Financial giants have made a conspicuous bullish move on Albemarle. Our analysis of options history for Albemarle ALB revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $88,092, and 6 were calls, valued at $483,146.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $100.0 for Albemarle over the last 3 months.

Analyzing Volume & Open Interest

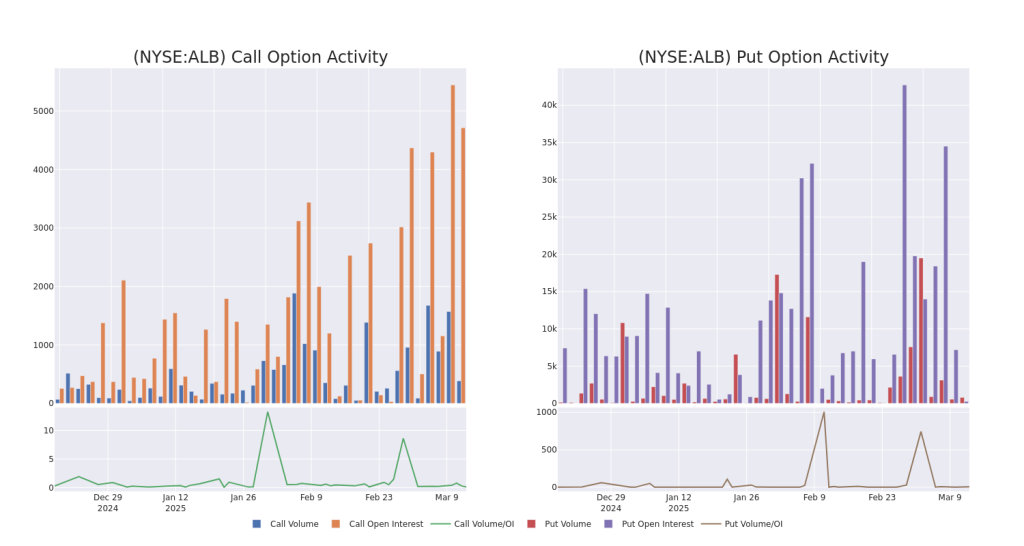

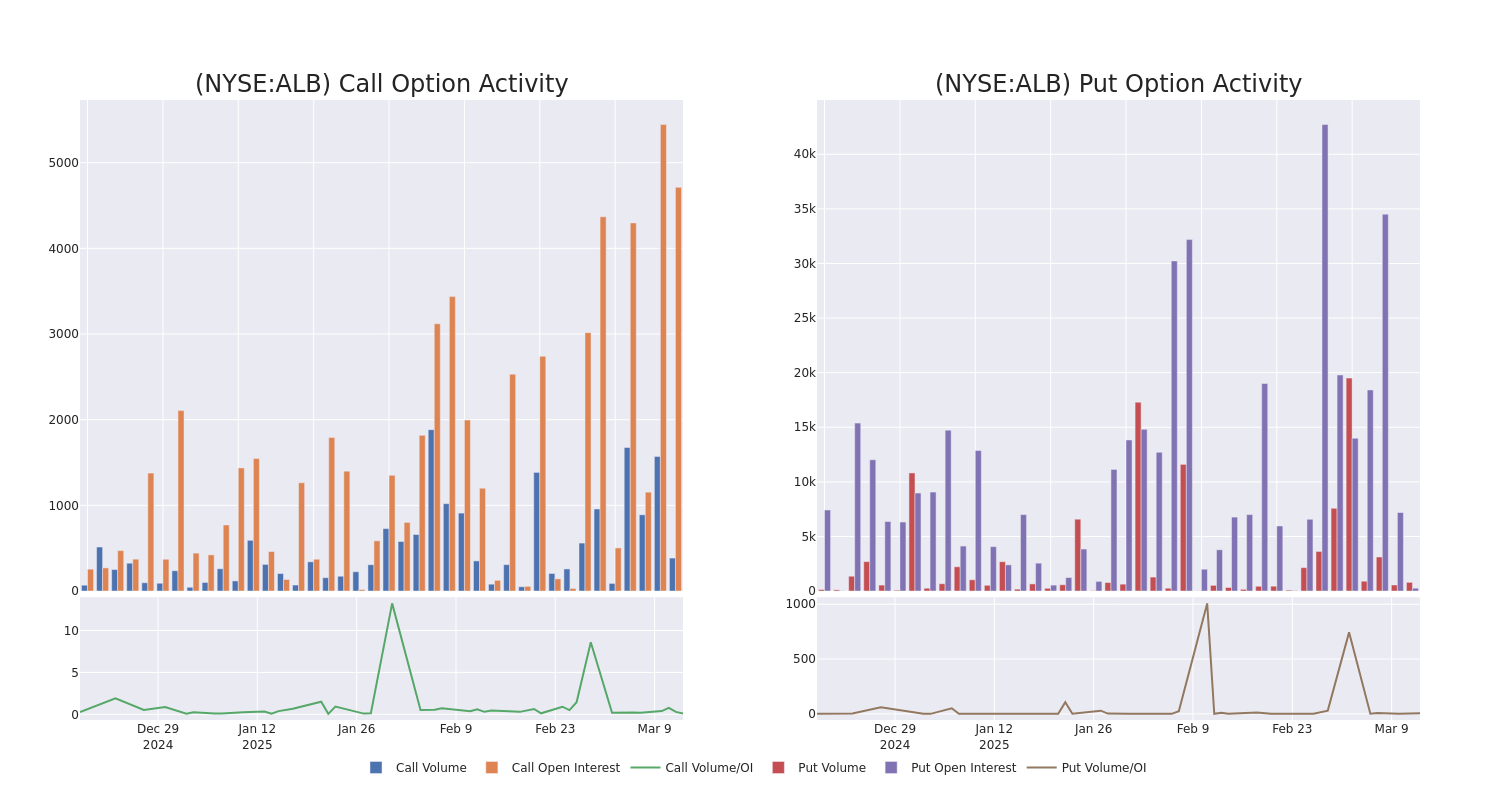

In today’s trading context, the average open interest for options of Albemarle stands at 621.5, with a total volume reaching 1,182.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Albemarle, situated within the strike price corridor from $60.0 to $100.0, throughout the last 30 days.

Albemarle Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | CALL | TRADE | BULLISH | 04/17/25 | $13.35 | $12.55 | $13.2 | $60.00 | $158.4K | 1.7K | 1 |

| ALB | CALL | SWEEP | BULLISH | 01/16/26 | $5.8 | $5.7 | $5.75 | $100.00 | $135.6K | 626 | 242 |

| ALB | CALL | SWEEP | BULLISH | 09/19/25 | $6.4 | $6.35 | $6.4 | $85.00 | $62.7K | 461 | 105 |

| ALB | PUT | SWEEP | BULLISH | 03/21/25 | $3.45 | $3.35 | $3.4 | $73.00 | $46.2K | 195 | 542 |

| ALB | CALL | SWEEP | BULLISH | 04/17/25 | $2.2 | $2.16 | $2.2 | $80.00 | $44.0K | 710 | 3 |

About Albemarle

Albemarle is one of the world’s largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

In light of the recent options history for Albemarle, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Albemarle

- Currently trading with a volume of 545,996, the ALB’s price is down by -1.62%, now at $71.63.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 48 days.

What The Experts Say On Albemarle

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $89.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Piper Sandler has decided to maintain their Underweight rating on Albemarle, which currently sits at a price target of $85.

* An analyst from Truist Securities persists with their Hold rating on Albemarle, maintaining a target price of $85.

* An analyst from Mizuho persists with their Neutral rating on Albemarle, maintaining a target price of $85.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Albemarle, targeting a price of $122.

* An analyst from Morgan Stanley persists with their Underweight rating on Albemarle, maintaining a target price of $68.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Albemarle options trades with real-time alerts from Benzinga Pro.

Momentum16.10

Growth8.76

Quality–

Value72.36

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.