Despite stellar fourth-quarter earnings, Nvidia Corp.’s NVDA stock has plunged over 16% in 2025. However, at these levels, its valuation is 41% cheaper as compared to November 2022, when ChatGPT was launched and 85% cheaper from its record high valuations in July 2023.

What Happened: The chipmaker led by Jensen Huang has been trading at a forward price-to-earnings ratio of 24.272 times after the Nasdaq has entered the correction zone. According to a report by Business Insider, this was about 41% lower from the November 2022 forward PE of 41 times, when ChatGPT was launched by OpenAI.

Describing these levels as, “an opportunity amid the 2025 tech correction,” Subho Moulik, the founder and CEO of Appreciate said that these metrics tell “quite a compelling story”.

According to Benzinga’s historical data, its current trailing PE of 36.993 is about 85% lower as compared to its record level of 247.36 times on July 18, 2023.

“The market hasn’t valued Nvidia this conservatively since August 2019, creating an unusual disconnect between Wall Street sentiment and operational reality,” Moulik said.

Why It Matters: Regardless of the challenges faced by the company this year, including the emergence of DeepSeek and sectoral rotation out of technology stocks, Nvidia issued a decent first quarter outlook, expecting $43.0 billion in revenue as compared to the street consensus of $41.75 billion.

However, due to the scaling Blackwell AI chip production, it projects a temporary gross margin dip to 70.6%-71% in the first quarter fiscal 2026, followed by a recovery to the mid-70s by the end of the year.

“Nvidia’s business fundamentals remain exceptionally robust throughout this valuation reset,” said Moulik, adding that “Market history suggests these periods of valuation recalibration often create the foundation for substantial long-term returns for genuine category leaders.”

Price Action: Shares of Nvidia were 24.4% lower from its 52-week high of $153.13 to its Wednesday’s closing price of $115.74 per share. While it has returned 27.34% over the last year, it was down 16.32% on a year-to-date basis.

In premarket on Thursday, the stock jumped 1.07%.

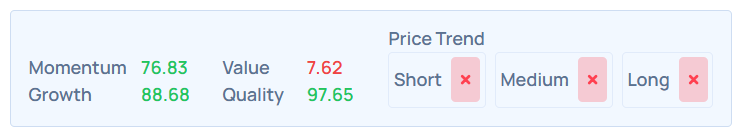

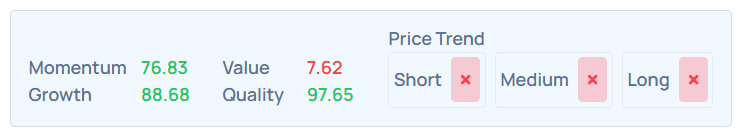

According to Benzinga Edge Rankings as well, Nvidia’s value remains quite lower with a poor price trend in the short, medium and long term. However, it had strong momentum, growth and quality rankings.

Its consensus price target was $176.13 based on the 41 analysts tracked by Benzinga. The price targets ranged from a low of $120 to a high of $220. The three latest ratings from DA Davidson, Cantor Fitzgerald, and Benchmark averaged at $175, implying a 50.03% upside.

Read Next:

Photo courtesy: Shutterstock

Momentum76.83

Growth88.68

Quality97.65

Value7.62

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.