Disclosed in a recent SEC filing on March 12, Johnson, Chief Accounting Officer at Vertiv Holdings VRT, made a noteworthy transaction involving the exercise of company stock options.

What Happened: In an insider options sale disclosed in a Form 4 filing on Wednesday with the U.S. Securities and Exchange Commission, Johnson, Chief Accounting Officer at Vertiv Holdings, exercised stock options for 0 shares of VRT. The transaction value amounted to $0.

The Wednesday morning market activity shows Vertiv Holdings shares up by 1.07%, trading at $84.01. This implies a total value of $0 for Johnson’s 0 shares.

Get to Know Vertiv Holdings Better

Vertiv has roots tracing back to 1946 when its founder, Ralph Liebert, developed an air-cooling system for mainframe data rooms. As computers started making their way into commercial applications in 1965, Liebert developed one of the first computer room air conditioning, or CRAC, units, enabling the precise control of temperature and humidity. The firm has slowly expanded its data center portfolio through internal product development and the acquisition of thermal and power management products like condensers, busways, and switches. Vertiv has global operations today; its products can be found in data centers in most regions throughout the world.

Vertiv Holdings: Financial Performance Dissected

Revenue Growth: Over the 3 months period, Vertiv Holdings showcased positive performance, achieving a revenue growth rate of 25.79% as of 31 December, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

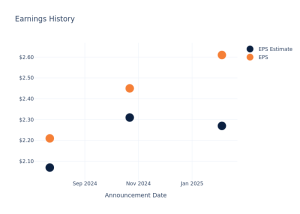

Evaluating Earnings Performance:

-

Gross Margin: Achieving a high gross margin of 37.09%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Vertiv Holdings’s EPS reflects a decline, falling below the industry average with a current EPS of 0.39.

Debt Management: Vertiv Holdings’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.29. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 64.94, Vertiv Holdings’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.01, Vertiv Holdings’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 28.14 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Cracking Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Vertiv Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Momentum81.22

Growth66.74

Quality97.38

Value16.52

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.