Investors with a lot of money to spend have taken a bearish stance on Toast TOST.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TOST, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 17 uncommon options trades for Toast.

This isn’t normal.

The overall sentiment of these big-money traders is split between 23% bullish and 70%, bearish.

Out of all of the special options we uncovered, 12 are puts, for a total amount of $1,000,007, and 5 are calls, for a total amount of $269,535.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $39.0 for Toast over the last 3 months.

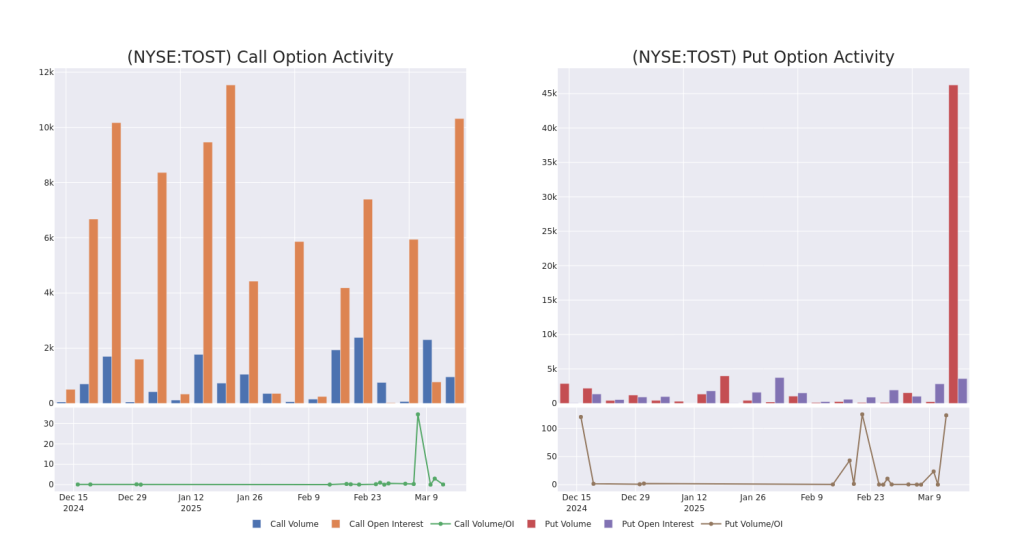

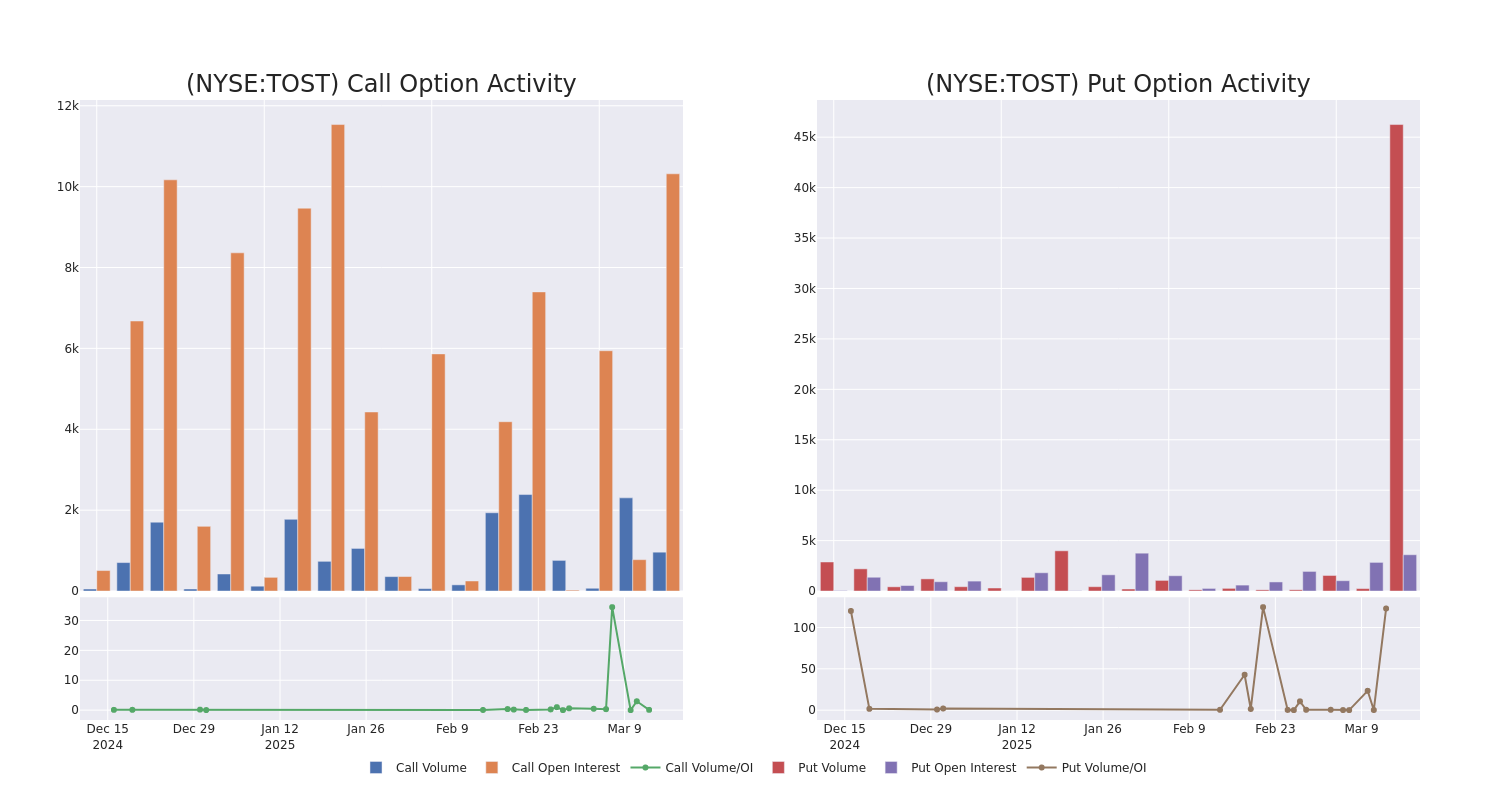

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Toast’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Toast’s whale activity within a strike price range from $25.0 to $39.0 in the last 30 days.

Toast 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TOST | PUT | SWEEP | NEUTRAL | 03/21/25 | $1.26 | $1.25 | $1.25 | $33.00 | $316.9K | 2.0K | 616 |

| TOST | CALL | SWEEP | BEARISH | 09/19/25 | $3.05 | $2.91 | $3.05 | $39.00 | $113.7K | 35 | 373 |

| TOST | PUT | TRADE | BEARISH | 06/20/25 | $1.0 | $0.98 | $1.0 | $25.00 | $100.0K | 332 | 13.2K |

| TOST | PUT | SWEEP | BEARISH | 01/15/27 | $5.0 | $3.9 | $5.0 | $27.00 | $99.0K | 53 | 250 |

| TOST | PUT | SWEEP | BEARISH | 03/21/25 | $1.25 | $1.25 | $1.25 | $33.00 | $96.3K | 2.0K | 4.3K |

About Toast

Toast is a US-based restaurant technology company that provides point-of-sale, payment processing, and various software services to 134,000 restaurant locations across the United States as of December 2024. The firm generates sales from software subscription fees, as a percentage take rate from each financial transaction it processes, from loan origination and servicing fees from its Toast Capital arm, and from hardware installation and professional services. Unlike competitors, Toast intermediates every payment transaction on its platform; it processed some $159 billion in gross platform volume in 2024. The firm’s product offerings span point-of-sale systems, inventory and payroll management, delivery integration, e-commerce ordering, reservation management, and loyalty programs.

In light of the recent options history for Toast, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Toast Standing Right Now?

- With a trading volume of 6,468,980, the price of TOST is down by -0.55%, reaching $34.59.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 54 days from now.

What Analysts Are Saying About Toast

5 market experts have recently issued ratings for this stock, with a consensus target price of $46.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for Toast, targeting a price of $40.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Toast with a target price of $50.

* An analyst from Canaccord Genuity has decided to maintain their Buy rating on Toast, which currently sits at a price target of $48.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Toast with a target price of $45.

* An analyst from BMO Capital persists with their Outperform rating on Toast, maintaining a target price of $48.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Toast with Benzinga Pro for real-time alerts.

Momentum92.93

Growth4.98

Quality–

Value7.10

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.