Financial giants have made a conspicuous bearish move on Astera Labs. Our analysis of options history for Astera Labs ALAB revealed 10 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $192,986, and 4 were calls, valued at $164,488.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $120.0 for Astera Labs over the recent three months.

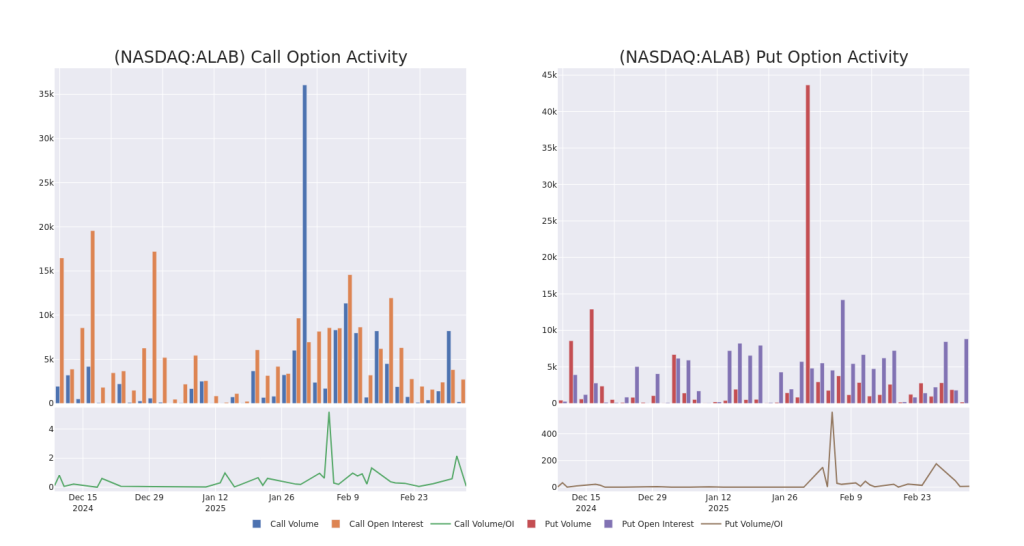

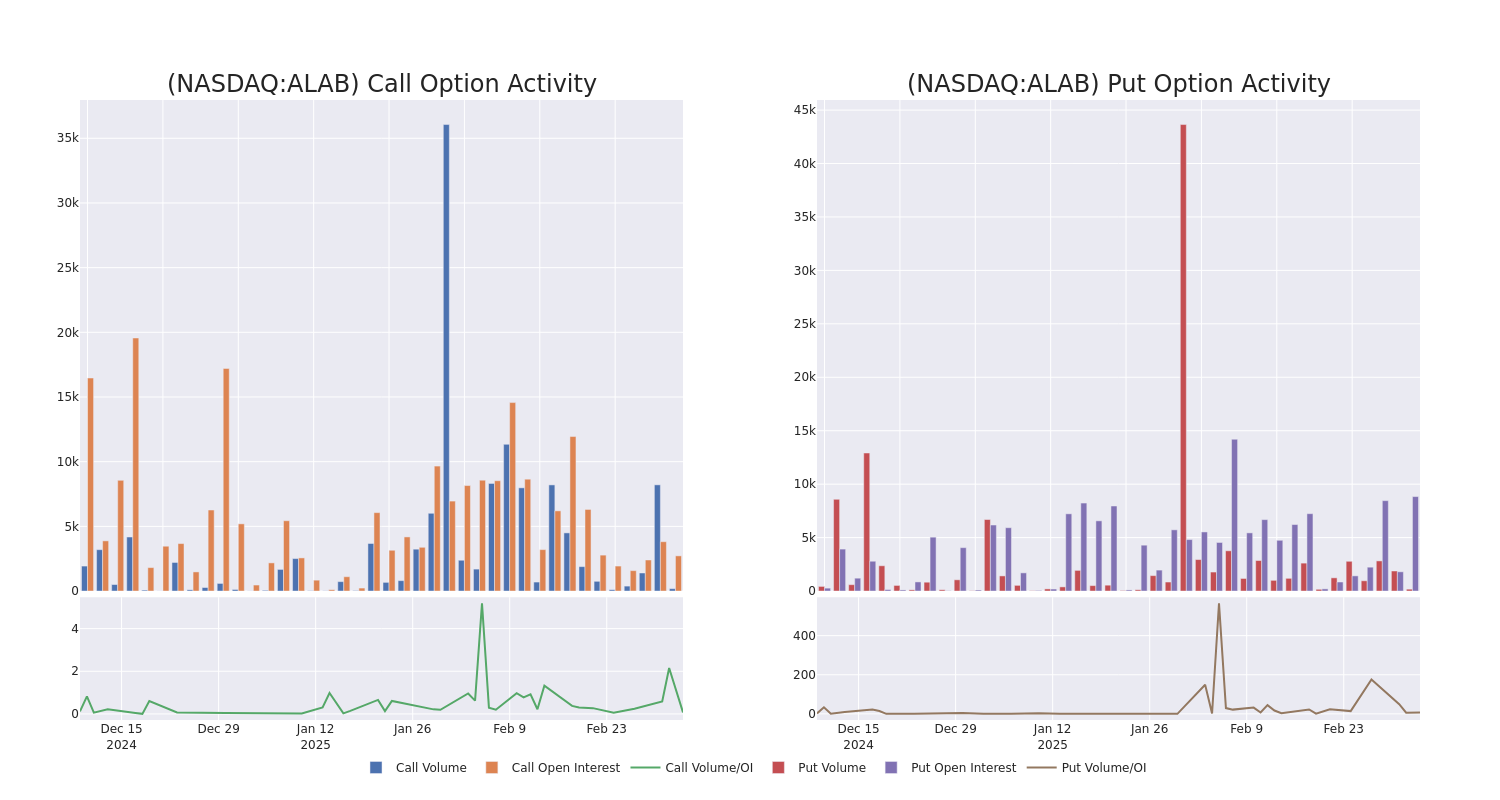

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Astera Labs’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Astera Labs’s whale trades within a strike price range from $20.0 to $120.0 in the last 30 days.

Astera Labs 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | CALL | TRADE | BEARISH | 04/17/25 | $1.3 | $1.05 | $1.15 | $90.00 | $69.0K | 2.6K | 34 |

| ALAB | PUT | TRADE | BULLISH | 10/17/25 | $53.5 | $53.1 | $53.1 | $115.00 | $53.1K | 107 | 10 |

| ALAB | CALL | TRADE | BEARISH | 03/21/25 | $4.5 | $4.2 | $4.32 | $65.00 | $43.2K | 20 | 150 |

| ALAB | PUT | TRADE | BULLISH | 09/19/25 | $9.9 | $9.8 | $9.8 | $55.00 | $31.3K | 14 | 62 |

| ALAB | PUT | TRADE | BULLISH | 09/19/25 | $9.9 | $9.8 | $9.8 | $55.00 | $29.4K | 14 | 30 |

About Astera Labs

Astera Labs Inc designs and delivers semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates semiconductor technology, microcontrollers, sensors, and software to enhance performance, scalability, and data management. The company offers products such as integrated circuits (ICs), boards, and modules, catering to hyperscalers and system OEMs. The company’s solutions focus on data, network, and memory management in AI-driven platforms.

Following our analysis of the options activities associated with Astera Labs, we pivot to a closer look at the company’s own performance.

Present Market Standing of Astera Labs

- Trading volume stands at 1,918,093, with ALAB’s price down by -5.02%, positioned at $65.12.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 79 days.

Professional Analyst Ratings for Astera Labs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $132.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $140.

* Consistent in their evaluation, an analyst from Craig-Hallum keeps a Buy rating on Astera Labs with a target price of $125.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Astera Labs options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.