HealthEquity, Inc. HQY will release its fourth-quarter financial results, after the closing bell, on Tuesday, March 18.

Analysts expect the Draper, Utah-based company to report quarterly earnings at 72 cents per share, up from 63 cents per share in the year-ago period. HealthEquity projects quarterly revenue of $305.82 million, compared to $262.39 million a year earlier, according to data from Benzinga Pro.

On Dec. 9, 2024, HealthEquity posted mixed results for the third quarter.

HealthEquity shares gained 3.4% to close at $100.72 on Monday.

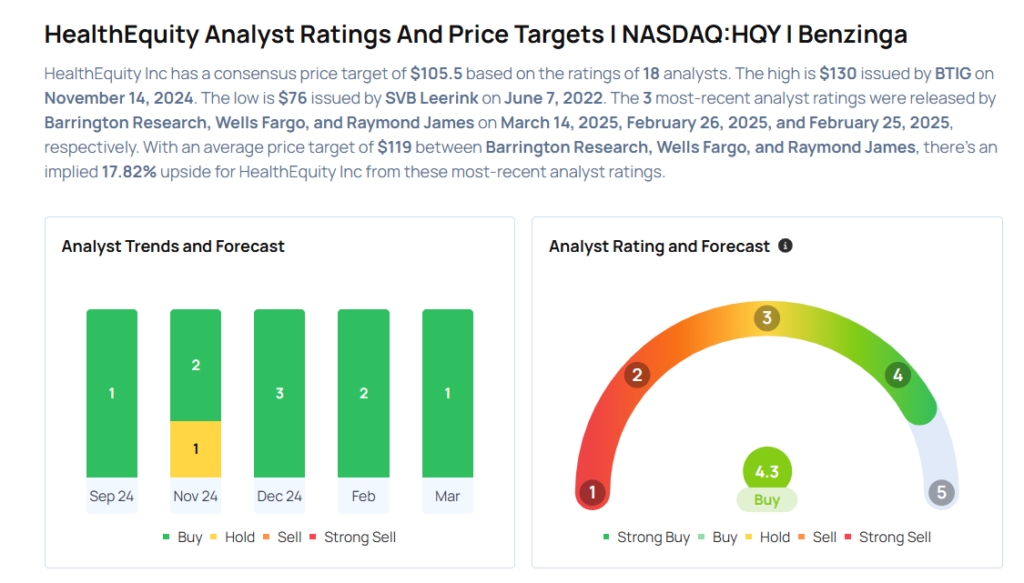

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Barrington Research analyst Alexander Paris maintained an Outperform rating and a price target of $112 on March 14, 2025. This analyst has an accuracy rate of 80%.

- Raymond James analyst C. Gregory Peters maintained an Outperform rating and raised the price target from $105 to $120 on Feb. 25, 2025. This analyst has an accuracy rate of 79%.

- Mizuho analyst Steven Valiquette initiated coverage on the stock with an Outperform rating and a price target of $126 on Dec. 4, 2024. This analyst has an accuracy rate of 60%.

- B of A Securities analyst Allen Lutz maintained a Buy rating and raised the price target from $100 to $120 on Nov. 13, 2024. This analyst has an accuracy rate of 64%.

- Deutsche Bank analyst George Hill maintained a Buy rating and increased the price target from $102 to $103 on Sept. 4, 2024. This analyst has an accuracy rate of 61%.

Considering buying HQY stock? Here’s what analysts think:

Read This Next:

Momentum86.69

Growth18.65

Quality63.66

Value12.44

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.