Financial giants have made a conspicuous bearish move on Ford Motor. Our analysis of options history for Ford Motor F revealed 8 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 75% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $350,682, and 2 were calls, valued at $132,630.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $7.85 and $9.85 for Ford Motor, spanning the last three months.

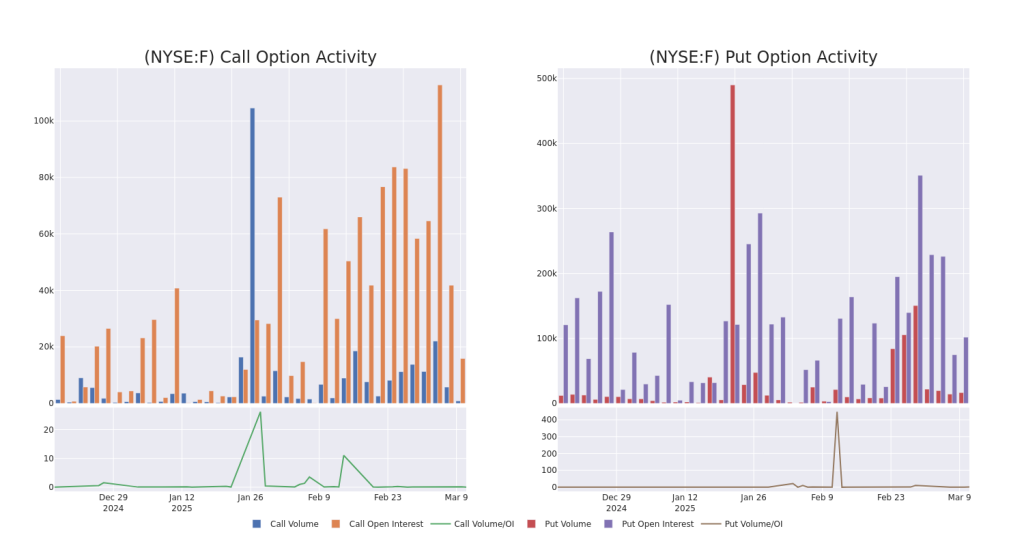

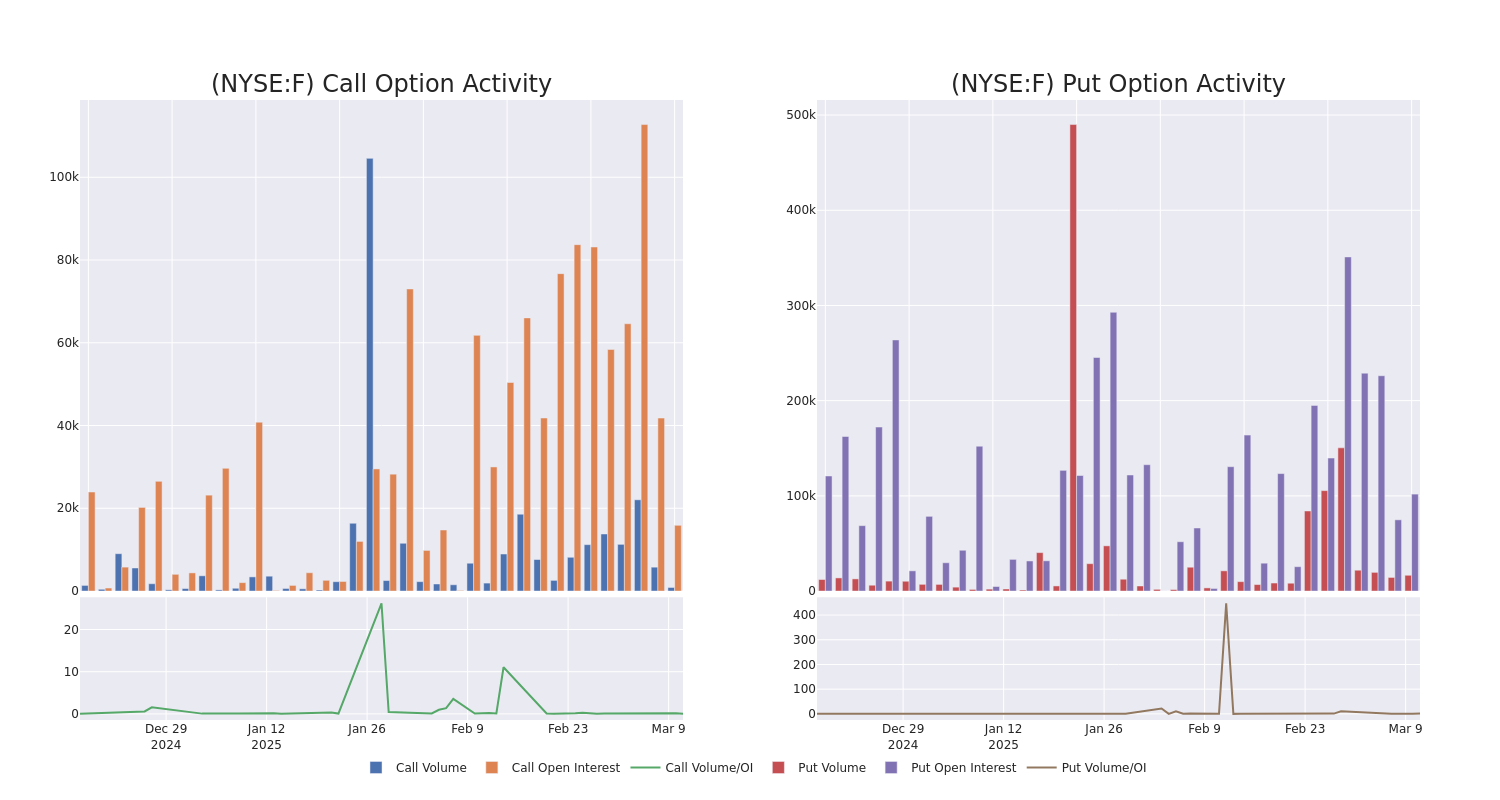

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Ford Motor’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Ford Motor’s whale activity within a strike price range from $7.85 to $9.85 in the last 30 days.

Ford Motor Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| F | CALL | TRADE | BEARISH | 01/15/27 | $1.63 | $1.51 | $1.53 | $9.85 | $107.1K | 12.1K | 830 |

| F | PUT | SWEEP | BEARISH | 03/14/25 | $0.2 | $0.19 | $0.19 | $9.85 | $100.7K | 7.5K | 6.7K |

| F | PUT | TRADE | BEARISH | 06/20/25 | $0.82 | $0.81 | $0.82 | $9.67 | $100.4K | 56.7K | 3.5K |

| F | PUT | SWEEP | BEARISH | 12/19/25 | $1.31 | $1.28 | $1.31 | $9.67 | $47.9K | 37.6K | 1.3K |

| F | PUT | TRADE | BEARISH | 06/20/25 | $0.81 | $0.8 | $0.81 | $9.67 | $36.8K | 56.7K | 1.7K |

About Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 10% share in the UK, and under 2% share in China including unconsolidated affiliates. Sales in the US made up about 68% of 2024 total company revenue. Ford has about 171,000 employees, including about 56,500 UAW employees, and is based in Dearborn, Michigan.

After a thorough review of the options trading surrounding Ford Motor, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Ford Motor’s Current Market Status

- Currently trading with a volume of 131,225,490, the F’s price is down by -4.47%, now at $9.52.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 43 days.

Expert Opinions on Ford Motor

In the last month, 1 experts released ratings on this stock with an average target price of $10.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Ford Motor with a target price of $10.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Ford Motor with Benzinga Pro for real-time alerts.

Momentum29.11

Growth5.25

Quality–

Value90.79

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.