(Bloomberg) — Supply Lines is a daily newsletter that tracks global trade. Sign up here.

Most Read from Bloomberg

An anxious sense of wait-and-see may emerge from central banks in the coming week, in their first collective assessment of how President Donald Trump’s trade policies are impacting the world economy.

While officials from Washington to London and Tokyo have already set borrowing costs once since the US president entered the White House in January, those decisions preceded a marked escalation in his rhetoric and measures against neighbors, allies and competitors alike.

With global tariffs now in place on steel and aluminum, and with Canada, China and the European Union all further suffering Trump’s ire, what were unrealized threats a few weeks ago have now emerged as full-blown hindrances to commerce.

Central bankers struggling to gauge whether the impact will be greater on growth or inflation may well choose to do nothing for now.

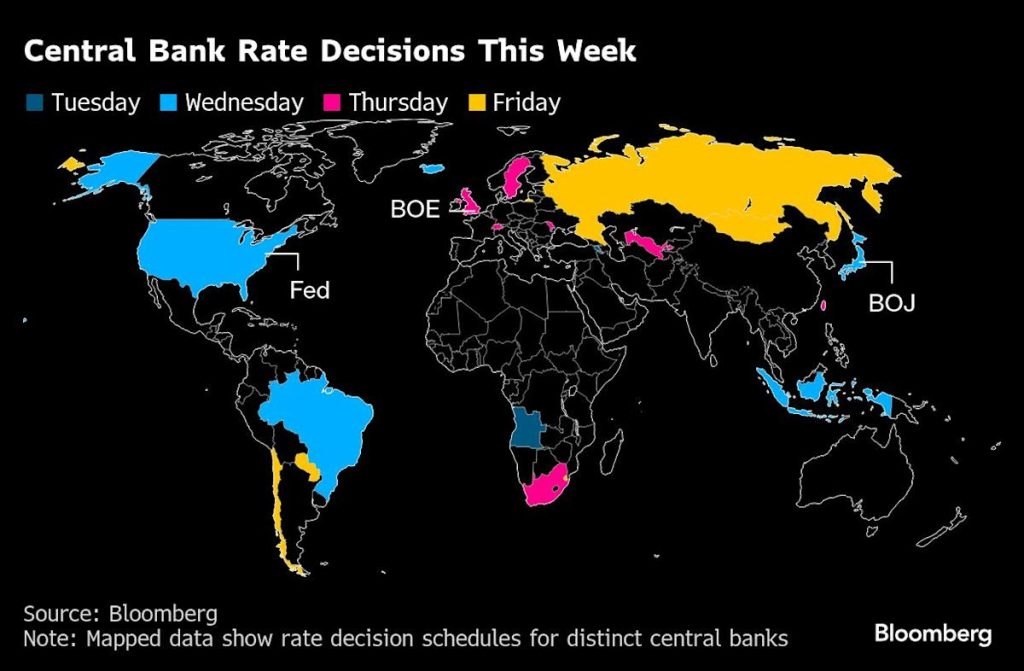

New-found worries about a potential US recession that gripped Wall Street in the past week probably won’t spur the Federal Reserve to deliver more easing for now, and unchanged interest rates are also the most likely outcomes at meetings in Japan, the UK and Sweden. Officials in South Africa, Russia and Indonesia may follow suit.

Some others will probably act immediately, though, against pressing risks — while warily assessing the shockwaves of Trump’s actions. In Brazil, for example, the central bank is widely anticipated to raise borrowing costs again to fight resurgent inflation.

What Bloomberg Economics Says:

“Even as consumer and business confidence deteriorate quickly, the Fed’s degree of freedom to cut rates is constrained by indicators showing a surge in inflation expectations. In the absence of a ‘Trump Put,’ the Fed’s reluctance to cut – to offer the market a ‘Fed Put’ at least – could push the downturn in sentiment into something beyond just vibes.”

—Anna Wong and Chris G. Collins, economists. For full analysis, click here

In all, officials responsible for half of the world’s 10 most-traded currencies, along with other Group of 20 peers, are poised to set rates over the coming days.

European Central Bank President Christine Lagarde on Wednesday described the challenge confronted by many of global counterparts. With her own institution recently having stopped short of signaling its next move out of caution about the backdrop, she says the job of monetary policymaking just got harder.