Martin Shkreli, the controversial former hedge fund manager known as “Pharma Bro,” questioned but ultimately defended Palantir Technologies Inc.‘s PLTR growth projections on Wednesday, calling analysis of the company’s $4 million average revenue per customer “flawed.”

What Happened: Shkreli noted that a common analysis of Palantir suggests only around 20,000 companies can afford its $4 million data analytics suite. He pointed out that some valuation models assume every one of these companies will adopt Palantir’s services by 2035, justifying its current valuation.

Shkreli, who previously projected Palantir’s cash flow from operations would reach $1.8 billion in 2025, countered that the analysis overlooks key factors.

He noted that Palantir’s software might generate a positive return on investment regardless of budget constraints, its per-seat pricing model could expand market reach, and the company will likely diversify its product offerings.

However, he acknowledged competitive threats from Snowflake Inc. SNOW, Databricks, and AI startups, while questioning whether any enterprise software company has achieved $50 billion in high-margin license revenue.

See Also: Mohamed El-Erian Says ‘Fed Put’ Optimism Rises As Inflation Cools—But ‘Trump Put’ Hopes Are Shaken

Why It Matters: Palantir’s stock has surged over 50% since President Donald Trump‘s November election victory, making it the S&P 500’s top performer during that period. The company recently joined the S&P 100 index, replacing Dow Inc., effective Mar 24.

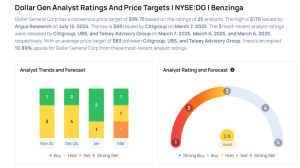

The data analytics firm’s market performance has been driven by its artificial intelligence capabilities, with recent analyst price targets averaging $123.67 among Wedbush Securities, Loop Capital, and Citigroup—implying a 46% upside from current levels.

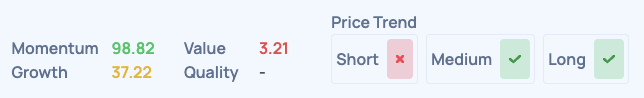

According to Benzinga Edge Ranking, Palantir outperforms Snowflake in momentum but lags in growth and value metrics.

Palantir Edge Ranking:

Snowflake Edge Ranking:

Despite his criticisms, Shkreli concluded with a bullish outlook: “I wouldn’t bet against them!”

Price Action: Palantir’s stock closed on Wednesday at $83.65, up 7.17%, marking a surge of 11.25% year-to-date, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Momentum14.86

Growth88.59

Quality63.51

Value67.60

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.