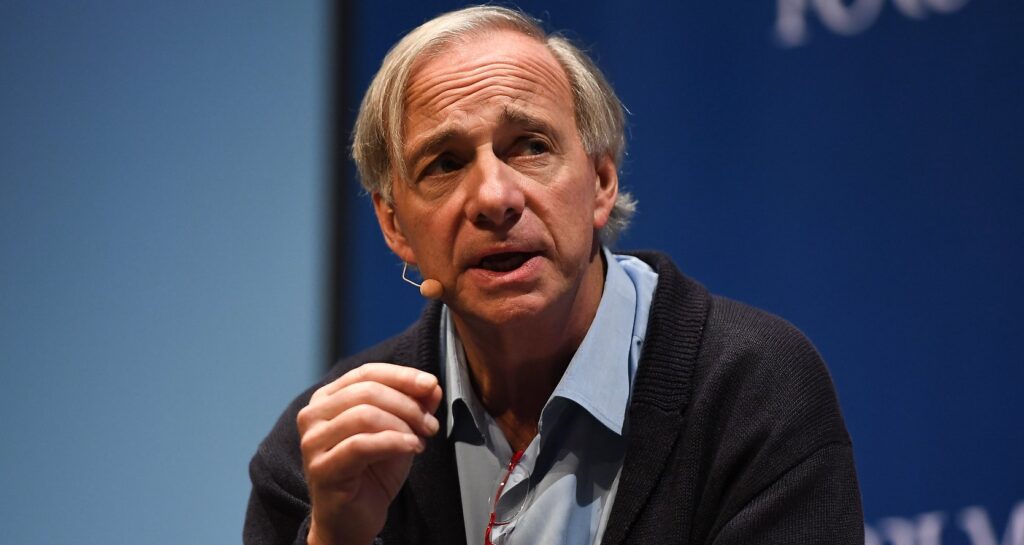

Bridgewater Associates founder Ray Dalio warned on Wednesday that the United States faces a “very severe” supply-demand problem that could lead to “shocking developments” in the near future.

What Happened: “The first thing is the debt issue,” Dalio said at the CONVERGE LIVE event in Singapore, emphasizing that the federal government will need to sell more debt than global markets can absorb, reported CNBC.

The billionaire investor stressed the urgency of reducing the U.S. deficit from its projected 7.2% of GDP to approximately 3% — a substantial adjustment that would require significant fiscal changes.

“That’s a big deal. You are going to see shocking developments in terms of how that’s going to be dealt with,” Dalio warned.

His comments come amid recent market volatility triggered by trade policy uncertainty, adding to Wall Street’s concerns about global economic stability.

See Also: Markets Bounce As Ukraine Expresses Readiness For 30-Day Ceasefire Proposal With Russia

Why It Matters: In previous statements at the World Governments Summit in February, Dalio likened the $36.4 trillion federal debt to plaque clogging the financial system’s arteries, warning of a potential “economic heart attack” without immediate action. The current debt-to-GDP ratio stands at approximately 125%, with federal debt having surged 80% since 2020 while GDP grew only 38%.

Dalio has consistently advocated for his “3% solution,” which combines spending cuts, tax adjustments, and careful interest rate management. He recently supported President Donald Trump‘s proposal for interest rate reductions but emphasized these must be accompanied by spending cuts to effectively address the deficit.

According to the Congressional Budget Office, annual budget deficits are projected to average 6.1% of GDP through 2035 — significantly higher than the 50-year average of 3.8% — with national debt potentially rising by nearly $24 trillion over the next decade.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.