Deep-pocketed investors have adopted a bearish approach towards Ulta Beauty ULTA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ULTA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 20 extraordinary options activities for Ulta Beauty. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 45% bearish. Among these notable options, 6 are puts, totaling $438,269, and 14 are calls, amounting to $3,262,030.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $295.0 to $450.0 for Ulta Beauty over the recent three months.

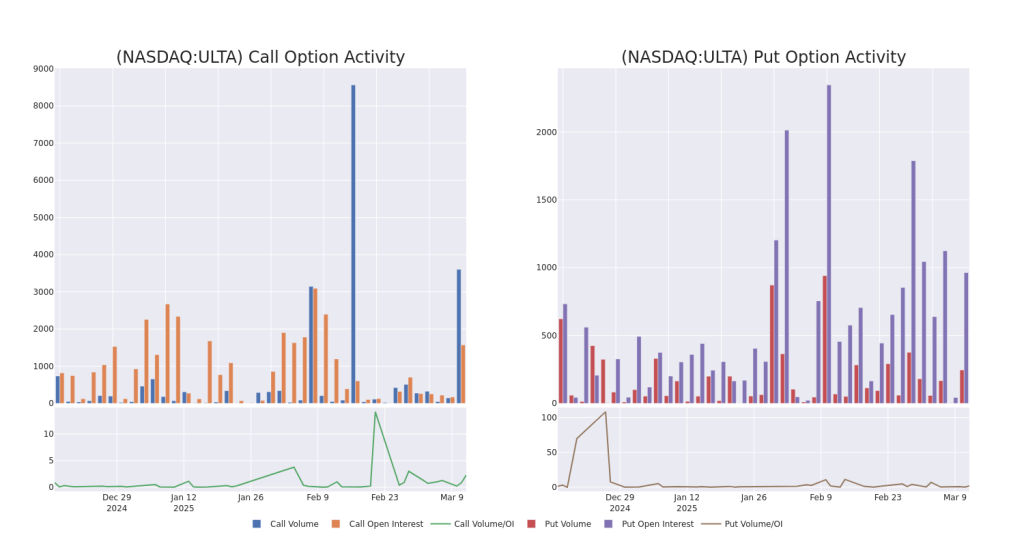

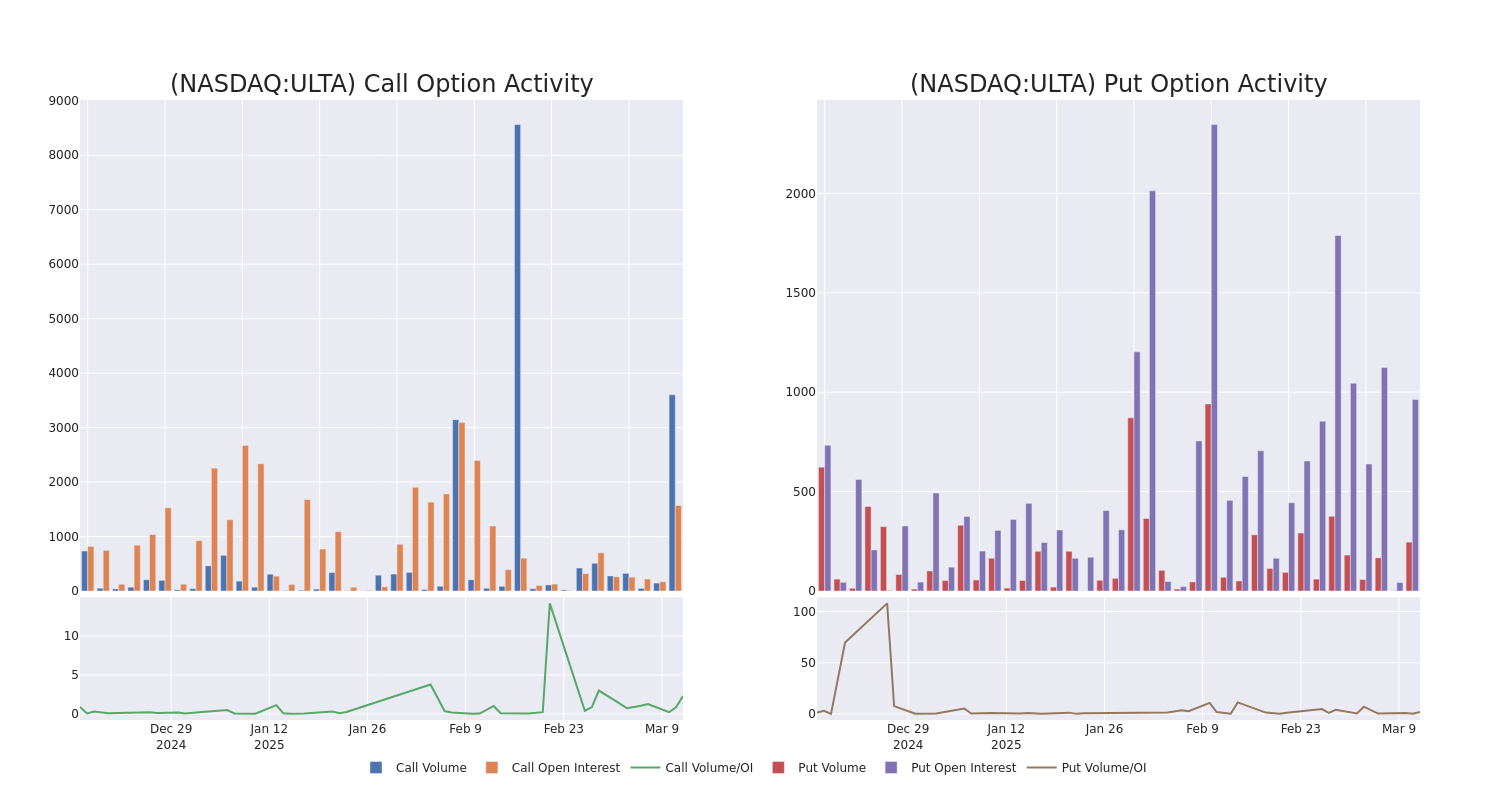

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Ulta Beauty’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Ulta Beauty’s substantial trades, within a strike price spectrum from $295.0 to $450.0 over the preceding 30 days.

Ulta Beauty Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ULTA | CALL | TRADE | BULLISH | 04/17/25 | $25.6 | $24.6 | $25.7 | $325.00 | $2.7M | 5 | 1.0K |

| ULTA | PUT | TRADE | BEARISH | 03/21/25 | $28.0 | $24.7 | $27.2 | $350.00 | $155.0K | 305 | 77 |

| ULTA | PUT | SWEEP | BEARISH | 06/20/25 | $29.8 | $28.9 | $29.8 | $335.00 | $101.3K | 62 | 38 |

| ULTA | PUT | SWEEP | BEARISH | 03/14/25 | $12.1 | $10.2 | $11.3 | $335.00 | $56.5K | 99 | 51 |

| ULTA | CALL | TRADE | BULLISH | 03/21/25 | $5.2 | $5.0 | $5.2 | $365.00 | $55.1K | 393 | 9 |

About Ulta Beauty

With more than 1,400 freestanding stores and a partnership with Target, Ulta Beauty is the largest specialized beauty retailer in the US. The firm offers makeup (41% of 2023 sales), fragrances, skin care (19% of sales), and hair care products (19% of sales), and bath and body items. Ulta offers private-label products and more than 600 individual brands. It also offers salon services, including hair, makeup, skin, and brow services, in all stores. Most Ulta stores are approximately 10,000 square feet and are in suburban strip centers. The firm intends to open franchises in Mexico in 2025. Ulta was founded in 1990 and is based in Bolingbrook, Illinois.

Following our analysis of the options activities associated with Ulta Beauty, we pivot to a closer look at the company’s own performance.

Ulta Beauty’s Current Market Status

- With a trading volume of 804,968, the price of ULTA is down by -2.4%, reaching $334.5.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 1 days from now.

What Analysts Are Saying About Ulta Beauty

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $500.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group persists with their Outperform rating on Ulta Beauty, maintaining a target price of $500.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Ulta Beauty options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.