(Bloomberg) — ON Semiconductor Corp. made its pursuit of Allegro Microsystems Inc. public on Wednesday, disclosing an unsolicited bid valuing the company at $6.9 billion including debt.

Most Read from Bloomberg

The chip company, which does business as Onsemi, is offering $35.10 per share for Allegro, up from a September proposal of $34.50, it said in a statement. Allegro responded hours later to say it had reviewed the bid but found it “inadequate.”

Onsemi has been working with advisers in recent months to pursue Allegro, Bloomberg News previously reported. Making takeover offers public is not a common move but it’s an M&A tactic designed to put shareholder pressure on a potential target. It’s been done before in the semiconductor industry. In 2017, Broadcom Inc. made a $103 billion unsolicited takeover bid for Qualcomm Inc., which was fended off with help from the White House.

Manchester, New Hampshire-based Allegro had a market capitalization of about $4.9 billion at the close Wednesday in New York, while Onsemi was valued at $19.6 billion. Shares in Allegro rose as much as 13% in premarket US trading on Thursday, while Onsemi fell as much as 3.6%.

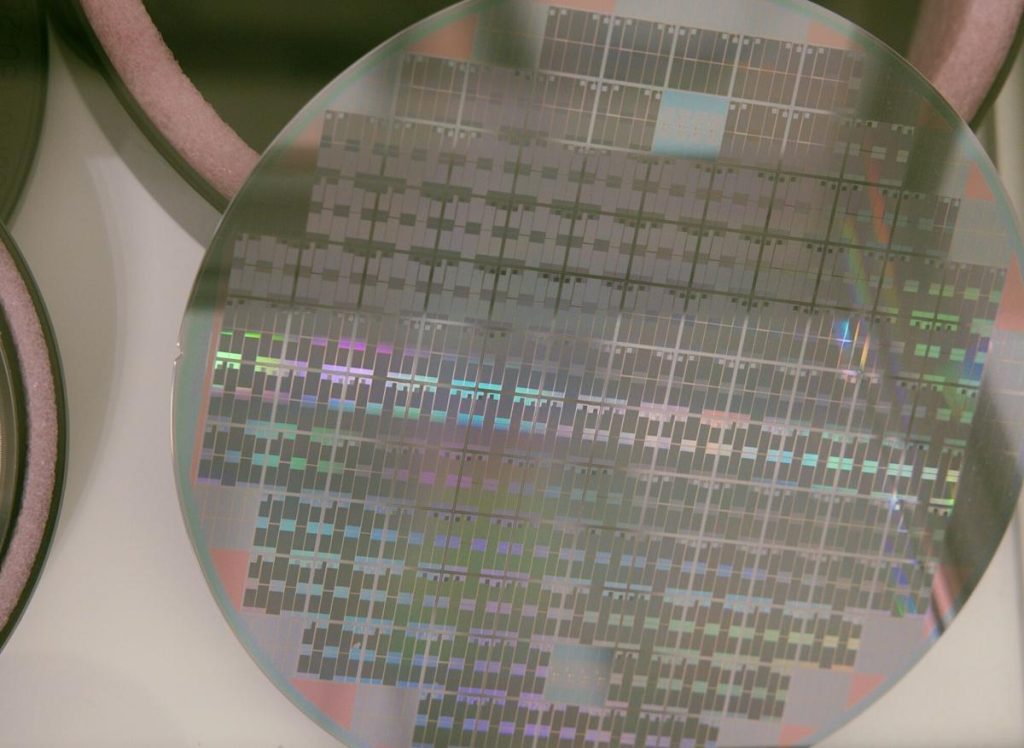

Allegro develops advanced semiconductors, describing itself as a leader in power and sensing solutions for motion control and energy-efficient systems. The products are used in car engines and safety systems as well as data centers and factories. Onsemi also develops power and sensing technologies used in the automotive, industrial and cloud computing sectors. Since news of Onsemi’s pursuit broke, research analysts have written that a deal makes strategic sense.

Allegro’s biggest shareholder is Japan’s Sanken Electric Co., with a stake of about 32%, according to data compiled by Bloomberg.

–With assistance from Subrat Patnaik.

(Updates with pre-market share move in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.