Whales with a lot of money to spend have taken a noticeably bullish stance on Roku.

Looking at options history for Roku ROKU we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $316,703 and 4, calls, for a total amount of $161,765.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $105.0 for Roku over the recent three months.

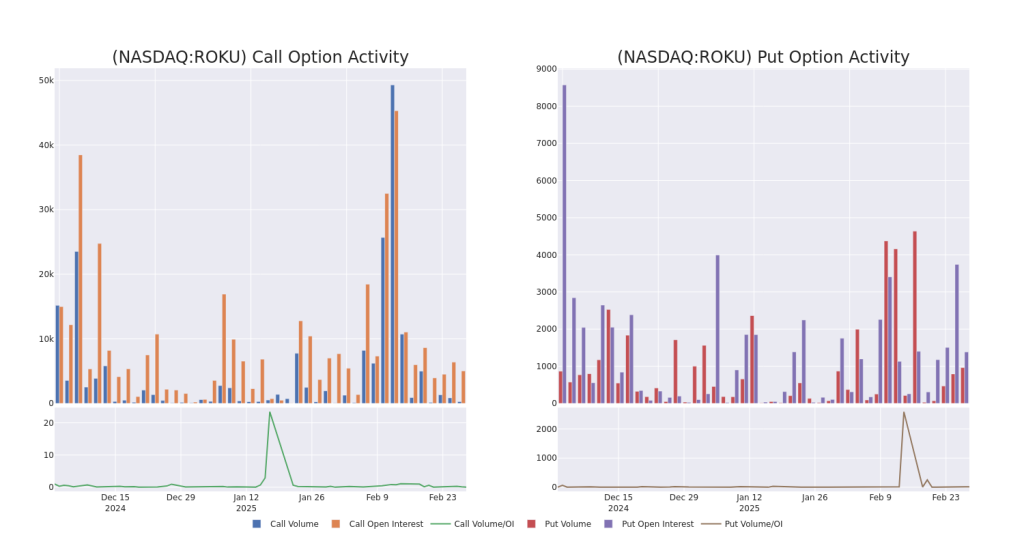

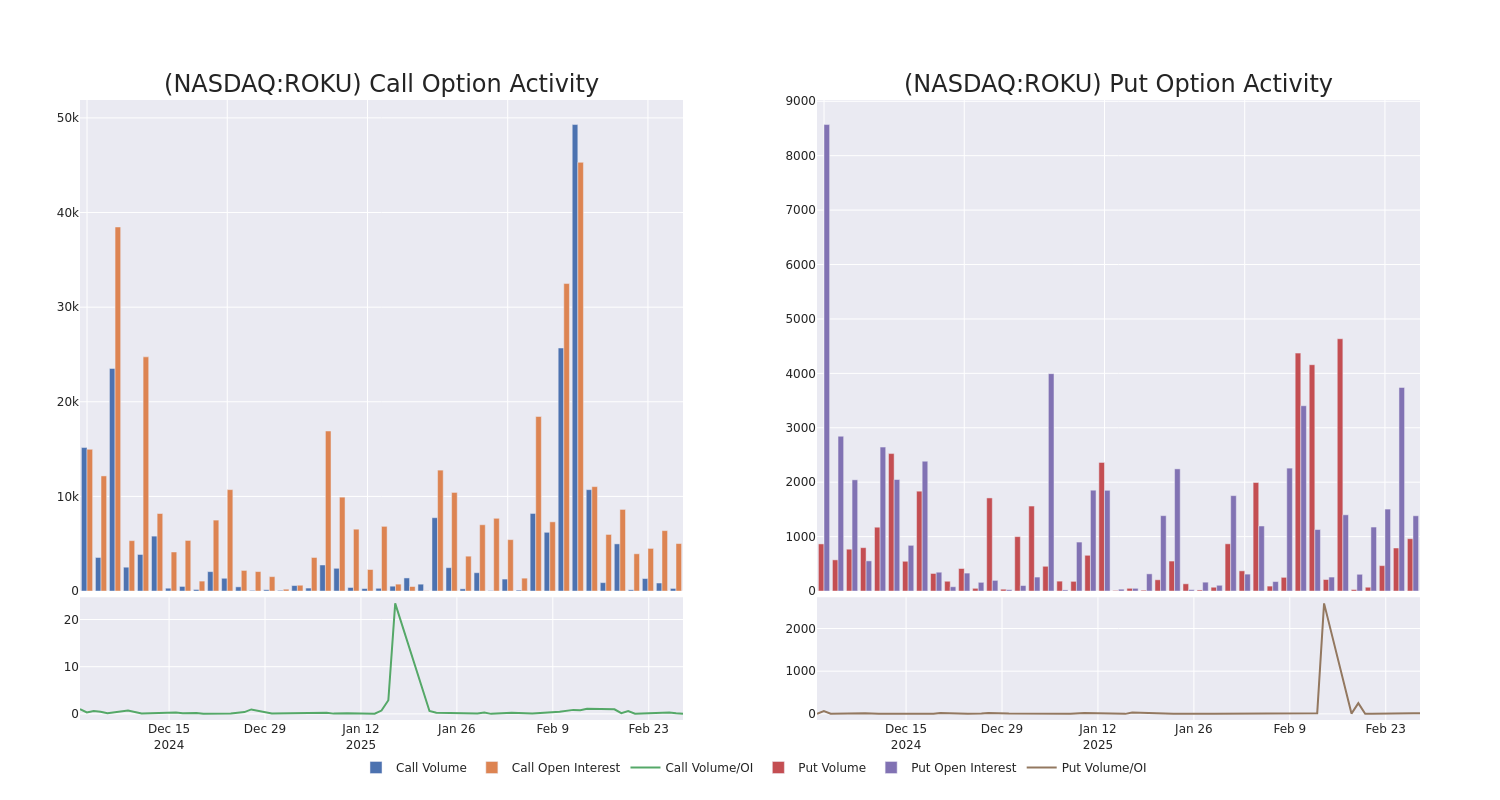

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Roku’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Roku’s significant trades, within a strike price range of $70.0 to $105.0, over the past month.

Roku Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | PUT | TRADE | BULLISH | 03/28/25 | $4.8 | $4.3 | $4.4 | $82.00 | $118.8K | 22 | 182 |

| ROKU | CALL | SWEEP | BEARISH | 04/17/25 | $7.95 | $7.75 | $7.75 | $80.00 | $72.0K | 1.8K | 165 |

| ROKU | PUT | TRADE | BULLISH | 02/28/25 | $4.8 | $4.65 | $4.65 | $87.00 | $62.7K | 891 | 462 |

| ROKU | PUT | SWEEP | BEARISH | 02/28/25 | $7.9 | $7.4 | $7.87 | $90.00 | $49.7K | 160 | 74 |

| ROKU | CALL | SWEEP | BULLISH | 04/17/25 | $7.95 | $7.75 | $7.85 | $80.00 | $31.4K | 1.8K | 72 |

About Roku

Roku enables consumers to stream television programming. It has more than 90 million streaming households and provided 127 billion streaming hours in 2024. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku’s OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku’s name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Following our analysis of the options activities associated with Roku, we pivot to a closer look at the company’s own performance.

Present Market Standing of Roku

- Trading volume stands at 1,160,607, with ROKU’s price up by 0.06%, positioned at $81.54.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 55 days.

Professional Analyst Ratings for Roku

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $107.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities persists with their Buy rating on Roku, maintaining a target price of $120.

* An analyst from Jefferies has elevated its stance to Hold, setting a new price target at $100.

* An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $95.

* Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Roku, targeting a price of $90.

* An analyst from Benchmark has decided to maintain their Buy rating on Roku, which currently sits at a price target of $130.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roku options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.