Wagers on a U.S. recession in 2025 have climbed sharply in recent weeks, as softer-than-expected economic data and cautious outlooks from economists fuel investor anxiety.

The likelihood of the U.S. economy entering a recession this year has hit 37%, according to betting markets tracked by CFTC-regulated Kalshi.

A $100 wager on a “yes” outcome in the market “Recession this year?” would yield $243 if a recession materializes.

See Also: Trump Administration Signals Aggressive Cost-Neutral Bitcoin Accumulation Strategy

Is A 2025 Recession Really Inevitable?

“There’s also confusion over the outlook for U.S. economic growth,” said David Morrison, senior market analyst at Trade Nation.

“The current expectation is that this is about to slow sharply, thanks to a great extent to tariffs, with an increased probability of an outright recession in 2025,” he added.

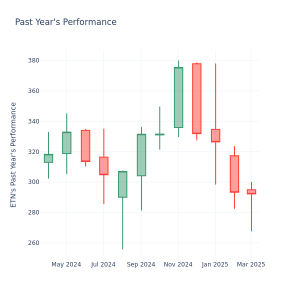

Latest economic forecasts paint a concerning picture. The Atlanta Federal Reserve’s GDPNow model forecasts a 2.4% contraction in the first quarter. That’s a stark reversal from the 2.3% expansion in the fourth quarter of 2024.

Interest rate expectations reflect these concerns, as Morrison highlighted. Traders now anticipate three 25-basis-point rate cuts from the Federal Reserve in 2025, a notable shift from just one expected cut two months ago.

Trump-related tariffs are a major driver of rising recession risks. “Tariff fears are pushing companies to increase prices, raising the likelihood of higher inflation this summer and complicating the Fed’s policy amid recession concerns,” said George Vessey, forex and macro strategist at Convera.

Several institutions have adjusted their recession probabilities higher, with JPMorgan economists now estimating a 40% likelihood of a recession in 2025.

The Atlanta Fed’s GDPNow model projects a 2.4% contraction in the first quarter, a stark reversal from the 2.3% growth rate seen in the final quarter of 2024.

Yet, a single quarter of negative GDP does not meet the technical definition of a recession. A recession occurs if there are two consecutive quarters of negative GDP growth.

This still leaves room for the economy to avoid a prolonged slump.

Bettors wagering $100 on a “no recession” outcome stand to earn $153 if the economy remains in positive territory.

Political Stakes And Recession Risks

The political landscape may also play a role in determining whether the U.S. slips into a recession.

On Friday, U.S. Commerce Secretary Howard Lutnick dismissed the Atlanta Fed’s contraction forecast as “ridiculous.

“It remains to be seen if all of the revolutionary changes to the economy and trans-Atlantic alliances will lead to a recession or if it will lead to higher growth rates in the future,” Chris Zaccarelli, chief investment officer for Northlight Asset Management, said.

“We expect [Trump] will avoid a recession that would cost the Republicans their majorities in both houses of Congress in the mid-term elections in late 2026,” Ed Yardeni, president of Yardeni Research, said.

Last Sunday, Trump seemed to acknowledge the possibility of a recession in 2025, citing a “period of transition.”

A No-Recession Scenario Could Lift Markets

The S&P 500—tracked by the SPDR S&P 500 ETF Trust SPY—has entered correction territory. It slid more than 10% from its February peak. The market selloff has coincided with rising growth concerns and increasing recession probabilities.

Yet, if the economy defies expectations and avoids a downturn, equities could be poised for a strong rebound.

Jeff Buchbinder, chief equity strategist at LPL Financial, highlighted that if a recession is averted and the current decline remains within the bounds of a correction, rather than evolving into a full-blown bear market — characterized by a decline of 20% or more — “then the upside potential over the next nine to 12 months may be as much as double the downside risk.”

Read Now:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.