(Bloomberg) — European stocks advanced after President Donald Trump sought to reassure about the outlook for the US economy and Ukraine accepted a proposal for a 30-day truce with Russia.

Most Read from Bloomberg

The Stoxx 600 index rose 0.7%, set to end four days of declines, while contracts for US stocks edged higher after Trump said he doesn’t see a US recession, downplaying Wall Street’s jitters. Zealand Pharma A/S soared 40% after Roche Holding AG licensed its new weight-loss drug. Shares in Inditex SA fell after the Zara owner’s sales made a slow start to the year.

The dollar strengthened against all of its Group-of-10 peers and Treasuries ticked higher.

The latest international trade salvos were also in focus as the European Union retaliated with levies of its own after US import duties on steel and aluminum took effect.

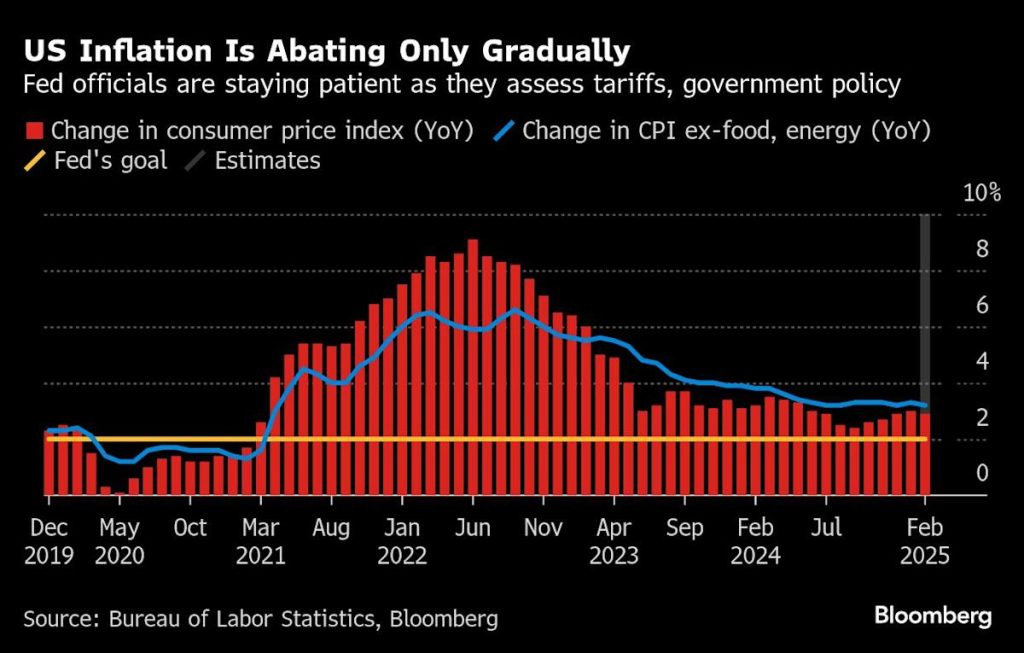

Trump’s tariff policies, geopolitical realignments over Ukraine, sticky inflation and the unknown pace of Federal Reserve interest-rate cuts have battered markets this year, leaving US stocks on the verge of a correction.

“Any relief from all that geopolitical noise is a good thing for markets right now,” said Ken Wong, an Asian equity portfolio specialist at Eastspring Investments. News regarding a ceasefire in Ukraine and relief in the tariff tensions between the US and Canada are helping, he said.

Get the Markets Daily newsletter to learn what’s moving stocks, bonds, currencies and commodities.

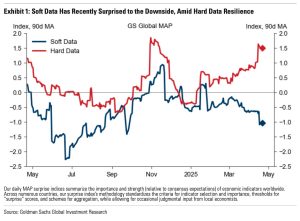

The VIX gauge of stock volatility is hovering near its highest since August, while a similar measure for Treasuries is at levels not seen since November as market participants remain nervous about US economic growth.

Trump told top executives gathered at a meeting of the Business Roundtable that he’s putting a priority on speedy approvals, particularly regarding environmental regulations, and planned to soon announce a major electricity project, according to a person familiar with the session. He also reiterated a suggestion that a company’s business taxes could be reduced if it manufactured its products in the US.

Growing skepticism over the US economic outlook prompted Goldman Sachs Group Inc. strategists to slash their target for the S&P 500, joining a growing chorus of banks that have expressed concerns over economic growth amid heightening geopolitical uncertainties.