Investors with a lot of money to spend have taken a bullish stance on Super Micro Computer SMCI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SMCI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 67 uncommon options trades for Super Micro Computer.

This isn’t normal.

The overall sentiment of these big-money traders is split between 55% bullish and 40%, bearish.

Out of all of the special options we uncovered, 28 are puts, for a total amount of $1,875,381, and 39 are calls, for a total amount of $1,970,353.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $70.0 for Super Micro Computer over the last 3 months.

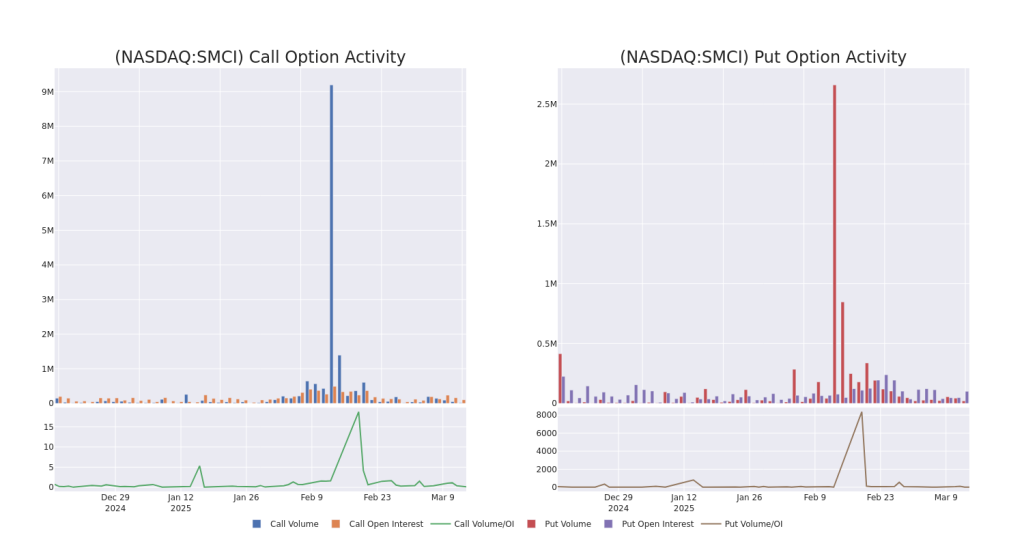

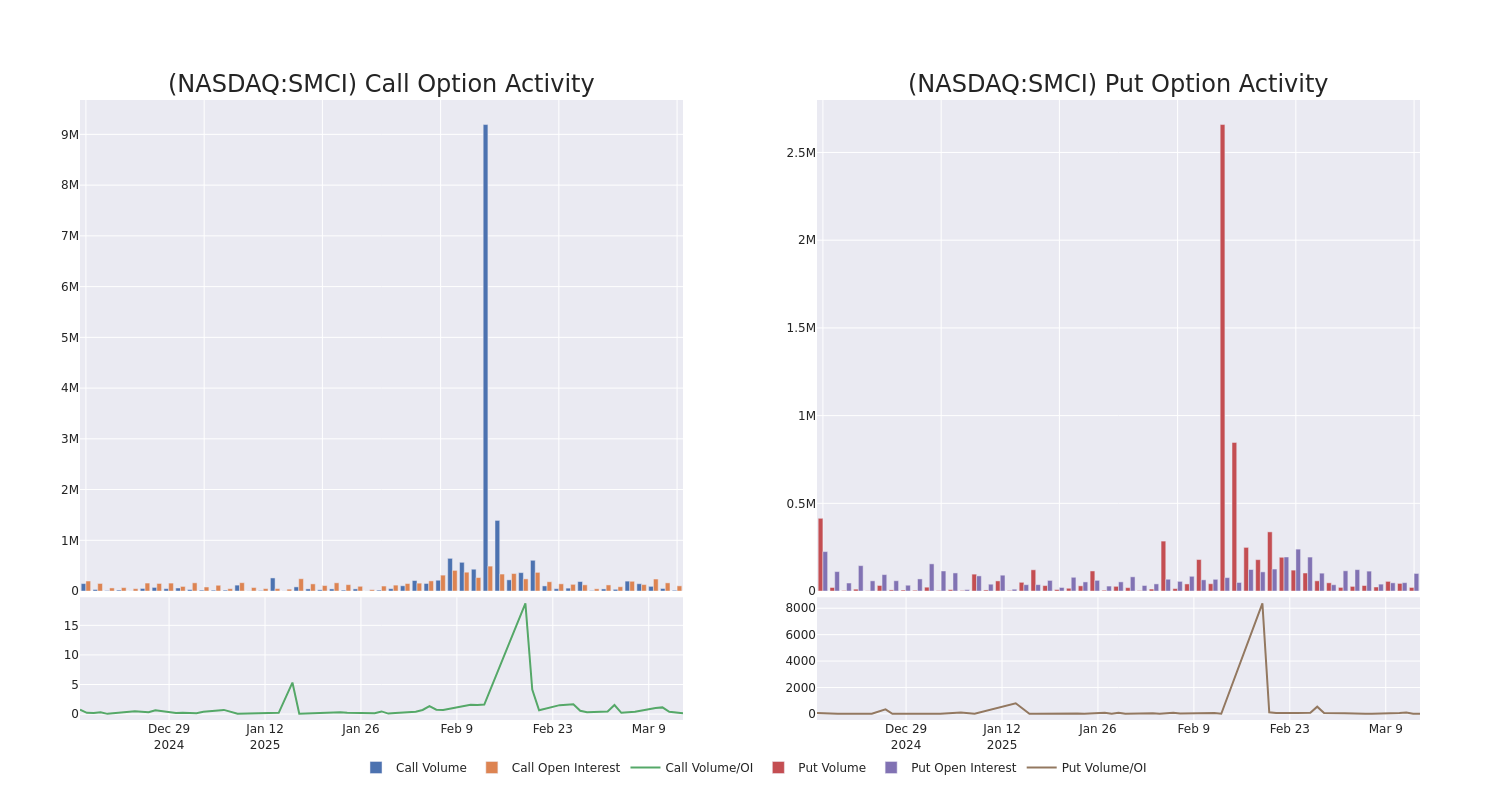

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Super Micro Computer options trades today is 3677.11 with a total volume of 35,203.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Super Micro Computer’s big money trades within a strike price range of $25.0 to $70.0 over the last 30 days.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | SWEEP | BULLISH | 08/15/25 | $19.5 | $19.4 | $19.4 | $56.00 | $269.6K | 807 | 139 |

| SMCI | PUT | TRADE | BULLISH | 04/17/25 | $29.25 | $29.1 | $29.1 | $70.00 | $203.7K | 265 | 140 |

| SMCI | CALL | TRADE | BULLISH | 01/16/26 | $13.75 | $13.6 | $13.7 | $40.00 | $124.6K | 8.2K | 328 |

| SMCI | CALL | TRADE | NEUTRAL | 05/16/25 | $13.2 | $13.05 | $13.13 | $30.00 | $105.0K | 1.1K | 584 |

| SMCI | CALL | SWEEP | BULLISH | 06/20/25 | $8.3 | $8.25 | $8.3 | $42.00 | $97.9K | 1.6K | 172 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data centers, Big Data, high-performance computing, and the “Internet of Things” embedded markets. Its solutions include server, storage, blade, and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular, and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Current Position of Super Micro Computer

- Trading volume stands at 48,599,015, with SMCI’s price up by 6.55%, positioned at $41.64.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 46 days.

What Analysts Are Saying About Super Micro Computer

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $53.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs persists with their Neutral rating on Super Micro Computer, maintaining a target price of $36.

* An analyst from Loop Capital has decided to maintain their Buy rating on Super Micro Computer, which currently sits at a price target of $70.

* Reflecting concerns, an analyst from Barclays lowers its rating to Equal-Weight with a new price target of $59.

* In a cautious move, an analyst from Rosenblatt downgraded its rating to Buy, setting a price target of $60.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Super Micro Computer with a target price of $40.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.

Momentum12.23

Growth84.22

Quality98.35

Value67.93

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.