Financial giants have made a conspicuous bullish move on Reddit. Our analysis of options history for Reddit RDDT revealed 60 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 24 were puts, with a value of $1,456,724, and 36 were calls, valued at $2,448,767.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $230.0 for Reddit over the last 3 months.

Insights into Volume & Open Interest

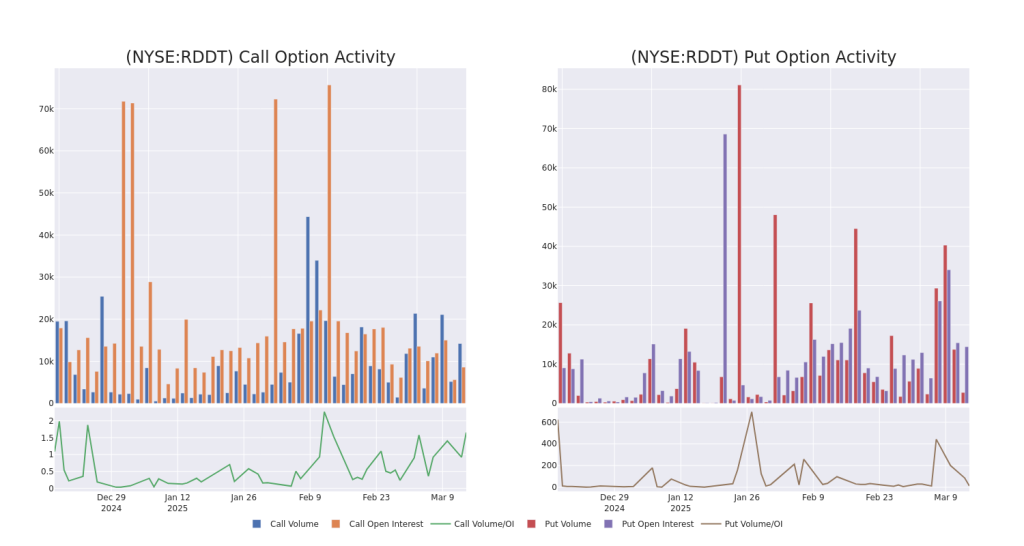

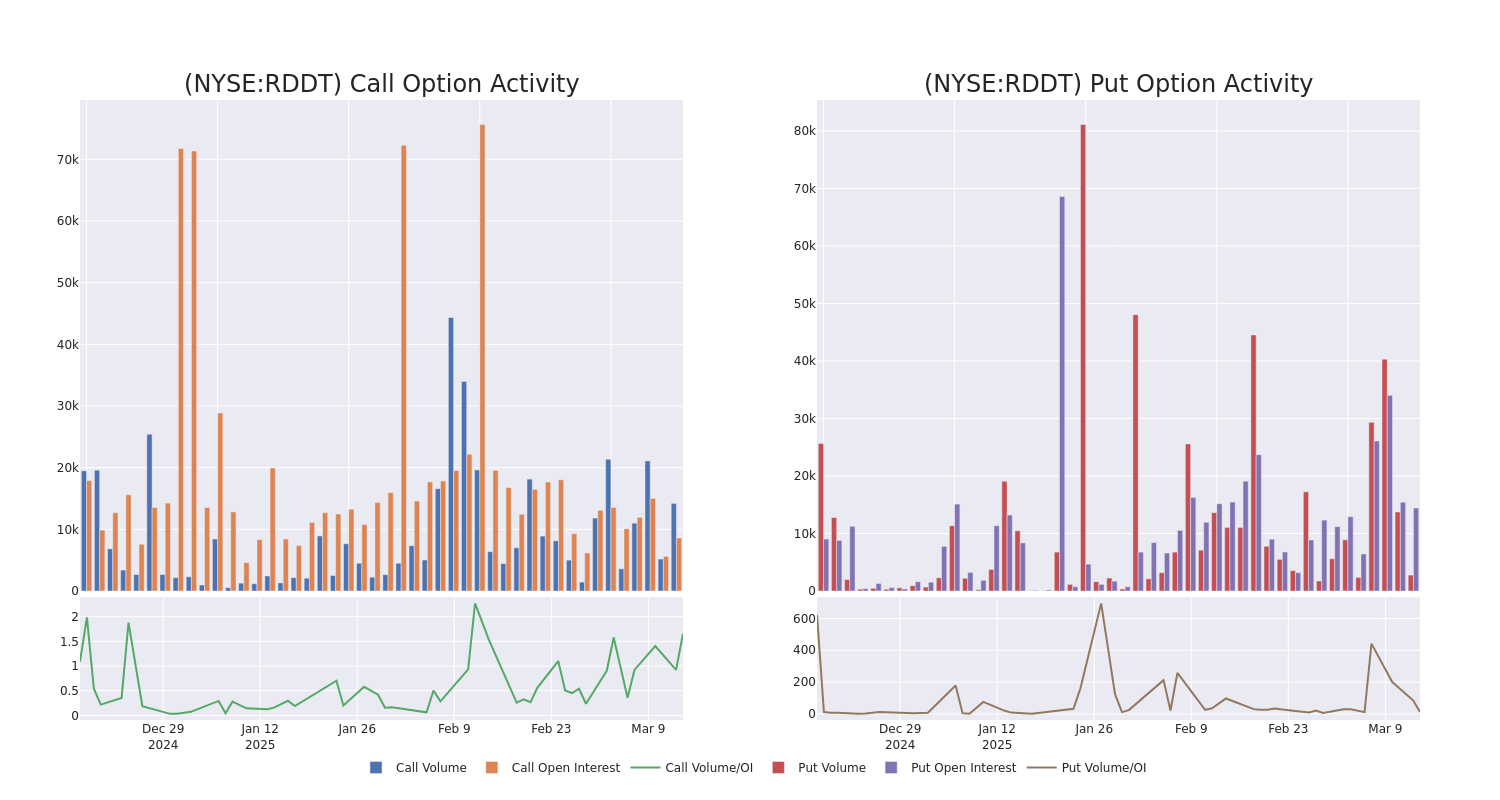

In terms of liquidity and interest, the mean open interest for Reddit options trades today is 587.85 with a total volume of 16,862.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Reddit’s big money trades within a strike price range of $100.0 to $230.0 over the last 30 days.

Reddit Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RDDT | CALL | SWEEP | BEARISH | 03/28/25 | $13.45 | $13.45 | $13.45 | $120.00 | $365.8K | 46 | 303 |

| RDDT | PUT | SWEEP | BEARISH | 03/14/25 | $40.0 | $37.9 | $40.0 | $165.00 | $260.0K | 78 | 66 |

| RDDT | CALL | SWEEP | BULLISH | 03/28/25 | $13.25 | $13.2 | $13.25 | $120.00 | $239.8K | 46 | 596 |

| RDDT | PUT | TRADE | BULLISH | 10/17/25 | $15.55 | $15.3 | $15.3 | $100.00 | $153.0K | 153 | 101 |

| RDDT | PUT | SWEEP | BULLISH | 03/21/25 | $1.6 | $1.52 | $1.52 | $110.00 | $130.8K | 557 | 109 |

About Reddit

Reddit Inc is engaged in providing internet content. The company provides online human connections to communities, endless conversation, sports, business, crypto, television, and others. It generates a majority of revenue through the sale of advertising on mobile applications and websites. Other revenue consists of revenue from content licensing, Reddit Premium subscriptions, and products within the user economy.

In light of the recent options history for Reddit, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Reddit

- Trading volume stands at 5,618,346, with RDDT’s price up by 4.8%, positioned at $127.36.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 72 days.

Expert Opinions on Reddit

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $206.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Raymond James keeps a Strong Buy rating on Reddit with a target price of $200.

* An analyst from Needham persists with their Buy rating on Reddit, maintaining a target price of $220.

* Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Reddit with a target price of $185.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Reddit, targeting a price of $215.

* An analyst from Piper Sandler has revised its rating downward to Overweight, adjusting the price target to $210.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Reddit with Benzinga Pro for real-time alerts.

Momentum–

Growth84.92

Quality–

Value21.15

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.