Whales with a lot of money to spend have taken a noticeably bullish stance on Adobe.

Looking at options history for Adobe ADBE we detected 139 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 74 are puts, for a total amount of $5,755,959 and 65, calls, for a total amount of $10,179,550.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $230.0 to $750.0 for Adobe over the recent three months.

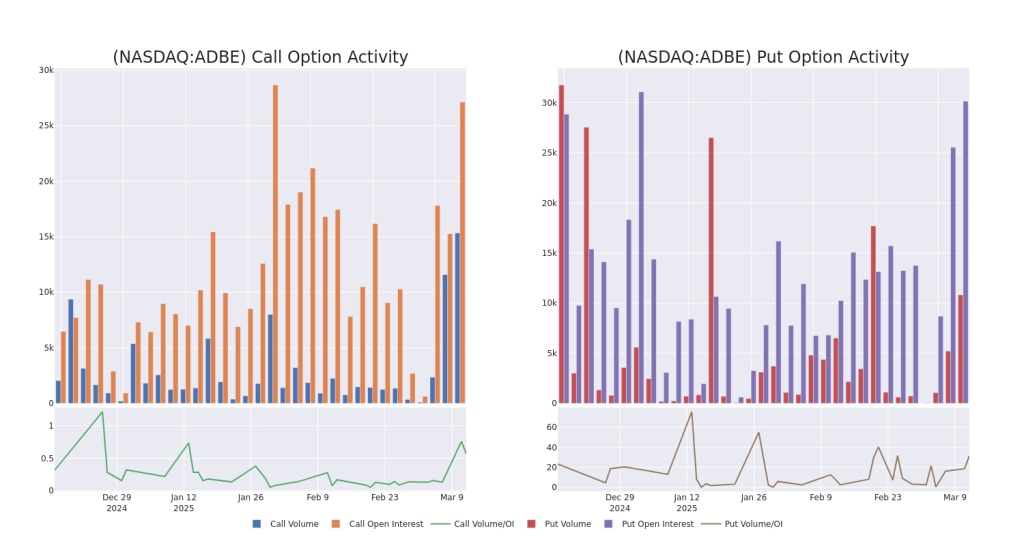

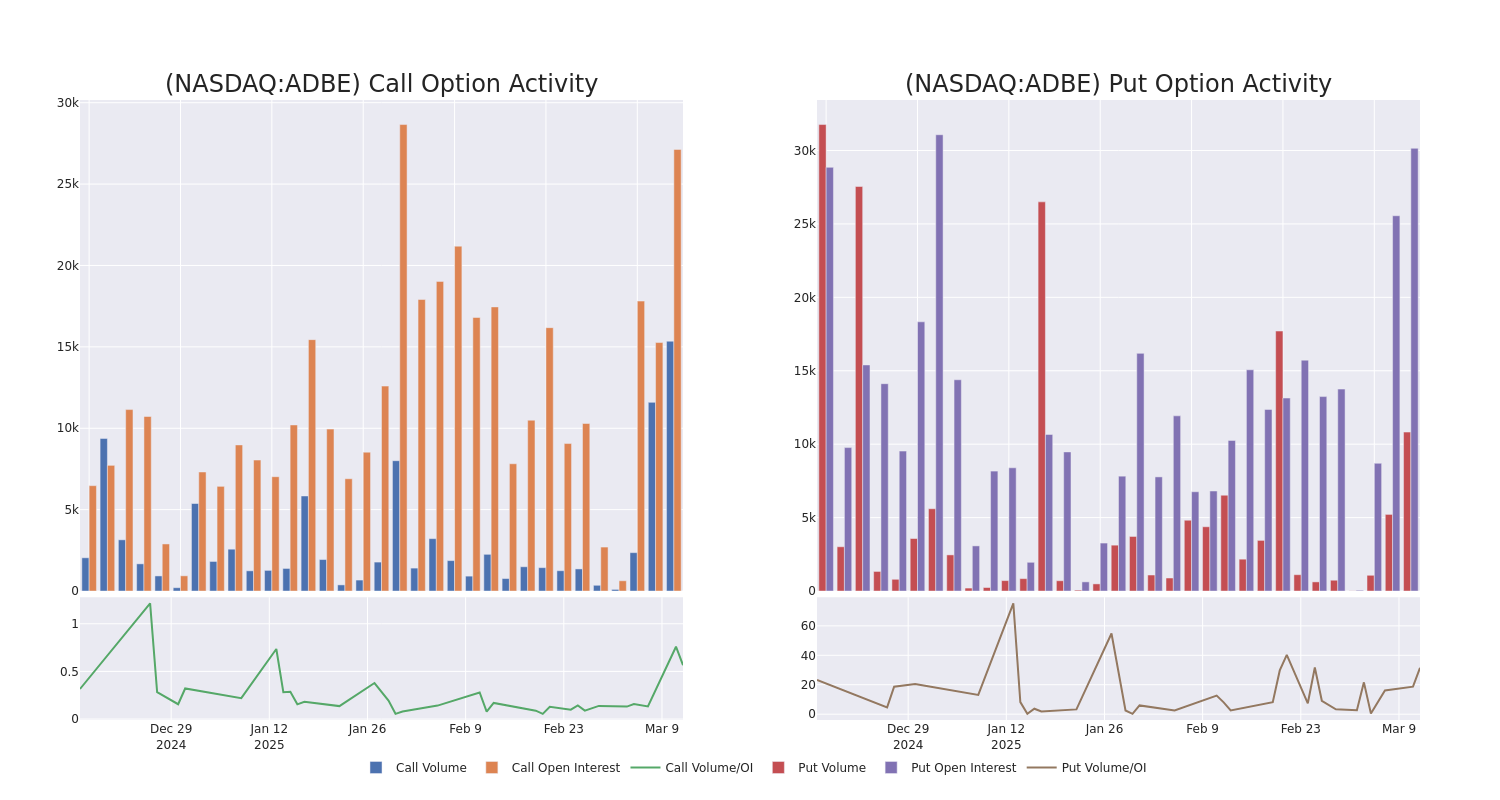

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe’s whale trades within a strike price range from $230.0 to $750.0 in the last 30 days.

Adobe 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | TRADE | BEARISH | 07/18/25 | $25.75 | $25.4 | $25.7 | $390.00 | $385.5K | 238 | 168 |

| ADBE | CALL | SWEEP | BEARISH | 06/20/25 | $15.7 | $15.35 | $15.35 | $430.00 | $296.2K | 327 | 235 |

| ADBE | PUT | TRADE | BULLISH | 04/17/25 | $37.1 | $36.4 | $36.6 | $430.00 | $256.2K | 766 | 27 |

| ADBE | PUT | SWEEP | BULLISH | 06/18/26 | $31.55 | $31.4 | $31.4 | $350.00 | $197.8K | 210 | 63 |

| ADBE | CALL | TRADE | BULLISH | 12/18/26 | $29.0 | $27.7 | $29.0 | $570.00 | $179.8K | 14 | 62 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe’s Current Market Status

- Currently trading with a volume of 6,069,707, the ADBE’s price is up by 4.47%, now at $394.74.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 90 days.

What The Experts Say On Adobe

In the last month, 5 experts released ratings on this stock with an average target price of $509.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Adobe, targeting a price of $600.

* An analyst from Citigroup persists with their Neutral rating on Adobe, maintaining a target price of $490.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Adobe with a target price of $515.

* Maintaining their stance, an analyst from Keybanc continues to hold a Underweight rating for Adobe, targeting a price of $390.

* An analyst from Evercore ISI Group persists with their Outperform rating on Adobe, maintaining a target price of $550.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

Momentum13.87

Growth61.31

Quality32.07

Value16.23

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.