Financial giants have made a conspicuous bearish move on Home Depot. Our analysis of options history for Home Depot HD revealed 35 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 25 were puts, with a value of $1,294,675, and 10 were calls, valued at $512,365.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $250.0 to $405.0 for Home Depot during the past quarter.

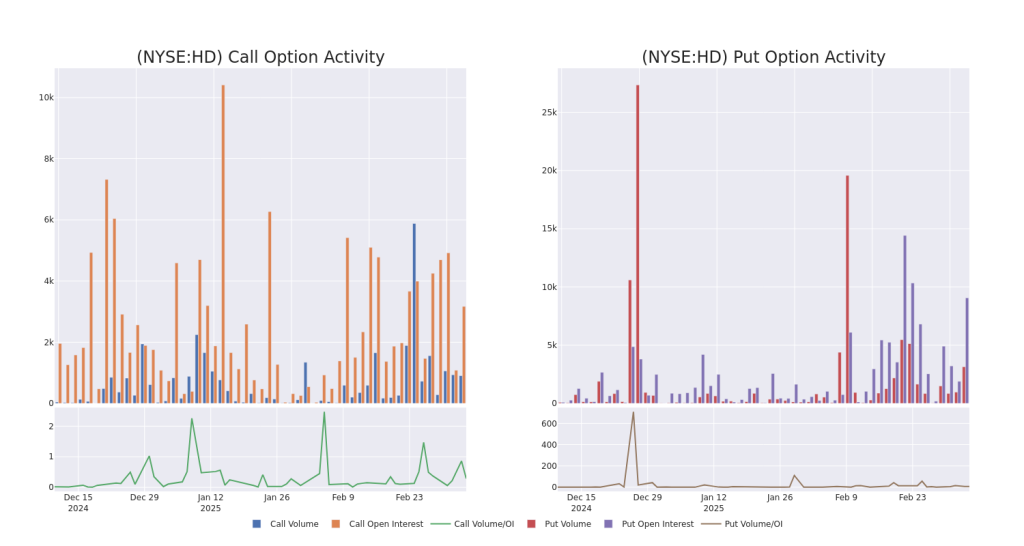

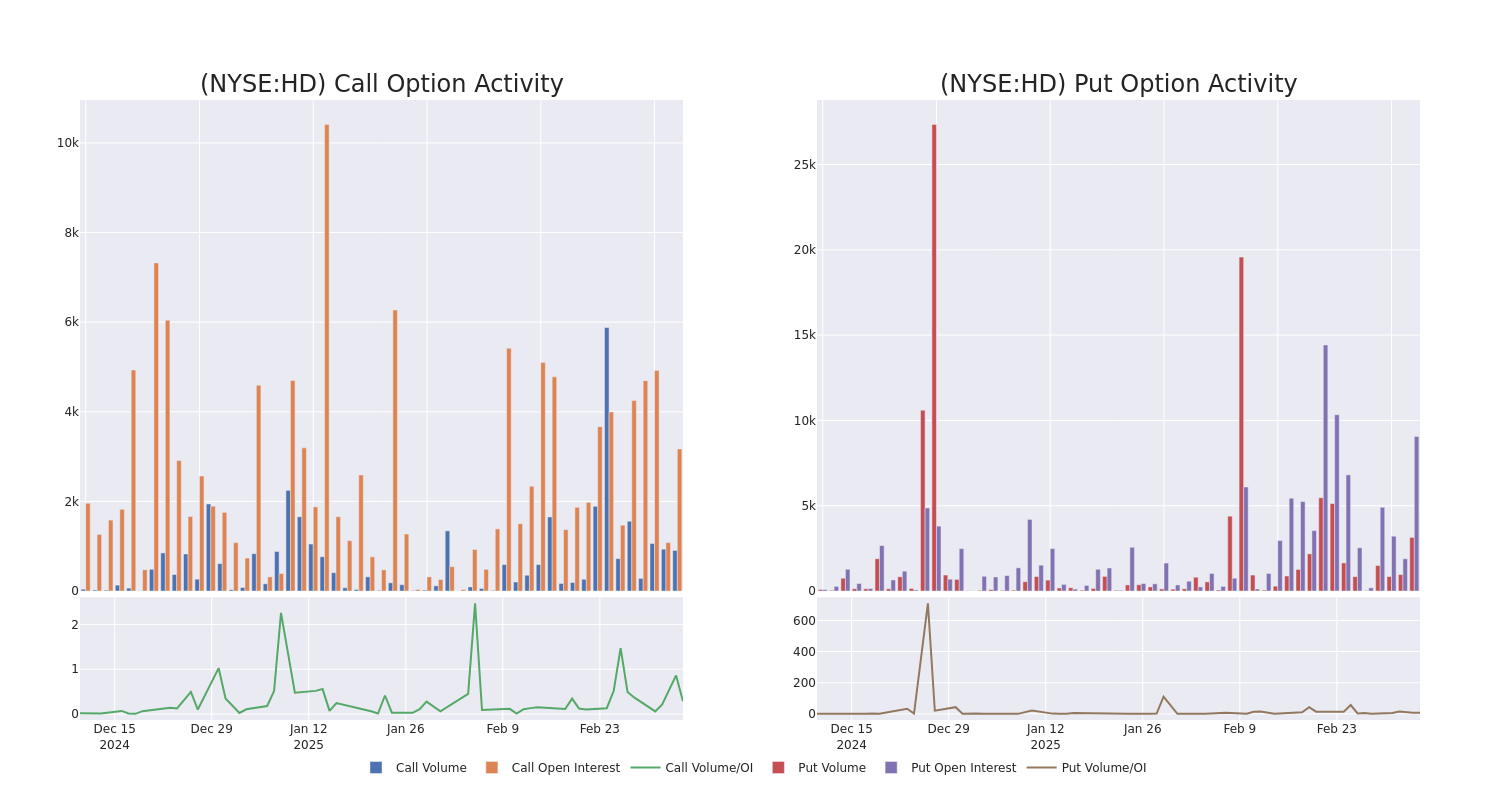

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Home Depot options trades today is 489.32 with a total volume of 4,049.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Home Depot’s big money trades within a strike price range of $250.0 to $405.0 over the last 30 days.

Home Depot Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | PUT | TRADE | NEUTRAL | 03/07/25 | $15.85 | $14.55 | $15.2 | $385.00 | $152.0K | 782 | 364 |

| HD | CALL | SWEEP | BEARISH | 05/16/25 | $7.3 | $6.95 | $6.95 | $400.00 | $128.5K | 846 | 3 |

| HD | PUT | SWEEP | BEARISH | 03/21/25 | $23.5 | $23.2 | $23.5 | $390.00 | $102.6K | 890 | 51 |

| HD | PUT | SWEEP | NEUTRAL | 03/14/25 | $10.45 | $9.85 | $10.15 | $380.00 | $81.2K | 515 | 93 |

| HD | PUT | SWEEP | BULLISH | 03/07/25 | $15.4 | $14.45 | $14.8 | $385.00 | $72.5K | 782 | 414 |

About Home Depot

Home Depot is the world’s largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the 2024 tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

Having examined the options trading patterns of Home Depot, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Home Depot’s Current Market Status

- Trading volume stands at 2,904,785, with HD’s price down by -1.71%, positioned at $375.21.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 67 days.

Professional Analyst Ratings for Home Depot

In the last month, 5 experts released ratings on this stock with an average target price of $456.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Guggenheim lowers its rating to Buy with a new price target of $450.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Home Depot, targeting a price of $435.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Home Depot with a target price of $467.

* Consistent in their evaluation, an analyst from Telsey Advisory Group keeps a Outperform rating on Home Depot with a target price of $455.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Home Depot with a target price of $475.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Home Depot options trades with real-time alerts from Benzinga Pro.

Momentum56.05

Growth65.03

Quality–

Value24.27

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.