Whales with a lot of money to spend have taken a noticeably bullish stance on Cameco.

Looking at options history for Cameco CCJ we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $1,088,228 and 4, calls, for a total amount of $237,200.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $38.0 and $49.0 for Cameco, spanning the last three months.

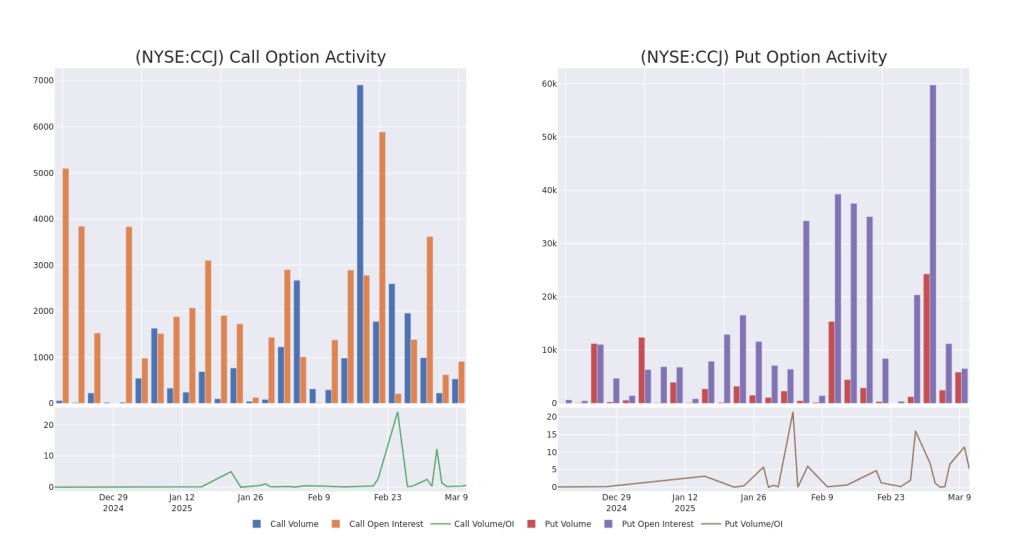

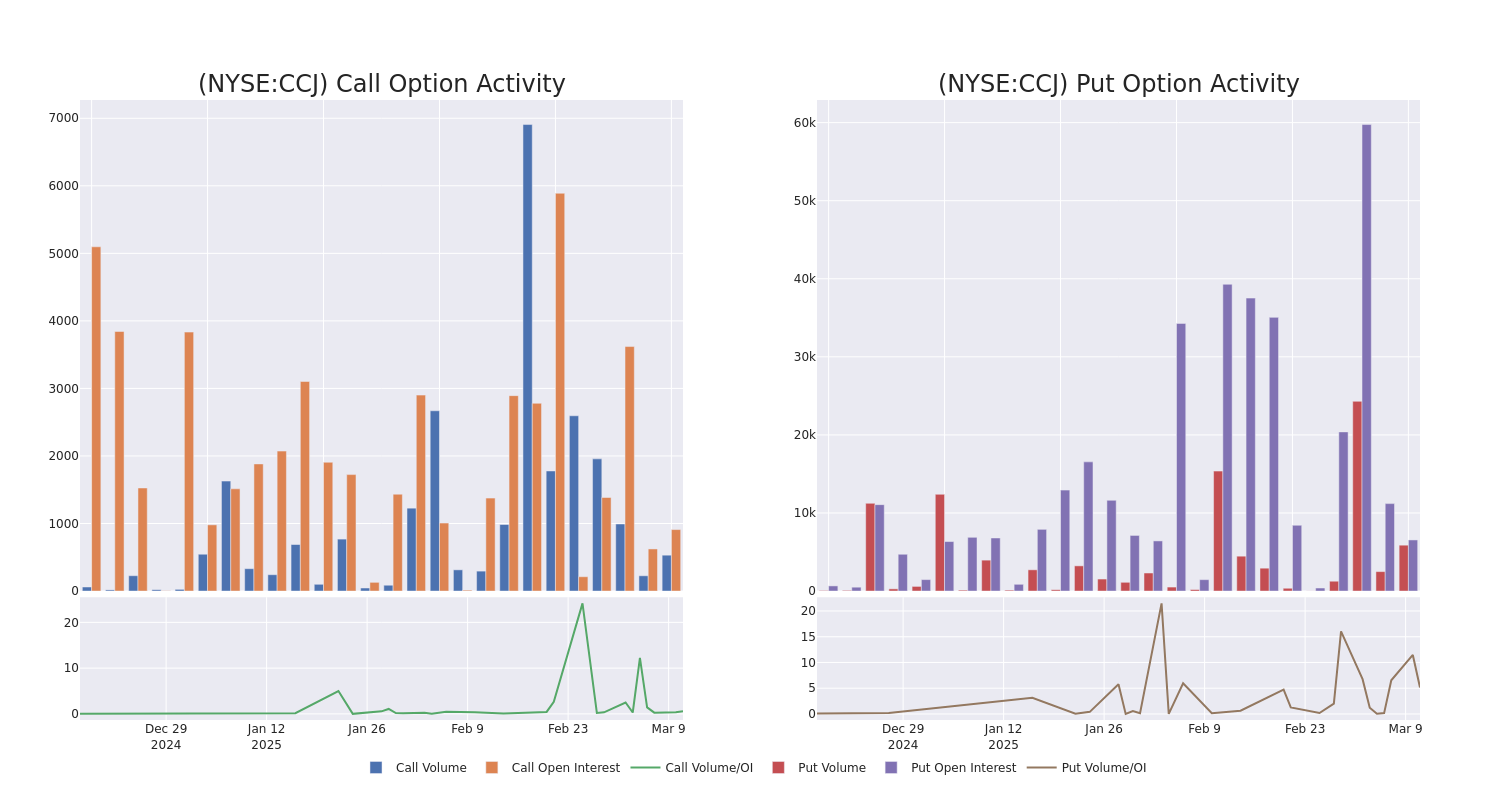

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cameco’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cameco’s significant trades, within a strike price range of $38.0 to $49.0, over the past month.

Cameco 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.7 | $4.6 | $4.6 | $45.00 | $386.0K | 6.1K | 1.4K |

| CCJ | PUT | SWEEP | BULLISH | 03/21/25 | $4.65 | $4.6 | $4.6 | $45.00 | $302.0K | 6.1K | 659 |

| CCJ | PUT | SWEEP | BEARISH | 03/21/25 | $4.6 | $4.45 | $4.6 | $45.00 | $118.2K | 6.1K | 1.7K |

| CCJ | CALL | SWEEP | BULLISH | 06/20/25 | $4.1 | $4.0 | $4.1 | $42.00 | $102.9K | 112 | 252 |

| CCJ | PUT | TRADE | BEARISH | 03/21/25 | $4.6 | $4.6 | $4.6 | $45.00 | $76.8K | 6.1K | 1.6K |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. It has three reportable segments, Uranium, Fuel Services, and Westinghouse. It derives maximum revenue from the Westinghouse Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre, and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia, and the United States.

Having examined the options trading patterns of Cameco, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Cameco

- Trading volume stands at 528,971, with CCJ’s price down by -0.06%, positioned at $40.62.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 49 days.

What Analysts Are Saying About Cameco

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $90.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cameco options trades with real-time alerts from Benzinga Pro.

Momentum65.88

Growth62.87

Quality–

Value39.01

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.