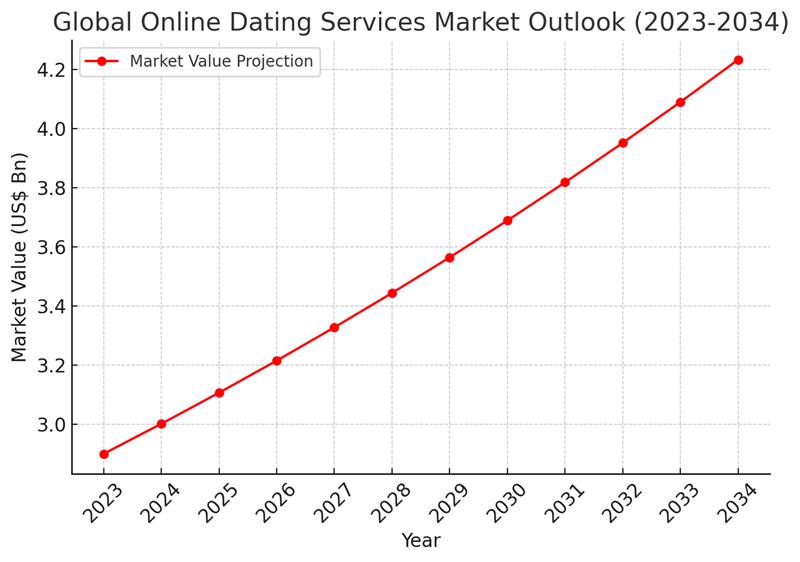

Wilmington, Delaware, Transparency Market Research Inc. –, March 12, 2025 (GLOBE NEWSWIRE) — The surge in digital connectivity and evolving social dynamics are fueling the growth of matchmaking platforms. The Global Online Dating Services Market was valued at US$ 2.9 Billion in 2023 and is projected to expand at a 3.5% CAGR through 2034. Increasing smartphone penetration, AI-driven matchmaking, and shifting relationship trends are driving market expansion. By 2034, the industry is expected to reach US$ 4.3 Billion, transforming how people connect globally.

With the rise of freemium models, video-based interactions, and AI-driven compatibility matching, online dating platforms are evolving beyond traditional swiping features. The market is witnessing increased participation from Gen Z and Millennials, who prefer virtual dates, personalized matches, and interactive experiences.

Discover the Future of Online Dating! Access Your Exclusive Sample Report Now. – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86472

Industry Overview

The online dating industry is undergoing rapid transformation, fueled by social trends, technological advancements, and changing user preferences. Key players are integrating machine learning, blockchain verification, and AR/VR dating experiences to enhance user engagement and trust.

The demand for diverse and inclusive dating platforms catering to specific communities, interests, and demographics is also surging. Additionally, the rise of video-first dating experiences is reducing the reliance on traditional text-based interactions.

Key Players

Leading companies dominating the online dating market include:

- Match Group (Tinder, Hinge, OkCupid, Plenty of Fish) – Continues to expand its AI-driven matching and video dating features.

- Bumble Inc. (Bumble, Badoo) – Innovating with women-first dating approaches and incorporating friendship and business networking options.

- eHarmony – Leading in compatibility-based dating models powered by deep-learning algorithms.

- Grindr LLC – Dominating the LGBTQ+ dating segment with privacy-focused features and community-building tools.

- The League & EliteSingles – Expanding the exclusive, career-focused dating market with AI-assisted vetting processes.

Recent Developments

- Tinder introduced an AI-powered compatibility feature that analyzes user preferences and behavior for better match recommendations.

- Bumble expanded its premium subscription model, adding voice and video interaction options before matches can chat.

- Hinge launched a “video-first” dating mode, encouraging users to engage through video prompts and live interactions.

- eHarmony integrated blockchain-based ID verification to enhance safety and reduce catfishing risks.

Key Market Drivers

- Increased Smartphone and Internet Penetration: With over 6.8 billion smartphone users globally in 2023, the accessibility of dating apps has skyrocketed.

- Changing Social Norms and Growing Acceptance: The stigma around online dating is fading, with 53% of Americans having a positive view of digital matchmaking.

- AI-Driven Matchmaking: Platforms are leveraging AI and machine learning to enhance personalization and user experience.

- Rise in Paid Services: Subscription-based models and premium features continue to drive revenue growth.

- Growing Popularity of Niche Dating: Platforms catering to specific communities (e.g., LGBTQ+, professionals) are gaining traction.

Looking for a detailed market research report? Contact us for in-depth insights into trends, competitors, and revenue opportunities in the online dating industry!

Get Customized Insights & Analysis for Your Business Needs: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86472

Emerging Market Trends & Innovations

1. AI & Behavioral Analytics for Matchmaking

- AI algorithms analyze user preferences, interests, and behavioral patterns.

- Advanced recommendation engines ensure higher success rates.

2. Video-First & Virtual Dating Experiences

- Platforms integrating live chat, video calls, and virtual date spaces.

- Metaverse dating emerging as the next frontier.

3. Premium & Exclusive Memberships

- Rise in subscription-based models offering enhanced security and privacy.

- VIP features like profile verification, background checks, and compatibility reports.

4. Niche & Hyper-Personalized Dating Apps

- Growth in platforms tailored to specific religious, ethnic, and lifestyle-based preferences.

- Apps catering to introverts, pet lovers, fitness enthusiasts, and professionals.

5. Enhanced Security & Privacy Measures

- AI-powered fraud detection, profile verification, and scam prevention.

- Blockchain integration for identity authentication.

Market Segmentation

By Service Type

- Matching Services – AI-driven compatibility-based dating apps.

- Social Dating Apps – Casual dating with swiping-based mechanics.

- Niche & Specialized Dating Platforms – Catering to LGBTQ+, religion-based, senior dating, and professionals.

- Video & Live Dating Services – Interactive real-time engagement platforms.

By Revenue Model

- Subscription-Based – Paid plans for exclusive features (Tinder Gold, Hinge Premium).

- Ad-Supported – Free access with advertisements and sponsored content.

- In-App Purchases – Virtual gifts, boosts, and premium swipes.

By End User

- Young Professionals – Seeking long-term relationships or casual connections.

- Senior Citizens – Growing demand for companionship-focused dating.

- LGBTQ+ Community – Expanding user base with inclusive platforms.

By Region

- North America – Leading with Tinder, Bumble, and Match.com dominance.

- Europe – Strong market with diverse and culturally specific apps.

- Asia-Pacific – Rapid growth driven by urbanization and changing relationship dynamics.

Buy This Premium Research Report Now to Get Detailed Analysis: https://www.transparencymarketresearch.com/checkout.php?rep_id=86472<ype=S

Future Outlook & Opportunities

- Emerging opportunities in the online dating services market include:

- AI-Powered Relationship Coaching – AI-driven chatbots offering relationship guidance.

- Integration of AR/VR for Virtual Dating – Immersive experiences in digital date spaces.

- Crypto & Blockchain-Based Dating Platforms – Decentralized dating apps ensuring user privacy.

- Mental Health & Wellness-Focused Dating – Platforms integrating well-being assessments.

- Expansion into Emerging Markets – Growth in India, China, and Latin America.

Explore Latest Research Reports by Transparency Market Research:

- Spiritual and Wellness Products Market: Estimated to grow at a CAGR of 8.0% from 2024 to 2034 the Global Spiritual and Wellness Products industry is expected to reach US$ 9.6 Bn by the end of 2034.

- Bleisure Travel Market: Estimated to grow at a CAGR of 17.8% from 2025 to 2035 the global bleisure travel industry is expected to reach US$ 4,177.2 Bn by the end of 2035.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.