Investors with a lot of money to spend have taken a bullish stance on Procter & Gamble PG.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Procter & Gamble.

This isn’t normal.

The overall sentiment of these big-money traders is split between 66% bullish and 33%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $270,581, and 4 are calls, for a total amount of $160,940.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $190.0 for Procter & Gamble over the last 3 months.

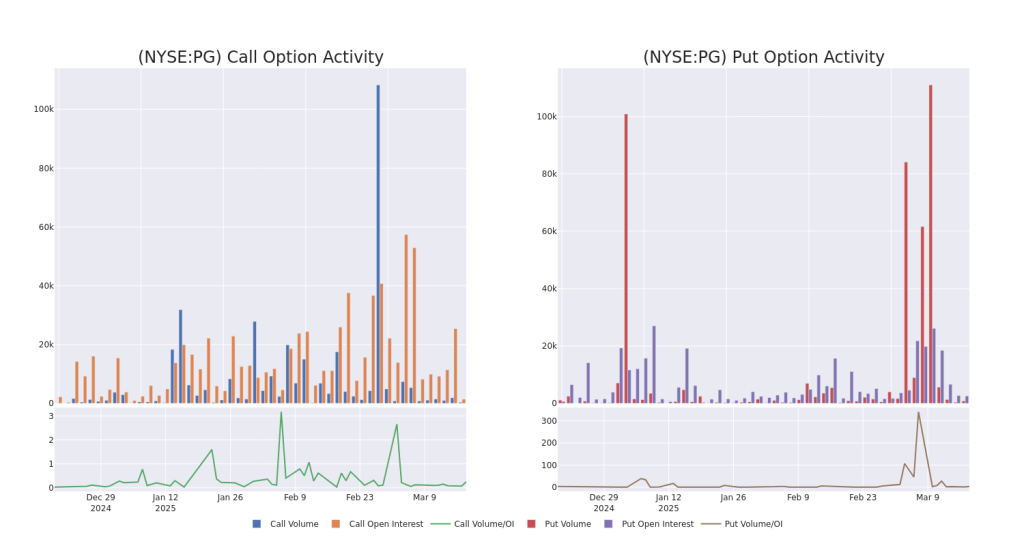

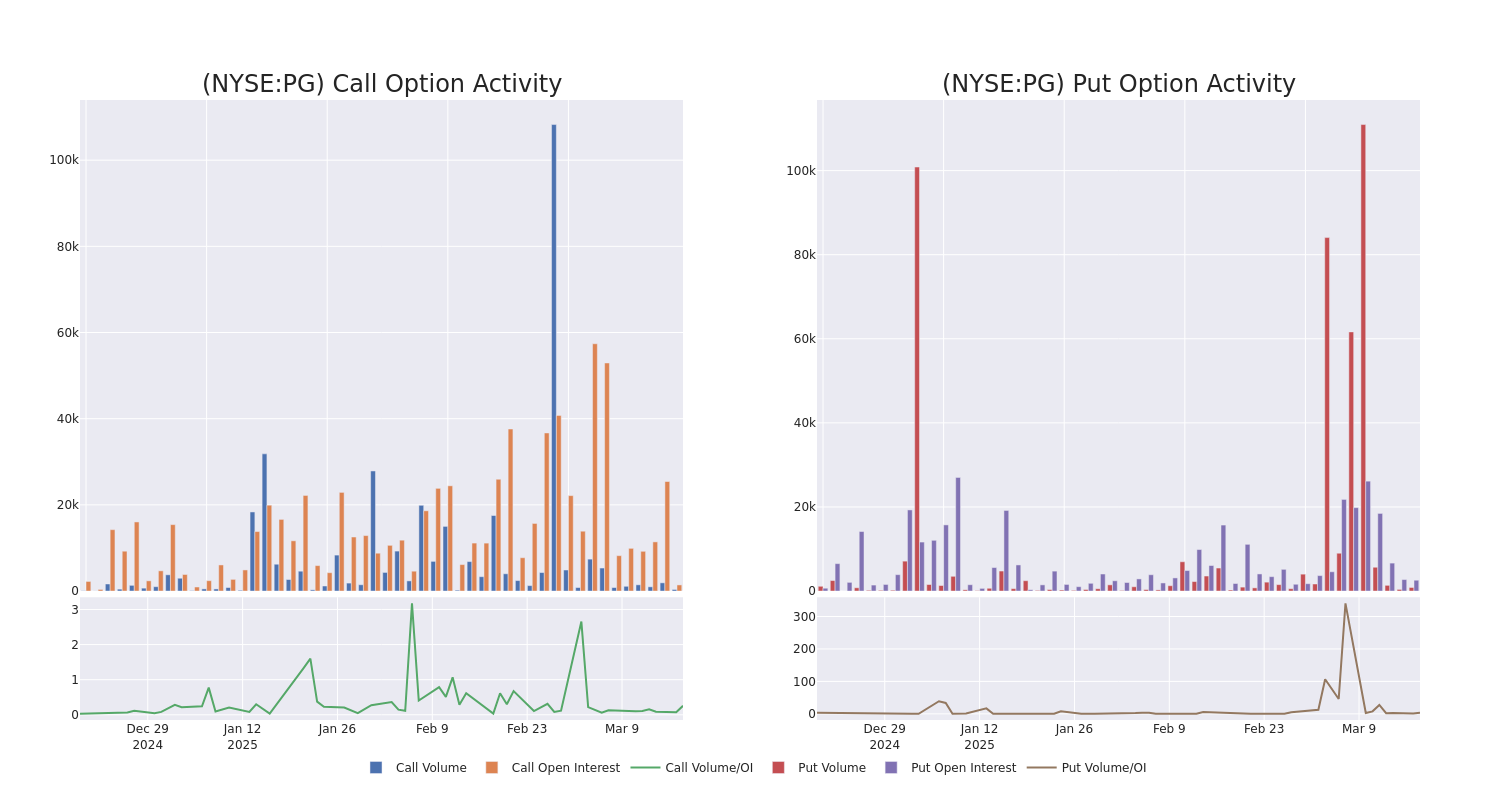

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Procter & Gamble stands at 798.2, with a total volume reaching 1,211.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Procter & Gamble, situated within the strike price corridor from $155.0 to $190.0, throughout the last 30 days.

Procter & Gamble Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | PUT | TRADE | BULLISH | 06/18/26 | $7.95 | $7.8 | $7.8 | $155.00 | $159.1K | 163 | 227 |

| PG | CALL | TRADE | BULLISH | 09/19/25 | $7.2 | $7.15 | $7.2 | $175.00 | $57.6K | 614 | 144 |

| PG | CALL | TRADE | BEARISH | 09/19/25 | $7.35 | $7.15 | $7.2 | $175.00 | $45.3K | 614 | 1 |

| PG | PUT | TRADE | BULLISH | 06/18/26 | $7.85 | $7.8 | $7.8 | $155.00 | $30.4K | 163 | 337 |

| PG | CALL | TRADE | BULLISH | 09/19/25 | $2.1 | $1.96 | $2.1 | $190.00 | $30.2K | 804 | 3 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world’s largest consumer product manufacturers, with annual sales approaching $85 billion. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm’s consolidated total.

Where Is Procter & Gamble Standing Right Now?

- Currently trading with a volume of 3,224,819, the PG’s price is up by 0.18%, now at $170.07.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

What The Experts Say On Procter & Gamble

In the last month, 1 experts released ratings on this stock with an average target price of $172.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler persists with their Neutral rating on Procter & Gamble, maintaining a target price of $172.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Procter & Gamble, Benzinga Pro gives you real-time options trades alerts.

Momentum51.67

Growth54.42

Quality39.11

Value19.39

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.