Whales with a lot of money to spend have taken a noticeably bullish stance on Lemonade.

Looking at options history for Lemonade LMND we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $233,560 and 7, calls, for a total amount of $350,204.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $17.0 and $50.0 for Lemonade, spanning the last three months.

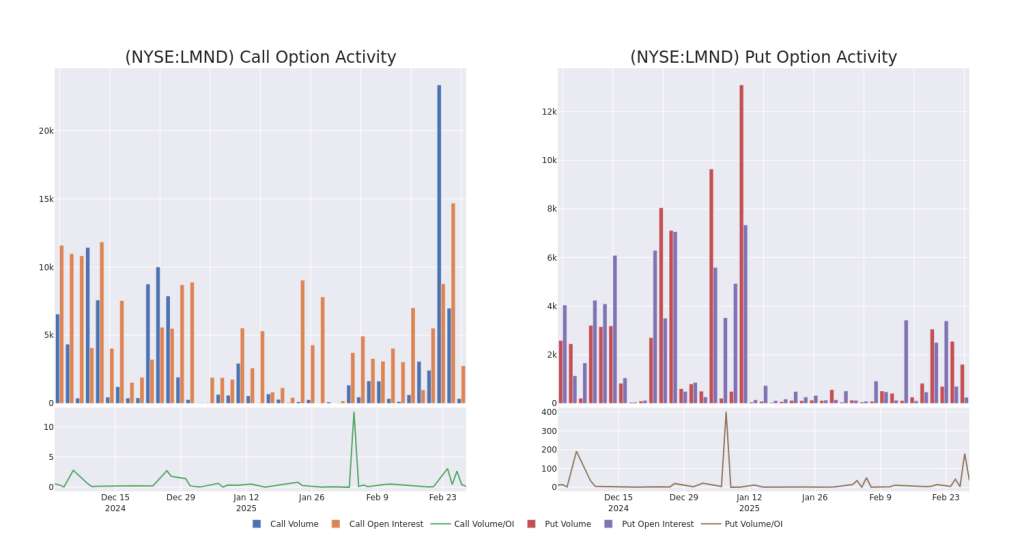

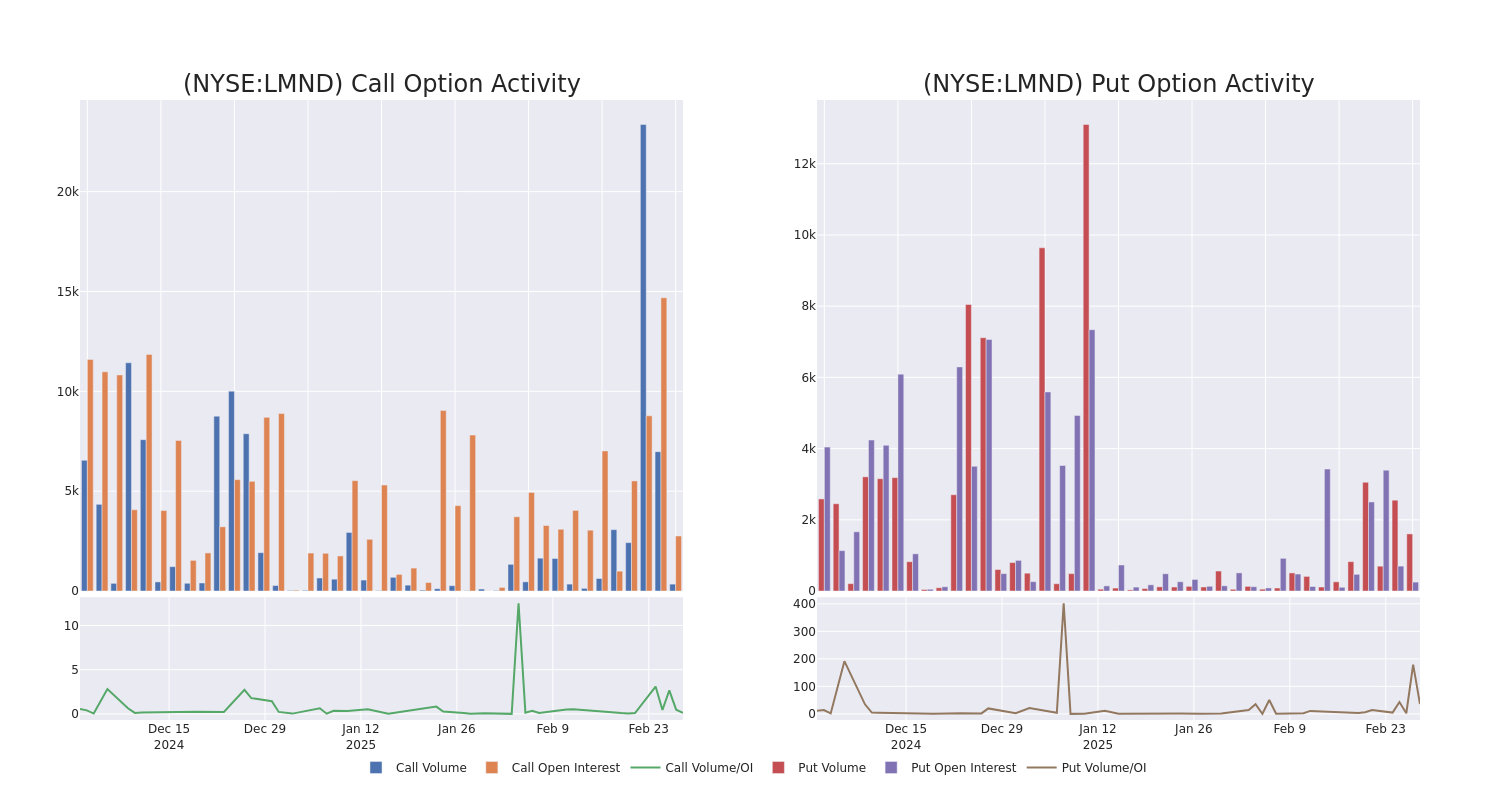

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lemonade’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lemonade’s whale trades within a strike price range from $17.0 to $50.0 in the last 30 days.

Lemonade Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMND | CALL | SWEEP | BEARISH | 02/28/25 | $9.6 | $8.3 | $8.45 | $28.00 | $168.1K | 201 | 201 |

| LMND | PUT | SWEEP | BULLISH | 03/14/25 | $3.2 | $3.1 | $3.11 | $36.00 | $62.2K | 25 | 605 |

| LMND | PUT | SWEEP | BEARISH | 03/28/25 | $3.6 | $3.5 | $3.5 | $35.00 | $54.2K | 72 | 164 |

| LMND | PUT | SWEEP | BEARISH | 03/14/25 | $2.6 | $2.5 | $2.6 | $35.00 | $51.9K | 147 | 355 |

| LMND | PUT | SWEEP | BEARISH | 12/19/25 | $16.5 | $16.3 | $16.5 | $45.00 | $39.6K | 7 | 25 |

About Lemonade

Lemonade Inc operates in the insurance industry. The company offers digital and artificial intelligence based platform for various insurances and for settling claims and paying premiums. The platform ensures transparency in issuing policies and settling disputes. The company is using technology, data, artificial intelligence, contemporary design, and social impact to deliver delightful and affordable insurances. Geographically, it operates in California, Texas, New York, New Jersey, Illinois, Georgia, Washington, Colorado, Pennsylvania, Oregon and others.

In light of the recent options history for Lemonade, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Lemonade

- With a volume of 1,905,991, the price of LMND is down -3.95% at $34.06.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 60 days.

What Analysts Are Saying About Lemonade

2 market experts have recently issued ratings for this stock, with a consensus target price of $47.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Piper Sandler has decided to maintain their Neutral rating on Lemonade, which currently sits at a price target of $34.

* In a cautious move, an analyst from Citizens Capital Markets downgraded its rating to Market Outperform, setting a price target of $60.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lemonade, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.