(Bloomberg) — Top US oil executives are planning a sit-down with their country’s president to discuss energy policy, of which coal is now seen as a key part. Cobalt, a key battery metal, is surging after a surprise export ban from the top producer. And countries around the world are keeping a tight grip on steel.

Most Read from Bloomberg

Here are five notable charts to consider in global commodity markets as the week gets underway.

Oil

Top US oil executives have a visit to the White House on their calendars this week to discuss energy production with President Donald Trump. The meeting comes amid a backdrop of falling crude prices, growing production and tariff uncertainty. In its latest report, the International Energy Agency reduced projections for growth in world oil consumption this year while anticipating a supply surplus.

Coal

Coal is cheaper in Asia than its been since 2021 as a global oversupply kept prices low. But that’s due to change. Coal’s popularity is rising, even in the US where the dirty fuel had been shunned and plants closed. Now, the Trump administration is working to stem those closures as the nation seeks to meet surging demand for power. The move follows the International Energy Agency’s December forecast that said use of coal would climb through at least 2027. Along with that, expect prices to also rise.

Cobalt

The price of cobalt is soaring as the ramifications of a surprise export ban from the world’s largest producer unfold. Cobalt hydroxide — the main product exported from the Democratic Republic of Congo — spiked after the country imposed a four-month suspension in February to rein in a glut. Last week, cobalt hit its highest level since July 2023, according to Fastmarkets. Congo accounts for about three-quarters of the world’s production of the battery metal.

Steel

Countries around the world rushing to stem imports of steel, seen as an historic symbol of manufacturing strength. Just as the US imposes tariffs on metals, South Korea, Vietnam, Brazil and the European Union also are seeking to protect domestic steel production and reduce supplies from China, the dominant producer whose exports surged close to a record last year.

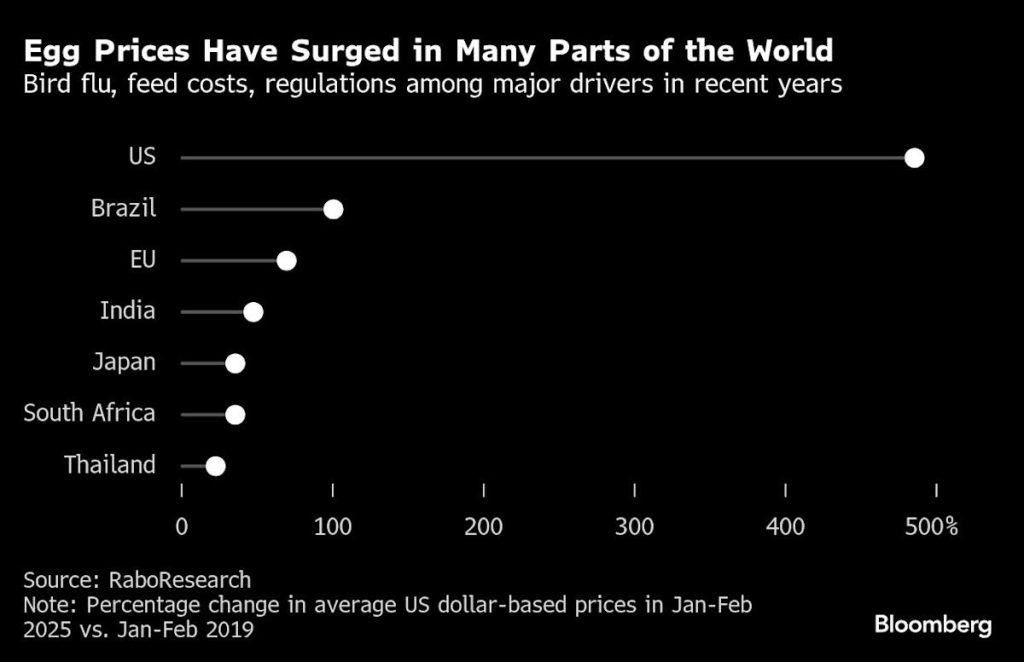

Eggs

First it was the US seeing the cost of eggs skyrocket. Now, it’s Europe and beyond as bird flu outbreaks span the globe. Wholesale prices climbed to the highest level in more than a decade last week in Europe. That’s just as US consumers finally were getting a break from record prices, in part thanks to imports. With Easter around the corner, expect demand to remain high.