Financial giants have made a conspicuous bearish move on Cleveland-Cliffs. Our analysis of options history for Cleveland-Cliffs CLF revealed 15 unusual trades.

Delving into the details, we found 26% of traders were bullish, while 73% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $643,060, and 5 were calls, valued at $202,414.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $9.0 and $13.0 for Cleveland-Cliffs, spanning the last three months.

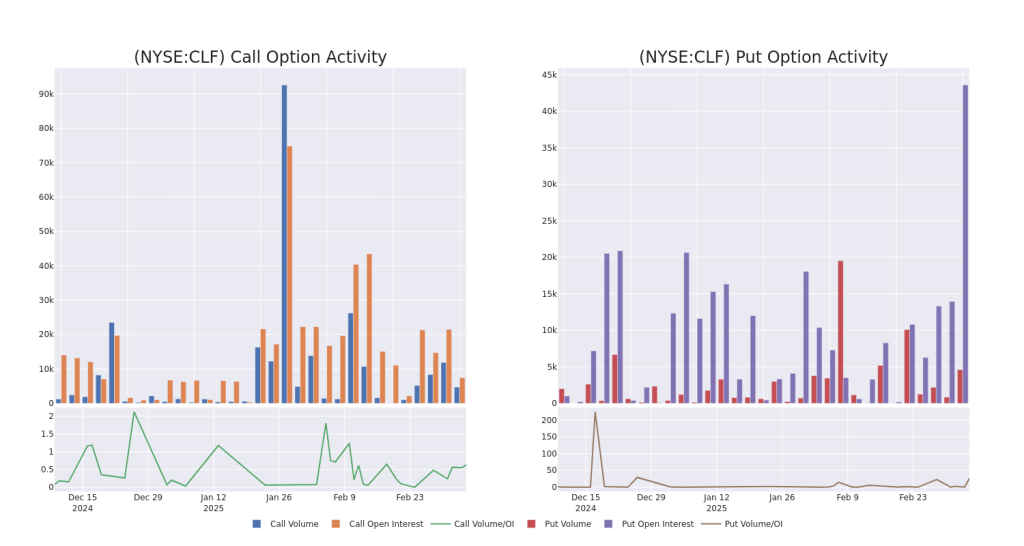

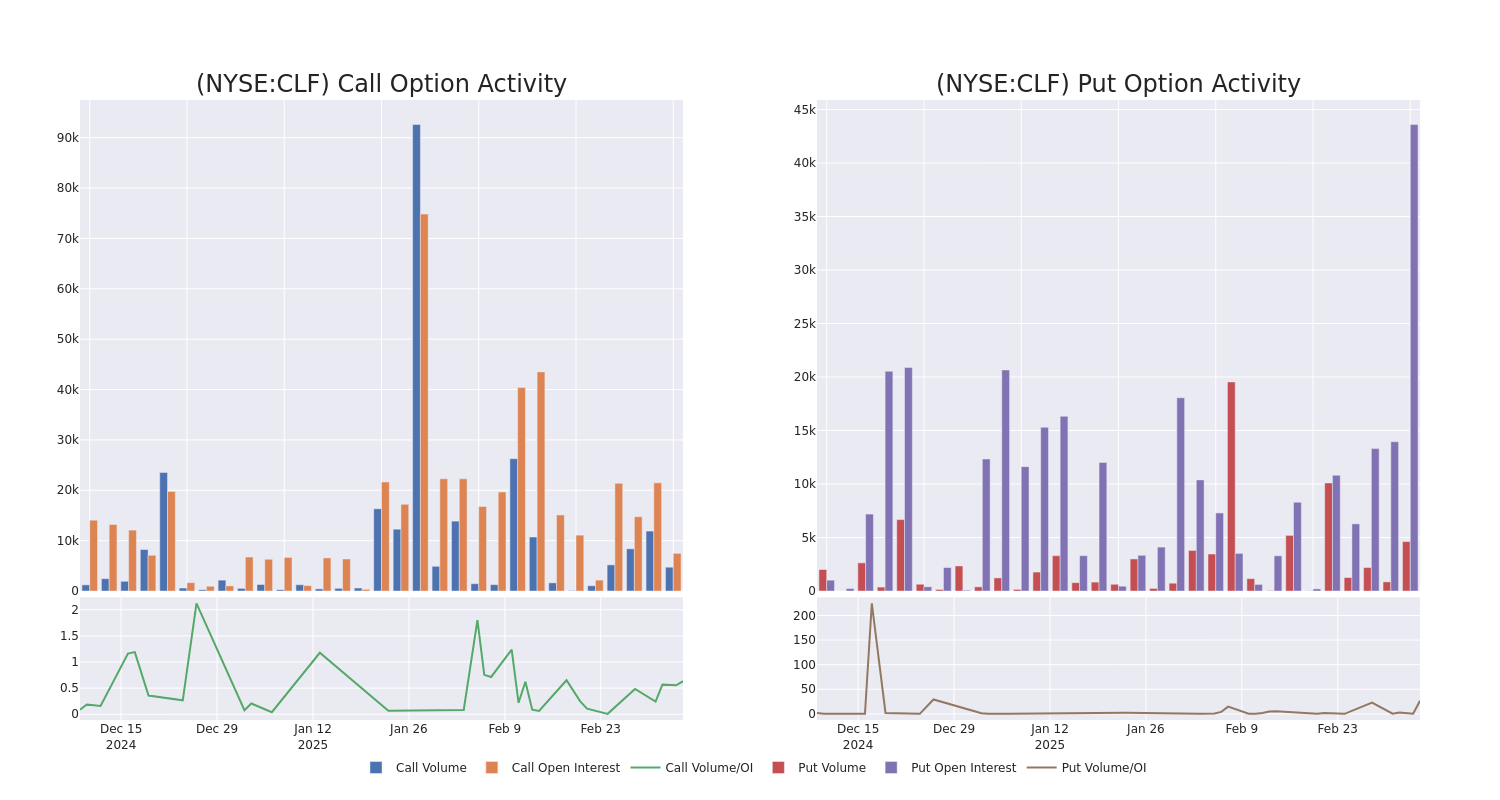

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Cleveland-Cliffs’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Cleveland-Cliffs’s substantial trades, within a strike price spectrum from $9.0 to $13.0 over the preceding 30 days.

Cleveland-Cliffs 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLF | PUT | SWEEP | BEARISH | 03/21/25 | $0.28 | $0.25 | $0.27 | $9.50 | $135.0K | 2.6K | 1.0K |

| CLF | PUT | SWEEP | BEARISH | 01/16/26 | $3.2 | $3.15 | $3.2 | $12.00 | $95.6K | 12.6K | 1 |

| CLF | PUT | SWEEP | BEARISH | 03/20/26 | $3.35 | $3.25 | $3.35 | $12.00 | $82.4K | 731 | 53 |

| CLF | PUT | SWEEP | BEARISH | 01/16/26 | $3.2 | $3.15 | $3.2 | $12.00 | $80.0K | 12.6K | 576 |

| CLF | CALL | TRADE | BEARISH | 04/17/25 | $0.87 | $0.86 | $0.86 | $10.00 | $77.9K | 3.7K | 533 |

About Cleveland-Cliffs

Cleveland-Cliffs Inc is a flat-rolled steel producer and manufacturer of iron ore pellets in North America. It is organized into four operating segments based on differentiated products, Steelmaking, Tubular, Tooling and Stamping and European Operations, but operates through one reportable segment -Steelmaking. It is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling and tubing. It serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Geographically, it operates in the United States, Canada and other countries. The majority of revenue is from the United States. It is a supplier of steel to the automotive industry in North America.

Following our analysis of the options activities associated with Cleveland-Cliffs, we pivot to a closer look at the company’s own performance.

Cleveland-Cliffs’s Current Market Status

- Currently trading with a volume of 13,377,814, the CLF’s price is down by -1.69%, now at $9.89.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 45 days.

What The Experts Say On Cleveland-Cliffs

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $13.95.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Cleveland-Cliffs with a target price of $15.

* Consistent in their evaluation, an analyst from GLJ Research keeps a Buy rating on Cleveland-Cliffs with a target price of $12.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cleveland-Cliffs, Benzinga Pro gives you real-time options trades alerts.

Momentum13.84

Growth40.38

Quality–

Value75.31

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.