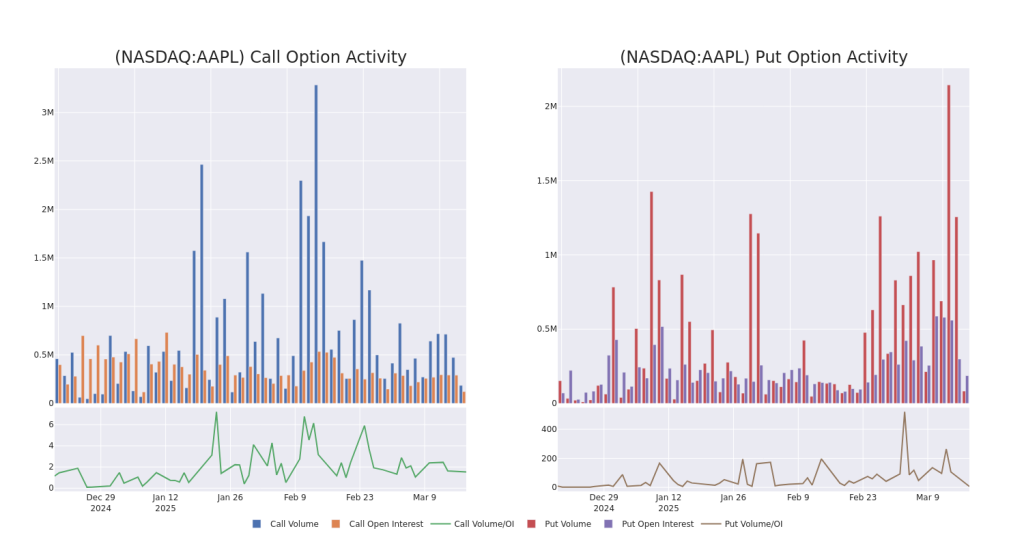

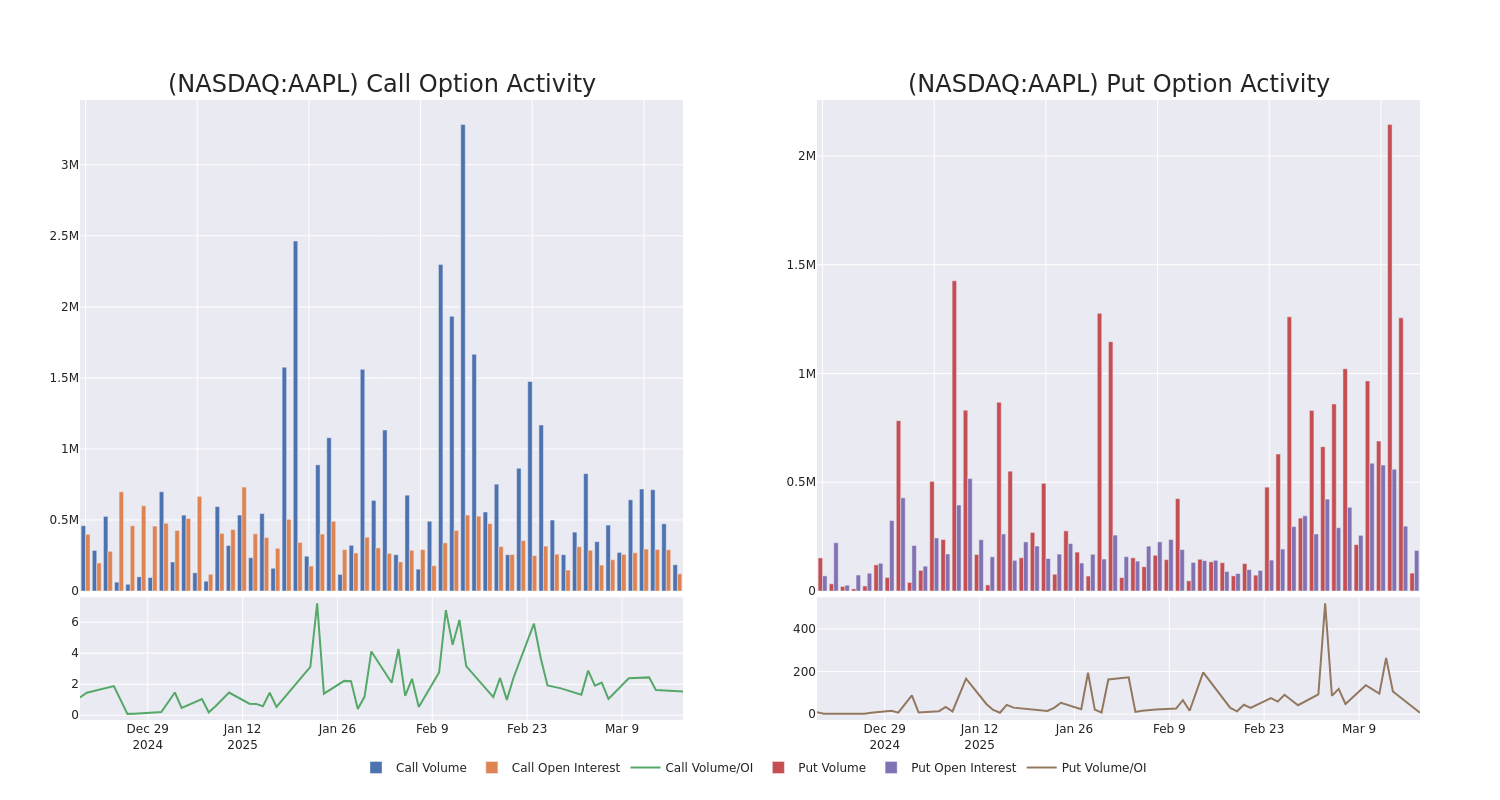

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Apple’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Apple’s whale trades within a strike price range from $165.0 to $250.0 in the last 30 days.

Apple 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | PUT | SWEEP | BEARISH | 06/20/25 | $9.9 | $9.75 | $9.9 | $210.00 | $4.5M | 26.8K | 9.6K |

| AAPL | PUT | SWEEP | BULLISH | 05/16/25 | $15.7 | $15.5 | $15.5 | $225.00 | $3.5M | 12.1K | 5.5K |

| AAPL | PUT | SWEEP | BEARISH | 06/20/25 | $9.95 | $9.75 | $9.93 | $210.00 | $1.8M | 26.8K | 4.9K |

| AAPL | PUT | SWEEP | BULLISH | 05/16/25 | $15.7 | $15.5 | $15.51 | $225.00 | $1.4M | 12.1K | 3.1K |

| AAPL | PUT | SWEEP | BULLISH | 05/16/25 | $15.75 | $15.6 | $15.6 | $225.00 | $975.0K | 12.1K | 2.2K |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

Apple’s Current Market Status

- With a volume of 11,330,686, the price of AAPL is up 0.07% at $214.15.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 44 days.

What The Experts Say On Apple

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $294.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Apple with a target price of $252.

* In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $325.

* An analyst from Wedbush downgraded its action to Outperform with a price target of $325.

* An analyst from Evercore ISI Group persists with their Outperform rating on Apple, maintaining a target price of $275.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Apple options trades with real-time alerts from Benzinga Pro.

Momentum77.08

Growth60.77

Quality79.28

Value7.82

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.