(Bloomberg) — Global stocks rose as the threat of a US government shutdown receded, removing at least one element of uncertainty confronting investors. Gold hit a record above $3,000 an ounce amid haven demand.

Most Read from Bloomberg

S&P 500 contracts rose 1% as a stopgap funding bill looked set to pass in Congress after Senate Democratic leader Chuck Schumer opted not to block the measure. That lifted the mood after the index extended its three-week rout beyond 10% on Thursday, the technical threshold for a correction. Futures on the Nasdaq 100 advanced 1.3% with Nvidia Corp. leading premarket gains among the Magnificent Seven tech cohort.

“It looks like the budget bill is still going through despite some opposition from Democrats and this has lifted sentiment in the US and probably there is also some spillover effect to Europe,” Julius Baer & Co. economist Sophie Altermatt said.

“This might be just some reprieve, given we had so many uncertainties with erratic policy moves in the US,” she added.

Avoiding a government shutdown would remove a concern for traders, already fretting over threats to the world economy from President Donald Trump’s tariff war. Two months into Trump’s presidency, $5 trillion has been erased from US stocks.

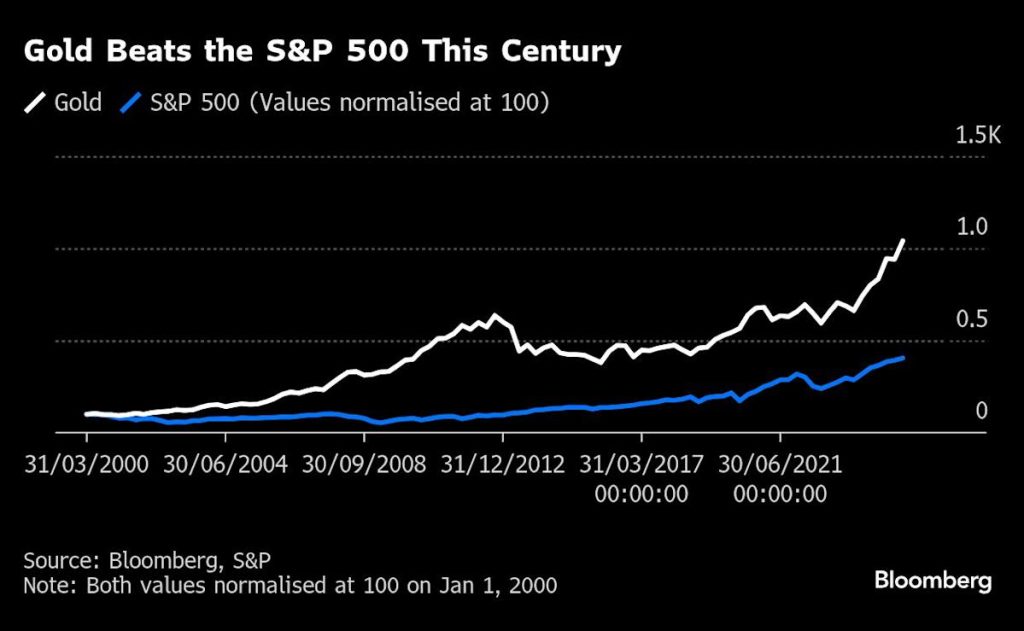

Those risks are spurring demand for haven assets, with investors the most bullish on Treasuries relative to stocks for at least three years, according to the Bloomberg Markets Live Pulse survey. They’ve also pushed gold to successive record highs, with the yellow metal now up more than 14% year-to-date.

“Gold is in a secular bull market,” said Peter Kinsella, head of foreign exchange strategy at Union Bancaire Privee UBp SA, who expects prices to reach $3,300 an ounce by year end. “For sure, that’s down to uncertainty caused by US trade policies but central bank demand is also a big factor.”

Europe’s Stoxx 600 index climbed about 1%, as Germany’s chancellor-in-waiting Friedrich Merz was said to have reached an agreement with the Greens party on a spending package for infrastructure and defense. Germany’s DAX stock index rose as much as 2.8% while a basket of European defense stocks gained 4.5% to a new record high.

However, the prospect of more borrowing reignited a selloff in euro-area bonds, lifting German 10-year borrowing costs about seven basis points. French yields hit the highest since 2011 on concerns Fitch Ratings will downgrade the country’s credit rating later in the day.