The market still looks weak but potentially overdone temporarily. Magnificent 7 stocks tried to make a stand on Tuesday so traders looking to take some bullish exposure may want to think about doing so in a limited way. Here’s a bullish butterfly spread on Amazon stock that could fit the bill.

Amazon Stock: Venturing To The Bullish Side

Amazon.com (AMZN) came down below its 200-day line but is trying to make a run back above it. An important level to keep an eye on is 200.

Traders can gain some upside exposure in a low-risk way via a bullish butterfly.

A butterfly option spread involves three different option strikes. Each option uses the same expiration date and the spread can use either calls or puts.

By trading a butterfly with a bullish bias, we can place the trade cheaply and have a large potential payoff if the stock hits our target.

Say we have a price target of 210 for Amazon within the next few weeks. Let’s look at how we can set up a bullish butterfly based on that assumption

- Buy 1 April 17 Amazon 200 call @ 8.10

- Sell 2 April 17 Amazon 210 calls @ 4.15

- Buy 1 April 17 Amazon 220 call @ 1.85

This trade only costs around $165 per spread but has a payoff potential much higher than that.

How To Profit

The ideal scenario is for Amazon to be right around 210 at the April 17 expiration.

The maximum loss on the trade is equal to the premium paid of around $165 per contract. This occurs anywhere below 200 or above 220.

The maximum potential profit on the trade is $835. This is calculated by taking the width of the butterfly (10) times 100 less the premium paid (165).

Taking a low-risk trade like this can be one way to participate in any further rally without risking too much capital.

Earnings Risk And Ratings

Amazon is due to report earnings in late April, so this trade shouldn’t have earnings risk if held to expiration.

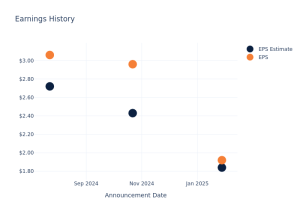

According to the IBD Stock Checkup, Amazon is ranked No. 11 in its group. Further, it has a Composite Rating of 80, an EPS Rating of 79 and a Relative Strength Rating of 65.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options and is very conservative in his style. He believes patience in waiting for the best setups is the key to successful trading. Follow him on X/Twitter at @OptiontradinIQ

YOU MIGHT ALSO LIKE:

NextEra Stock: How This Bull Put Spread Can Yield A Double-Digit Return

Strategy Stock Today: This Bear Call Spread In MSTR Might Deliver 24% By April 17

Goldman Sachs Option Trade Could Return 23% By Mid-April

How To Use High Volatility For A Short Strangle On Exxon Mobil Stock