Deep-pocketed investors have adopted a bearish approach towards Astera Labs ALAB, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ALAB usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 10 extraordinary options activities for Astera Labs. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 70% bearish. Among these notable options, 6 are puts, totaling $259,290, and 4 are calls, amounting to $205,945.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $90.0 for Astera Labs over the recent three months.

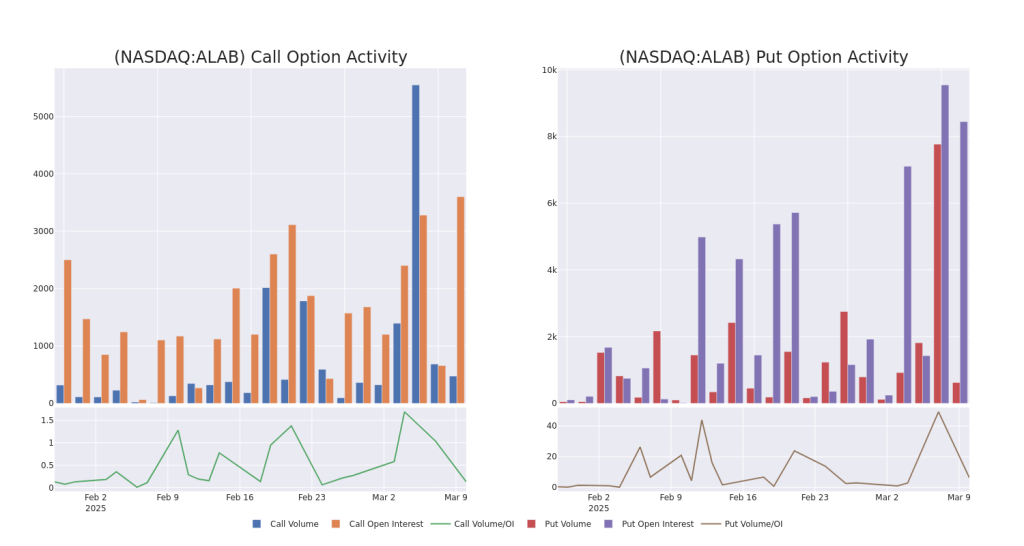

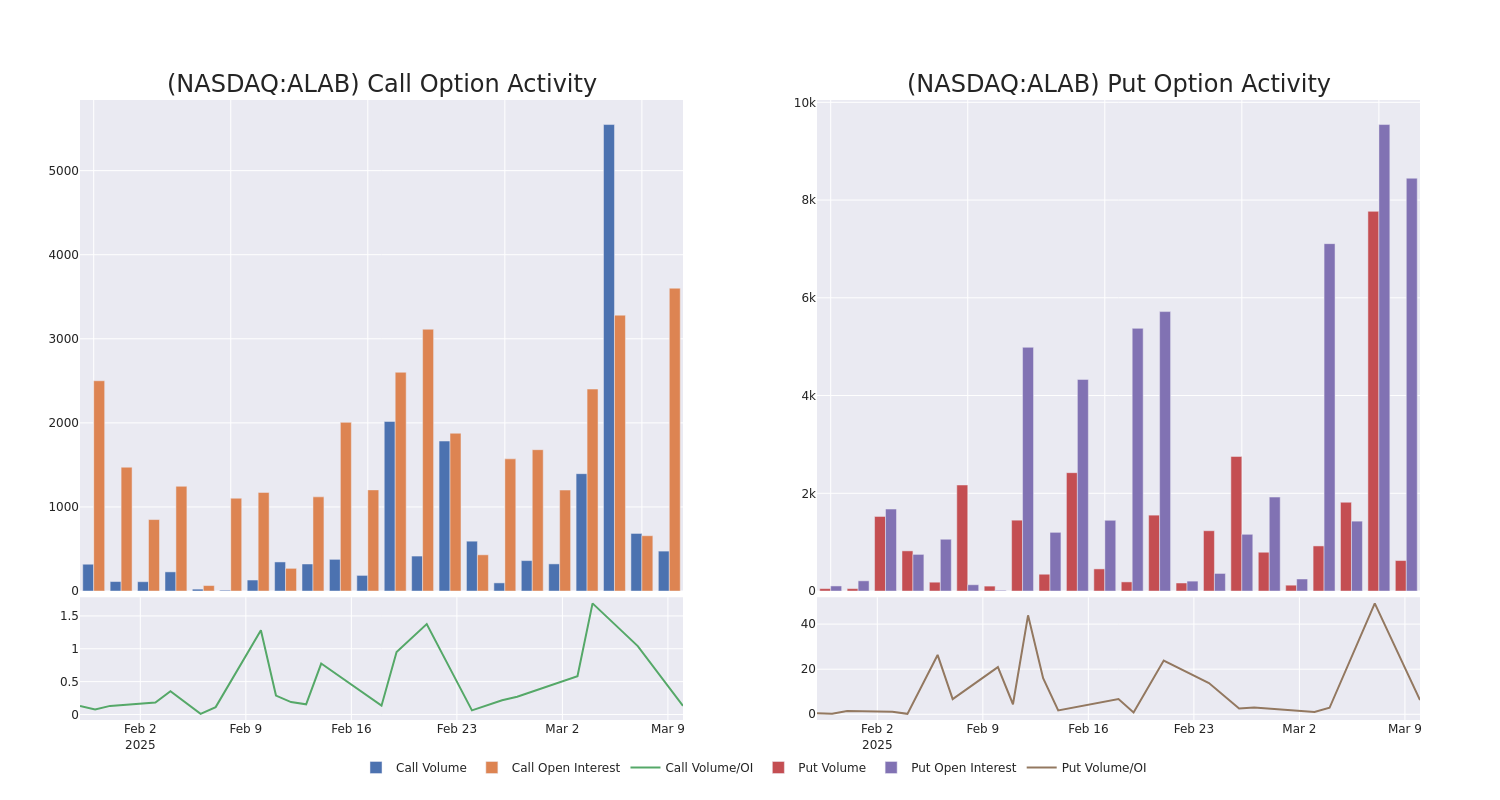

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Astera Labs’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Astera Labs’s whale activity within a strike price range from $60.0 to $90.0 in the last 30 days.

Astera Labs Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | PUT | SWEEP | BULLISH | 03/14/25 | $10.7 | $10.2 | $10.2 | $74.00 | $71.4K | 341 | 113 |

| ALAB | CALL | TRADE | BULLISH | 09/19/25 | $13.1 | $12.8 | $13.1 | $70.00 | $65.5K | 133 | 50 |

| ALAB | CALL | TRADE | BEARISH | 09/19/25 | $13.7 | $13.2 | $13.25 | $70.00 | $64.9K | 133 | 50 |

| ALAB | PUT | SWEEP | BEARISH | 03/28/25 | $4.0 | $2.45 | $4.0 | $60.00 | $47.6K | 29 | 142 |

| ALAB | CALL | TRADE | BEARISH | 04/17/25 | $1.3 | $1.1 | $1.15 | $90.00 | $45.9K | 3.4K | 401 |

About Astera Labs

Astera Labs Inc designs and delivers semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates semiconductor technology, microcontrollers, sensors, and software to enhance performance, scalability, and data management. The company offers products such as integrated circuits (ICs), boards, and modules, catering to hyperscalers and system OEMs. The company’s solutions focus on data, network, and memory management in AI-driven platforms.

Astera Labs’s Current Market Status

- With a trading volume of 500,807, the price of ALAB is down by -4.21%, reaching $64.1.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 75 days from now.

What Analysts Are Saying About Astera Labs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $132.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Craig-Hallum persists with their Buy rating on Astera Labs, maintaining a target price of $125.

* An analyst from Needham downgraded its action to Buy with a price target of $140.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Astera Labs with Benzinga Pro for real-time alerts.

Momentum–

Growth–

Quality–

Value13.04

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.