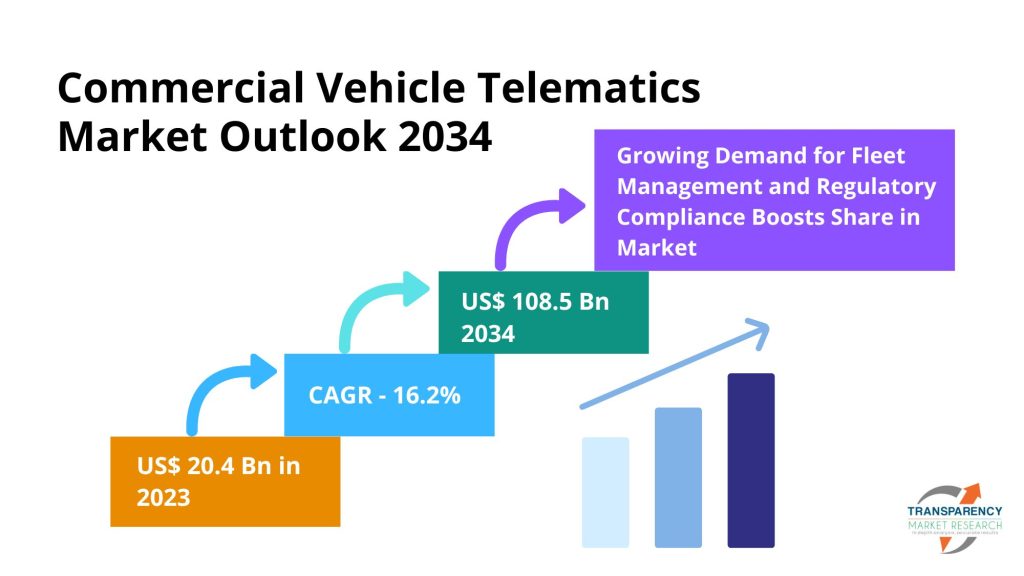

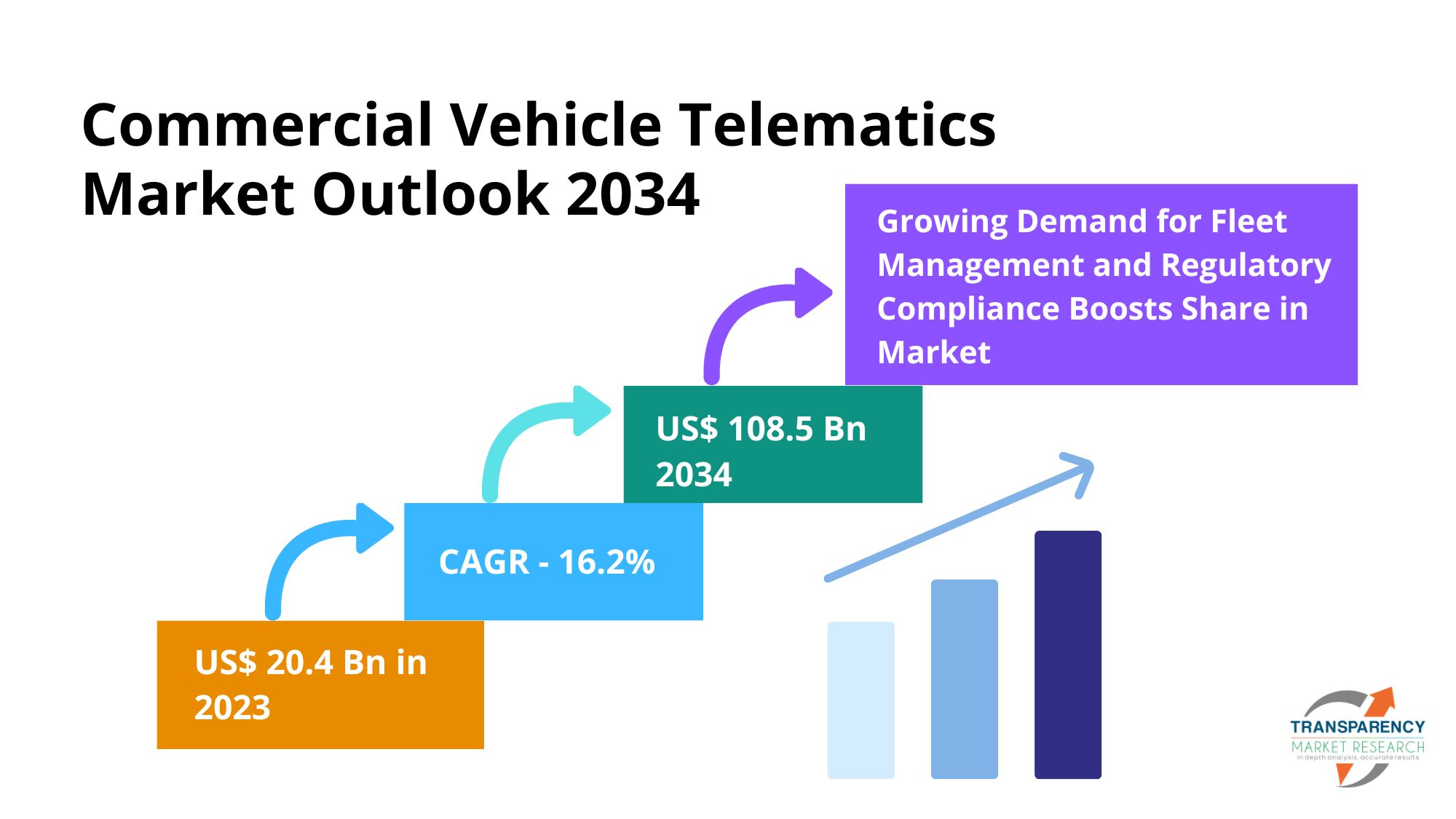

Wilmington, Delaware, Transparency Market Research Inc. –, Feb. 28, 2025 (GLOBE NEWSWIRE) — The global commercial vehicle telematics market (상업용 차량 텔레매틱스 시장), valued at approximately US$20.4 billion in 2023, is poised to expand at a robust CAGR of 16.2% from 2024 to 2034, reaching an estimated value of US$108.5 billion by the end of 2034.

Introduction: The Road to Smarter Fleet Management

The Commercial Vehicle Telematics Market is transforming fleet operations, logistics, and vehicle safety by integrating real-time data analytics, GPS tracking, and AI-driven predictive maintenance. With the increasing need for fuel efficiency, regulatory compliance, and enhanced fleet productivity, businesses are rapidly adopting telematics solutions to gain real-time vehicle insights and operational control.

As industries embrace connected vehicles and IoT-driven fleet management, commercial telematics is set to redefine transportation, logistics, and supply chain efficiency.

Discover The Most Impactful Takeaways From our Report in This Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=29957

Analysts’ Viewpoint: Regulatory Compliance and Technological Innovation at the Forefront

Regulatory mandates, such as the Electronic Logging Device (ELD) requirement in the United States and digital tachograph regulations in Europe, are key drivers behind the surge in telematics adoption. Fleet operators are increasingly investing in integrated telematics solutions to ensure compliance with these regulations, thereby reducing legal risks and enhancing safety.

Moreover, rapid advancements in connectivity through high-speed networks like 5G and the incorporation of AI and ML for real-time data analysis are significantly enhancing the performance of telematics systems. These technological breakthroughs not only provide deep insights into vehicle performance and driver behavior but also enable substantial cost savings and improved fleet management decision-making.

Market Overview: A Rapidly Expanding Industry

The commercial vehicle telematics market is growing at a remarkable pace, fueled by:

- Stringent Fleet Regulations – Governments worldwide are mandating electronic logging devices (ELDs), emissions monitoring, and driver compliance solutions.

- Cost Optimization Pressures – Rising fuel prices and maintenance costs are driving the adoption of AI-based fleet management systems.

- 5G & IoT Integration – Faster connectivity enables instant diagnostics, remote vehicle tracking, and smart route optimization.

- The Rise of Electric & Autonomous Fleets – The transition to EVs and self-driving commercial vehicles is reshaping fleet operations.

- Security & Theft Prevention – Businesses are investing in geofencing, real-time tracking, and AI-powered risk management.

The demand for connected, intelligent, and efficient fleet solutions is skyrocketing, opening doors for innovation and investment.

Market Leaders & Key Players: Who’s Dominating the Game?

The global commercial vehicle telematics market is highly competitive, with the top players collectively accounting for approximately 55%–60% of market revenue. Leading companies are focusing on new product developments, strategic collaborations, and partnerships with OEMs to deliver technologically advanced, integrated telematics solutions.

The market is led by global telematics giants, disruptive startups, and AI-driven fleet tech innovators.

Some of the top players include:

Industry Leaders:

- Geotab – A global force in AI-powered fleet analytics and telematics software.

- Trimble Inc. – Experts in GPS-based tracking, predictive maintenance, and fuel optimization.

- Verizon Connect – Pioneers in cloud-based fleet intelligence and remote vehicle diagnostics.

- Omnitracs – A leader in compliance-driven telematics and fleet automation.

- MiX Telematics – Specialists in fuel efficiency, driver monitoring, and logistics analytics.

Disruptive Startups to Watch:

- Motive (formerly KeepTruckin) – AI-powered dash cams and smart fleet monitoring.

- Samsara – A rising player in IoT-driven fleet management and vehicle safety analytics.

- Nauto – Revolutionizing driver behavior tracking and AI-driven risk assessment.

Trend Alert: The competition is intensifying, and companies that leverage AI, automation, and sustainability-focused solutions will dominate the future of commercial vehicle telematics.

Key Market Drivers

- Regulatory Compliance:

Governments worldwide are implementing stringent regulations to improve road safety and reduce emissions. Mandatory installation of telematics systems for monitoring driving hours, vehicle maintenance, and driver behavior has driven significant investment in these technologies. - Advancements in Technology:

The integration of IoT and AI technologies has revolutionized telematics by enabling real-time data collection and advanced analytics. These technologies enhance operational efficiency by facilitating remote diagnostics, predictive maintenance, and intelligent route optimization, all of which lead to cost reductions and improved fleet performance. - Sustainability and Efficiency:

With increasing pressure to reduce carbon footprints, fleet operators are leveraging telematics systems to optimize fuel consumption and minimize emissions. Enhanced route planning and real-time monitoring contribute to energy savings and promote sustainable transportation practices.

Regional Outlook

Asia Pacific has emerged as the most lucrative region in the commercial vehicle telematics market, accounting for a significant share—34.4%—of the global market revenue. Rapid economic growth, urbanization, and the expanding middle class in countries like China and India are driving increased demand for efficient logistics and transportation solutions.

In addition, government initiatives to improve road safety and enforce stringent fleet management standards are further propelling telematics adoption in the region. North America and Europe continue to exhibit strong growth due to advanced infrastructure, high regulatory standards, and significant investments in fleet modernization.

Uncover Essential Discoveries and Trends From our Report in This Sample https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=29957

Commercial Vehicle Telematics Market Snapshot

| Attribute | Detail |

| Market Size (2023) | US$ 20.4 Bn |

| Forecast Value (2034) | US$ 108.5 Bn |

| CAGR (2024-2034) | 16.2% |

| Forecast Period | 2024 – 2034 |

| Historical Data Available | 2020 – 2022 |

| Quantitative Units | US$ Bn (Value) |

This comprehensive report includes cross-segment analysis, regional insights, and qualitative evaluations of drivers, restraints, opportunities, and key trends shaping the global commercial vehicle telematics market.

Market Segmentation

By Technology:

- Embedded

- Tethered

- Integrated

By Application:

- Vehicle Tracking

- Fleet Management

- Satellite Navigation

- Vehicle Safety Communication

- Others

By Vehicle Type:

- Light Duty Vehicles

- Medium Duty Vehicles

- Heavy Duty Vehicles

By Sales Channel:

By Region:

- North America

- Central and South America

- Europe

- Asia Pacific

- Middle East & Africa

Purchase this Exclusive Premium Research Report Today – https://www.transparencymarketresearch.com/checkout.php?rep_id=29957<ype=S

Frequently Asked Questions

- How big was the global commercial vehicle telematics market in 2023?

It was valued at US$20.43 billion in 2023. - What is the forecast market value by 2034?

The market is expected to reach US$108.5 billion by the end of 2034. - What is the anticipated CAGR during the forecast period?

The market is projected to grow at a CAGR of 16.2% from 2024 to 2034. - Who are the prominent players in the global commercial vehicle telematics market?

Key players include Agero Inc., Clarion, Continental AG, Delphi Technologies, DENSO CORPORATION, Embitel, Harman International, Intel Corporation, LG Electronics, LUXOFT, NTT DOCOMO, INC., Panasonic Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, Trimble, Inc., Valeo SA, Verizon Communications Inc., and Vodafone Automotive SpA. - Which region is most lucrative in this market?

Asia Pacific holds a significant market share, with 34.4% of the global market, driven by rapid economic growth and urbanization in countries such as China and India. - What is the share of the vehicle tracking segment in this market?

The vehicle tracking segment has the highest share, due to its critical role in fleet management and real-time GPS tracking.

Discover More In-Depth Reports from Transparency Market Research –

- Truck Rental Market (트럭 렌탈 시장) Set to Reach US$ 156.0 Billion by 2031, Supported by E-Commerce Growth and Green Vehicle Rentals at 4.2% CAGR | Latest Insights by TMR

- Automotive Telematics Market (자동차 텔레매틱스 시장) to Exceed USD 34.52 billion by 2031 | According to Transparency Market Research Analysis.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.