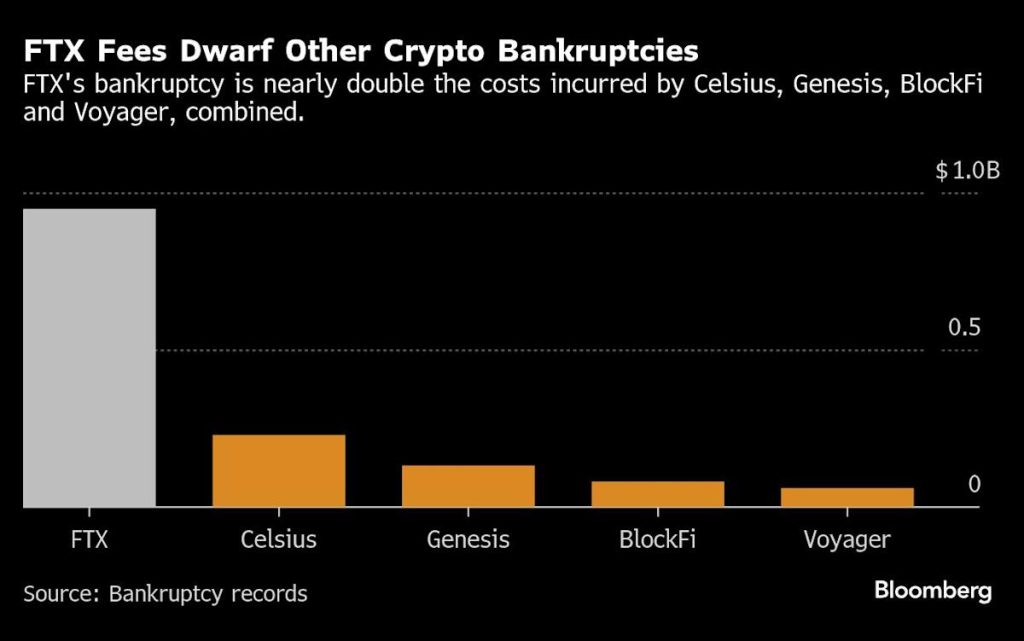

(Bloomberg) — The cost of FTX’s bankruptcy is approaching $1 billion, cementing the implosion of Sam Bankman-Fried’s crypto enterprise as one of costliest Chapter 11 cases in US history.

Most Read from Bloomberg

Nearly $948 million was paid to more than a dozen firms hired to work on the bankruptcy through Jan. 2, and more than $952 million in fees have been approved by the court, records show.

Hefty as it is, that outlay appears to be paying off for the crypto platform’s creditors. Most customers are poised to get back 118% of what they were owed, a rare outcome in the Chapter 11 process, where creditors usually end up getting pennies on the dollar.

The debtholders can thank the throngs of lawyers and financial advisers that have tracked down billions of dollars in digital assets and cash scattered across a byzantine network of accounts, legal experts told Bloomberg News. The beneficiaries include hedge funds that picked up FTX customer claims that traded as low as 10 cents on the dollar after the company collapsed. FTX, which sought protection in November 2022, said last week that it had commenced initial customer distributions.

Lawyers are still sifting through a number of disorganized legal entities under the FTX umbrella, seeking more assets to give to creditors. Some lawsuits related to the fallout remain outstanding, including a complaint against Binance Holdings Ltd. seeking nearly $1.8 billion.

Court records indicate that the high-profile bankruptcies of crypto players Celsius Network LLC, BlockFi Inc., Genesis Global and Voyager Digital Holdings Inc. cost about $502 million combined. The ongoing FTX case is nearly double that.

FTX’s lead law firm, Sullivan & Cromwell LLP, has been paid more than $248.6 million and financial adviser Alvarez & Marsal has been paid roughly $306 million, according to court records. Advisers representing the interests of FTX customers and other creditors have charged roughly $110.3 million in fees. It’s likely the most expensive Chapter 11 case of the past several years, according to fee data provided by BankruptcyData.

The eye-watering cost of FTX’s repayment plan, approved in October, “would have been cheaper” if the company “had bothered to have books and records, but they didn’t,” said Harvard Law School professor Jared Ellias, who has studied the costs of large Chapter 11 cases.